Technical Overview

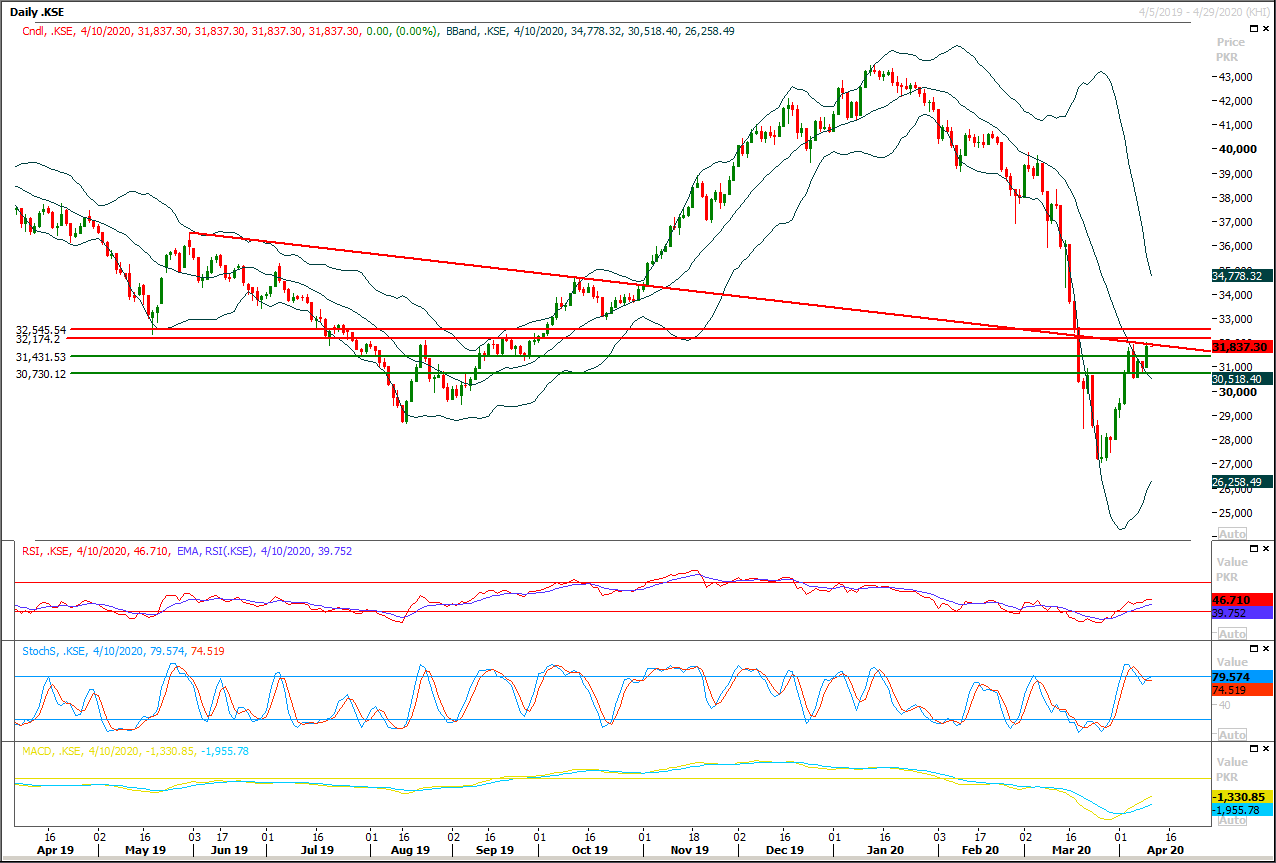

The Benchmark KSE100 index is being capped by multiple resistant regions between 32,000pts-32,500pts. Initially a strong descending trend line would try to cap current bullish sentiment and if index would succeed in penetration of said trend line at 32,000pts then index would face next resistance at 32,180pts where a strong a horizontal resistant region would try to push index downward again. It's expected that index would remain volatile therefore swing trading between 32,350pts 31,430pts would be beneficial. If index would not succeed in closing above 32,500pts during current trading session then it would face bearish pressure in next week. Being last day of the week today's closing matters a lot and closing below 32,000pts would generate a hammer in response of last bullish engulfing which would increase uncertainty among investors. It's recommended to stay on selling side with strict stop loss of 32.500pts. Bearish pressure would start increasing once index would succeed in sliding below 31,640pts on hourly closing basis. While on flipside daily closing above 32,500pts would call for 33,500pts in coming days.

