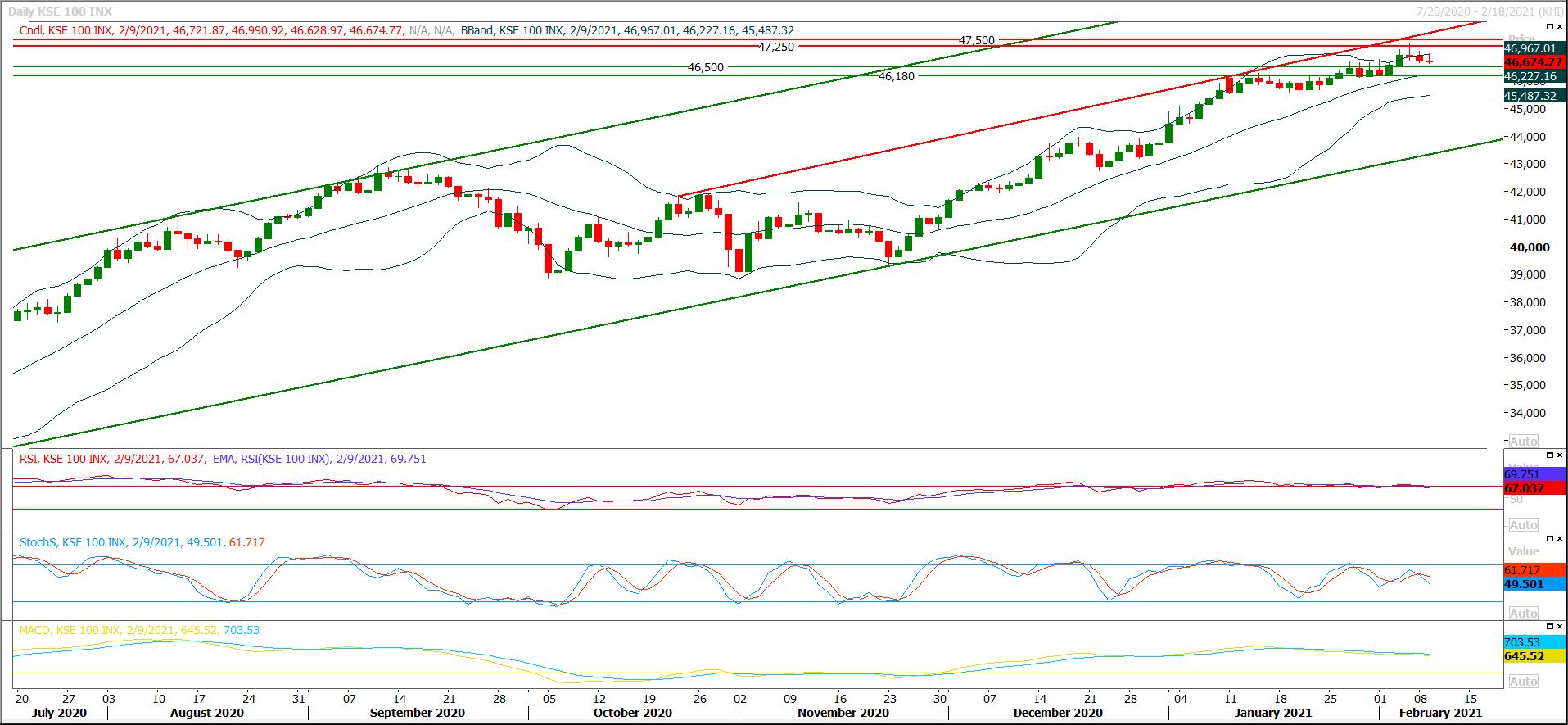

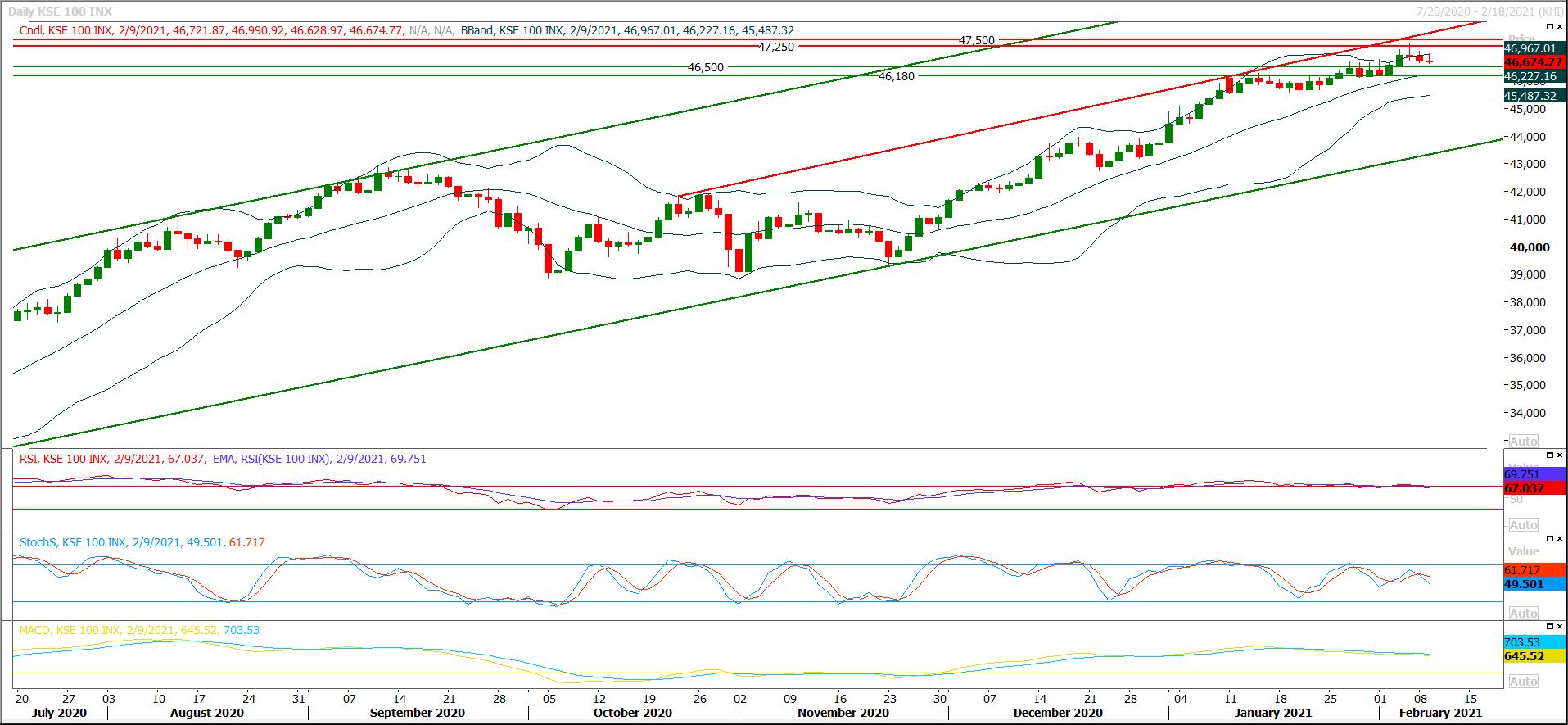

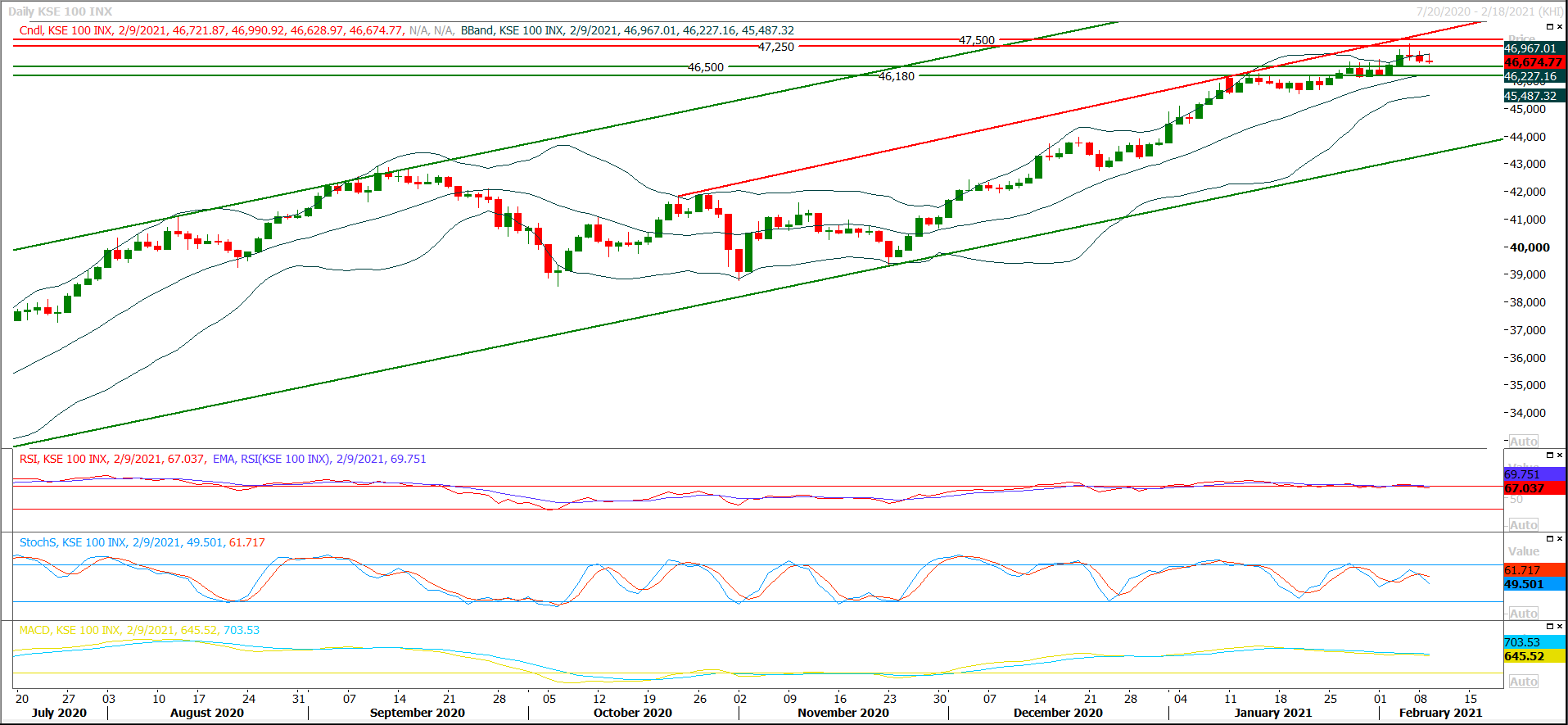

Technical Overview

The Benchmark KSE100 index is moving in a bullish price channel on hourly chart but have faced rejection from a strong horizontal resistant region during last three trading sessions, which pushed it downward for a slight correction. As of now index is trying to establish ground above supportive trend line of its bullish price channel its also being supported by a strong horizontal supportive region at same level therefore it's expected that index would try to continue its bullish journey during current trading session but if index would succeed in sliding below this line then a sharp bearish rally would be witnessed. Meanwhile hourly stochastic have changed its direction towards bearish side which indicates that index would remain under pressure today therefore it's recommended to adopt swing trading with side with strict stop loss. Currently it's expected that index would initially try to target 46,900pts and breakout above that region would call for 47,350pts and 47,500pts but it's recommended to trade step by step after breakout of each resistant region it could be beneficial to target next one with strict stop loss. While on flip side index would try establish ground above its major supportive region of 46,700pts and 46,500pts. Oil & Gas exploration sector would try to lead today's bullish rally because international oil prices are inching up and it's expected that WTI would continue moving towards 60$/bbl where it's being capped by a strong resistant trend line on monthly chart. In case of breakout above 47,500pts-47,660pts index would start moving towards 100% expansion of its last bullish rally which falls at 48,400pts but it's recommended to stay cautious and post trailing stop loss on existing long positions because once index would start a corrective rally then it would not provide chance to take a safe exit to day traders and short term investors.

