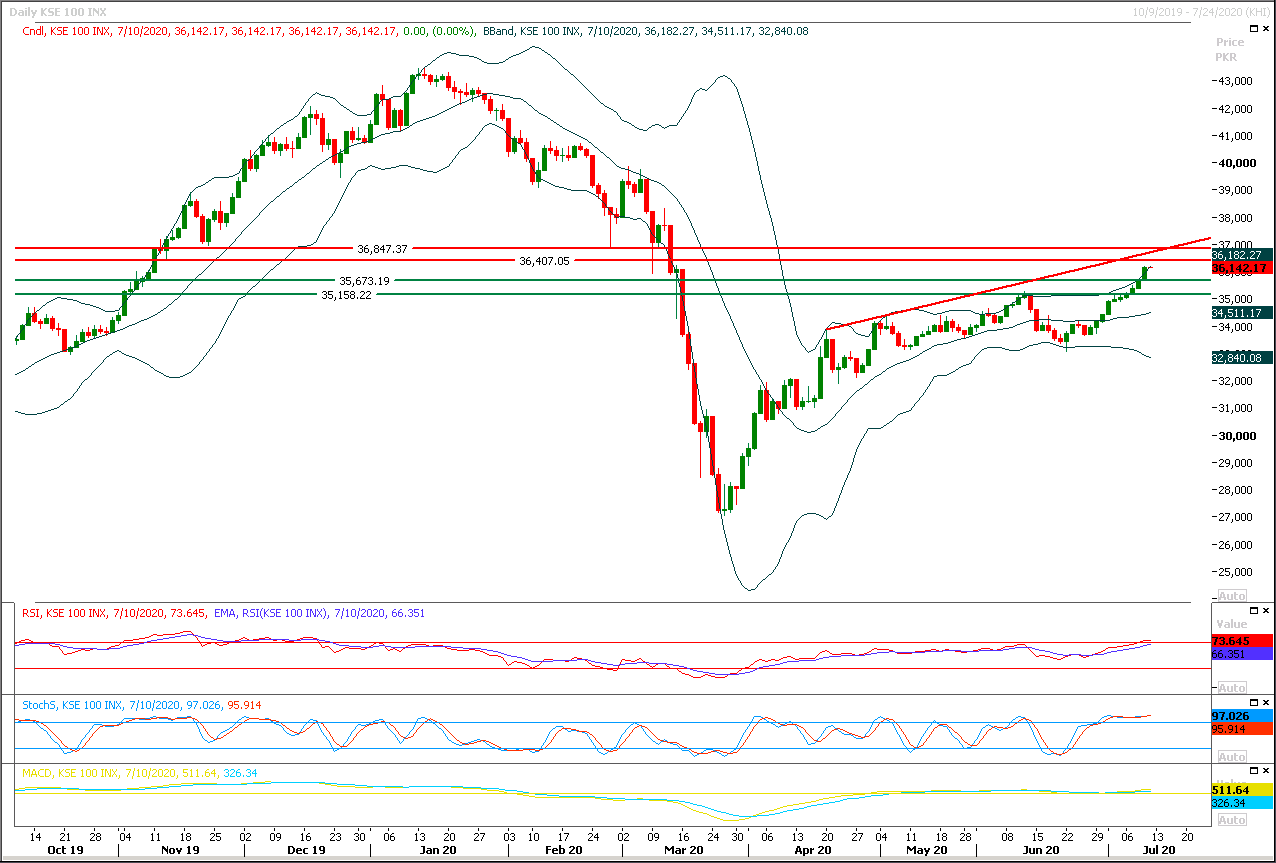

Technical Overview

The Benchmark KSE100 index have recovered about 61% of its last bearish rally on weekly and daily chart and now it's going to face major resistant region in next 500-1000 points. For current trading session it's expected that index would face major resistances at 36,200pts and 36,400pts from two strong horizontal resistant regions therefore it's recommended to start profit taking from existing long positions. If index would face rejection from said regions then it would slid downward and bearish pressure would be witnessed on intraday basis which would try to push index towards 35,760pts where index would try to find some ground against bears. It's expected that index would try to create a bearish reversal pattern on daily chart and in case it would succeed in doing so then bears would start riding the market and daily closing below 35,760pts would increase bearish momentum. While on flip side in case of bullish breakout above 36,400pts index would face major resistances at 37,000pts and 37,200pts where it's being capped by a strong resistant trend line and its weekly correction level. Selling on strength with strict stop loss could be beneficial for day trading today.

