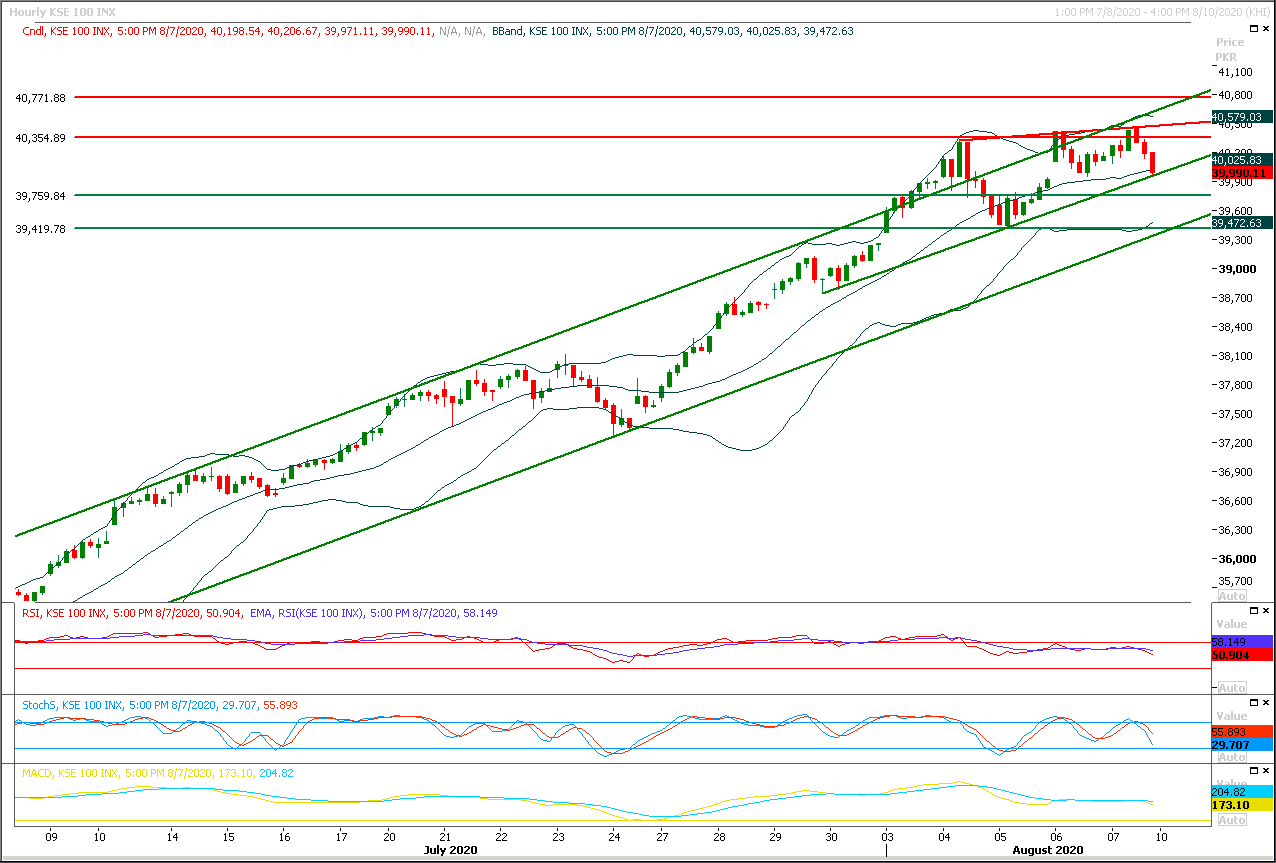

Technical Overview

The Benchmark KSE100 index is once again caged in a rising wedge on hourly chart and it's trying to retest supportive trend line of that wedge. Mean while hourly momentum indicators have changed their direction towards bearish side therefore it's recommended to stay cautious because if index would succeed in giving a breakout of this wedge in downward direction then its next targets would be 39,780pts and 39,500pts on intraday basis where it would try to fund some ground against bearish pressure. If index would succeed in opening below 39,950pts with a negative gap then pressure would start piling up in first hour otherwise a spike towards 40,165pts could be witnessed from where index would start facing some serious pressure. While in case of bullish breakout above40,165-40,200pts region index would try to target 40,500pts and later on next target would be 40,760pts. On basis of technical charts it's expected that a volatile session could be witnessed therefore swing trading could be beneficial until index gave a breakout of either side.

Regional Markets

Asian shares cautious as Sino-U.S. tensions weigh

Asian stocks held tight ranges on Monday as worries over flaring tensions between the United States and China weighed on sentiment although signs of a recovery in industrial activity in the world’s second-largest economy capped losses. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS see-sawed between red and green but held in small ranges to stay below a 6-1/2 month peak touched last week. Trading was expected to be light with Japanese and Singaporean markets closed for public holidays. Chinese shares started lower with the blue-chip CSI300 .CSI300 down a shade and Hong Kong's Hang Seng index .HSI falling 0.2%.

Read More...

Business News

Moody’s reaffirms Pakistan credit rating

Moody’s on Saturday confirmed Pakistan’s B3 credit rating with a stable outlook as part of the review for downgrade, the agency said in a statement. Concurrently, the agency has also confirmed the B3 foreign currency senior unsecured ratings for The Third Pakistan International Sukuk Co Ltd, according to press statement received here which added that the associated payment obligations are, in Moody’s view, direct obligations of the government of Pakistan. The review for downgrade was triggered by Pakistan’s announcement that it would seek to participate in the G20 Debt Service Suspension Initiative (DSSI), which raised questions that private sector creditors would be asked by the country to extend similar treatment to Pakistani debt.

Read More...

Services trade deficit shrinks 43pc in FY20

The country’s services trade deficit witnessed sharp decline of 42.96 per cent during the financial year 2019-20 as compared to the corresponding period of last year. During the period under review, the country’s services exports declined by 8.66 per cent, whereas services’ imports narrowed by 24.25 per cent, according to trade statistics released by the Pakistan Bureau of Statistics (PBS). The exports were recorded at $5.449 billion, as against the exports of $5.966 billion during the same period of last year. Similarly, services’ imports went down from $10.936 billion to $8.284 billion.

Read More...

Petroleum Division identifies 40 new blocks to step up E&P activities

Making a true calculation of the country’s existing and future energy needs, the Petroleum Division has aligned its strategy to achieve self-sufficiency in oil and gas sector by introducing ease-of-doing-business and radical measures to ensure a level-playing field for all competitors. “As many as 40 new blocks have been identified in different parts of the country to step up oil and gas exploration activities as the existing reservoirs are fast-depleting and since long there is no major discovery,” a senior official privy to petroleum sector developments told APP while sharing two-year performance of the Pakistan Tehreek-e-Insaf (PTI) government.

Read More...

Power tariff increased under fuel adjustment charges

The power tariff has been increased by 95 paisa per unit for the current month and Rs1.09 per unit for the next month under fuel adjustment charges. However, the new tariff will not be applicable to lifeline consumers. The National Electric Power Regulatory Authority (Nepra) has notified the changes in the approved tariff on account of variations in fuel charges for eight months — from November 2019 to June 2020 — for all power distribution companies.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.