Regional Markets

Saudi, Russia outline record oil cut under U.S. pressure as demand crashes

OPEC, Russia and other allies outlined plans on Thursday to cut their oil output by more than a fifth and said they expected the United States and other producers to join in their effort to prop up prices hammered by the coronavirus crisis. But the group, known as OPEC+, said a final agreement was dependent on Mexico signing up to the pact after it balked at the production cuts it was asked to make. Discussions among top global energy ministers will resume on Friday. The planned output curbs by OPEC+ amount to 10 million barrels per day (bpd) or 10% of global supplies, with another 5 million bpd expected to come from other nations to help deal with the deepest oil crisis in decades. Global fuel demand has plunged by around 30 million bpd, or 30% of global supplies, as steps to fight the virus have grounded planes, cut vehicle usage and curbed economic activity.

Read More...

Business News

ECC approves Rs300bn bailout for power sector

A special meeting of the Economic Coordination Committee (ECC) of the Cabinet on Thursday cleared a cumulative bailout package of almost Rs300 billion for the power sector to settle immediate liabilities besides allowing compensation against foreign exchange loss to oil marketing companies (OMCs). The ECC also approved a board resolution of the Karachi Port Trust for extension in the existing free period from five working days to 15 working days for cargo/containers landing with effect from March to April 30. Under the power sector bailout package, about Rs200bn Islamic sukuk being raised originally for retirement of stock of the circular debt would now be used to meet immediate cash shortfall — fresh flow to the circular debt — of the power sector arising out of the deferment on fuel price adjustment and quarterly tariff adjustments.

Read More...

SCCI urges govt to defer electricity, gas bills of industrial consumers

Sarhad Chamber of Commerce and Industry President Engr Maqsood Anwar Pervaiz on Thursday appealed to the government to defer electricity and gas bills of industrial and commercial consumers for at least three months. Addressing a joint meeting of industrialists, traders and shopkeepers via video link here, the SCCI chief appreciated the government for deferring the payment of electricity and gas bills of domestic consumers for next three months, which would definitely give relief to the coronavirus hit poor masses. Maqsood Pervaiz said the industrial and commercial activities had been completely suspended due to the lockdown imposed in the country as a precautionary step to contain the spread of novel coronavirus. He said the business community was facing financial challenges and other issues due to halt of industrial and commercial activities, and urged the government to defer payment of their electricity and gas bills, and their payment in installments.

Read More...

Another $50m to come from ADB to fight pandemic

The Asian Development Bank (ADB) is making available another $50 million to Pakistan to support the government’s efforts to fight the outbreak of novel coronavirus in the country. This amount has been repurposed from the National Disaster Risk Management Fund (NDRMF) project. Following a request from the government for an emergency support, the ADB swiftly processed a change in the scope of its NDRMF project, enabling the repurposing and immediate use of these resources in the fight against Covid-19. The funds, which form part of ADB’s series of support for Pakistan’s fight against Covid-19, will help to procure medical equipment and supplies to strengthen hospitals, diagnostic laboratories, isolation units, and other medical facilities in the country, says a press release issued by the ADB on Thursday. The funds include the reallocation of $30m of previously approved but unutilised resources from the Asian Bank to the disaster risk management fund.

Read More...

Capital market outflows jump to $3.27bn

Over 79 per cent of all foreign investment in the country’s capital markets — including bonds and equities — has fled the country in the last 40 days. The State Bank of Pakistan’s (SBP) latest data issued on Thursday showed the pace of outflows from the country’s treasury bills, Pakistan Investment Bonds (PIBs) and equity markets has accelerated. During the current fiscal year, foreign investment in domestic bonds and equity markets noted an inflow of $4.144 billion, however, that quickly turned into outflows during March. The pace has continued into April as well. As of April 8, total outflows during the current fiscal year have reached $3.274bn accounting for 79pc of the total investments. Foreign investors had in the current fiscal year rushed to buy T-bills in the wake of high interest rates investing $3.431bn. But volatility fueled by the pandemic and investors’ risk-aversion led to sudden outflows of $2.357bn in just 40 days.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.