Regional Markets

Asian stocks make cautious gains after patchy Wall St. rally

Asian stocks inched higher on Wednesday, as upbeat Wall Street earnings and optimism about a global recovery supported sentiment, although concerns about the sustainability of a recent risk rally are likely to cap gains. The Australian S&P/ASX 200 Index was last up 0.5% and e-mini futures for the S&P 500 rose 0.14%. Japan’s Nikkei 225 slipped 0.31%. Bitcoin, which gained 19.5% on Monday, was down 0.1% at $46,354 as Asian trading got underway. The cryptocurrency was headed toward $50,000 on Tuesday, but paused at $48,216. The early action came as shares of Lyft Inc rose as much as 11% while Twitter Inc climbed 2% in aftermarket trading on their latest quarterly results. The earnings follow a slowdown in the global market rally on Tuesday as investors reconsidered how much government stimulus spending, easy money from central banks and vaccinations will boost stocks, oil and inflation.

Read More...

Business News

Govt plans to bring down soaring debt-to-GDP ratio to 78pc by 2024

The government has plan to bring the down the soaring debt-to-GDP ratio to 78 per cent in next few years by increasing revenue mobilisation, reduce expenditures and reform public sector enterprises (PSEs). Pakistan’s debt-to-GDP ratio was recorded at 87.2 per cent at end June 2020, which was 86.1 percent at end June 2019, according to the official documents of the ministry of finance. However, the government has projected to bring it down to 78 per cent by 2024 due to several measures. “Over the medium term, government’s objective is to increase revenue mobilisation, reduce expenditures and reform public sector enterprises (PSEs). These measures are expected to bring stability leading to gradual reduction in the fiscal deficit over next few years and subsequently would reduce the country’s reliance on additional debt,” the documents said.

Read More...

Nepra, NTDC want to create competition in electricity transmission system

Both National Electric Power Regulatory Authority (Nepra) and National Transmission & Despatch Company (NTDC) have said that they don’t have any objection to the setting up a provincial grid transmission company as they want to create competition in the electricity transmission system. Nepra has conducted public hearing on the application of the Khyber Pakhtunkhwa government for the grant of license for provincial Transmission & Grid System Company (Pvt) Limited. The regulator has completed the hearing and reserved the judgment on the KP petition for provincial grid company. The hearing, presided over by Chairman NEPRA Tauseef. H. Farooqi, was informed by the KP government that a license has already been issued by the regulator to Sindh government for the establishment transmission company.

Read More...

ADB shows interest in construction of Strategic Underground Gas Storages

Asian Development Bank has shown interest in the construction of Strategic Underground Gas Storages (SUGSs). Work on SUGSs is likely to commence in August 2021. The Strategic Underground Gas Storages (SUGSs) along with other matters of the oil and gas sector was discussed by Nadeem Babar, Special Assistant to Prime Minister on Petroleum, in a virtual meeting with ADB team in Manila together with Ms Xiaohong Yang, Country Director Asian Development Bank, and their energy team here Tuesday. The meeting was aimed to discuss progress of reform programme in petroleum sector of Pakistan. During the meeting, the SAPM appreciated the support of ADB for hiring of consultant & study of Strategic Underground Gas Storages project. He appreciated the interest of ADB in funding the construction of the project.

Read More...

Pakistan ranks 3rd in govt support provided to SMEs to mitigate COVID-19 impact

Pakistan ranks 3rd in government support provided to SMEs to mitigate the impact of COVID-19, according to a recently launched “Impact of COVID-19 on SMEs” Survey Report conducted online by SMEDA, Asian Development Bank Institute (ADBI) and Asian Productivity Organization (APO). The survey was conducted by ADBI and APO in other countries from the region including; Indonesia, India, Bangladesh, Malaysia, Vietnam, Mongolia and Lao PDR. The online survey was administered in August 2020 and lasted till September 2020, in which, 236 SMEs from Pakistan participated. Findings of the survey reveal that the majority of enterprises in Pakistan were facing cash flow (82%) and raw material (65%) shortage. However, 11.44% SMEs in Pakistan expect their sales revenue to increase as compared to 2019, while 12.29% respondent enterprises expect their sales revenue to remain the same.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.