Regional Markets

Asian stocks fall on virus worry, China stock rally pauses

Asian shares and U.S. stock futures fell on Friday as record-breaking new coronavirus cases in several U.S. states stoked concerns that new lockdowns could derail an economic recovery, while investors looked forward to earnings season.MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.76%. Australian stocks dropped 0.42%, while Japanese stocks declined by 0.4%. Shares in China fell 0.72%, the first decline in more than a week, as investors booked profits on a surge in equities to a five-year high. E-mini futures for the S&P 500 erased early gains to trade down 0.01%. The Antipodean currencies fell and the yen rose as traders shunned risk and sought safe havens. More than 60,500 new COVID-19 infections were reported across the United States on Thursday, the largest single-day tally of cases by any country since the virus emerged late last year in China.

Read More...

Business News

Major locust swarms may reach Pakistan later this month

Officials on Thursday warned that the next few weeks could be crucial in the fight against desert locust infestation with major swarms expected to be reaching here later this month from the Horn of Africa. They are confident that the country is much better prepared to deal with the short-horned grasshoppers, considered as one of the most voracious insects, this time than the last major attack here in 1993, but the shortage of resources could impede the effort to contain the problem. Chairman of the National Disaster Management Authority Lt Gen Mohammad Afzal, while briefing the diplomatic corps at the National Locust Control Centre (NLCC), said the locust problem is likely to peak in the next three to four weeks. “Next eight weeks between July 15 and Sept 15 would be critical because of monsoon and the government’s ongoing commitment with anti-Covid-19 measures.”

Read More...

LCCI demands cut in energy prices

Lahore Chamber of Commerce & Industry (LCCI) President Irfan Iqbal Sheikh said on Thursday that balanced energy prices could act as an economic booster therefore, these should be reduced for the trade and industry. He expressed these views while talking to a delegation of leading businessmen at LCCI on Thursday. LCCI Vice President Mian Zahid Jawaid Ahmad was also present on the occasion. Irfan Iqbal Sheikh said that industries need low-cost energy to bring down their cost of doing business and keep their merchandise competitive in the international market. He said that cut in energy prices would be a great relief to the industries and traders who were suffering heavily because of circumstances caused by coronavirus. The LCCI President said that high cost of doing business was one of the major issues being faced by the industrial sector and industries need support of the government to bring down their input cost to ensure prominent presence in the international market. Definitely, it would bring much-needed precious foreign exchange to the country and reduce financial pressure.

Read More...

Pakistan, India planning to convene meeting using alternative means

Pakistan and India are planning to convene the annual meeting of Permanent Indus Commission in the COVID-19 situation using alternative means. The meeting of the Water Commission was due in March but was postponed due to emergency situation due to COVID-19, official source told The Nation here Thursday. It was mutually agreed that the meeting scheduled for March 2020 be postponed and now it has been decided to convene the meeting through alternative means, the source said. India has shown its readiness to convene the meeting using alternative means, the source added. However, it has yet to be decided what online resource should be utilized for interaction between both the commissioners. The source said that during the meeting, Pakistan will demand India for sharing flood data on daily basis.

Read More...

NA body expresses displeasure over delay in formulating ZTBL board

A parliamentary committee on Thursday expressed displeasure over the delay in constituting the board of Zarai Taraqiati Bank Limited (ZTBL) from last several months, which is affecting the performance of the Bank. The meeting of National Assembly Standing Committee on Finance, Revenue and Economic Affairs was held under the chairmanship of Faiz Ullah, MNA. The committee has asked from the government about delay in formulation of ZTBL board. Committee members were of the view that performance of the ZTBL is getting affected due to the ministry of finance, which failed to constitute its Board from last several months. They have noted that loan disbursement of the ZTBL has declined by 43 percent.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.