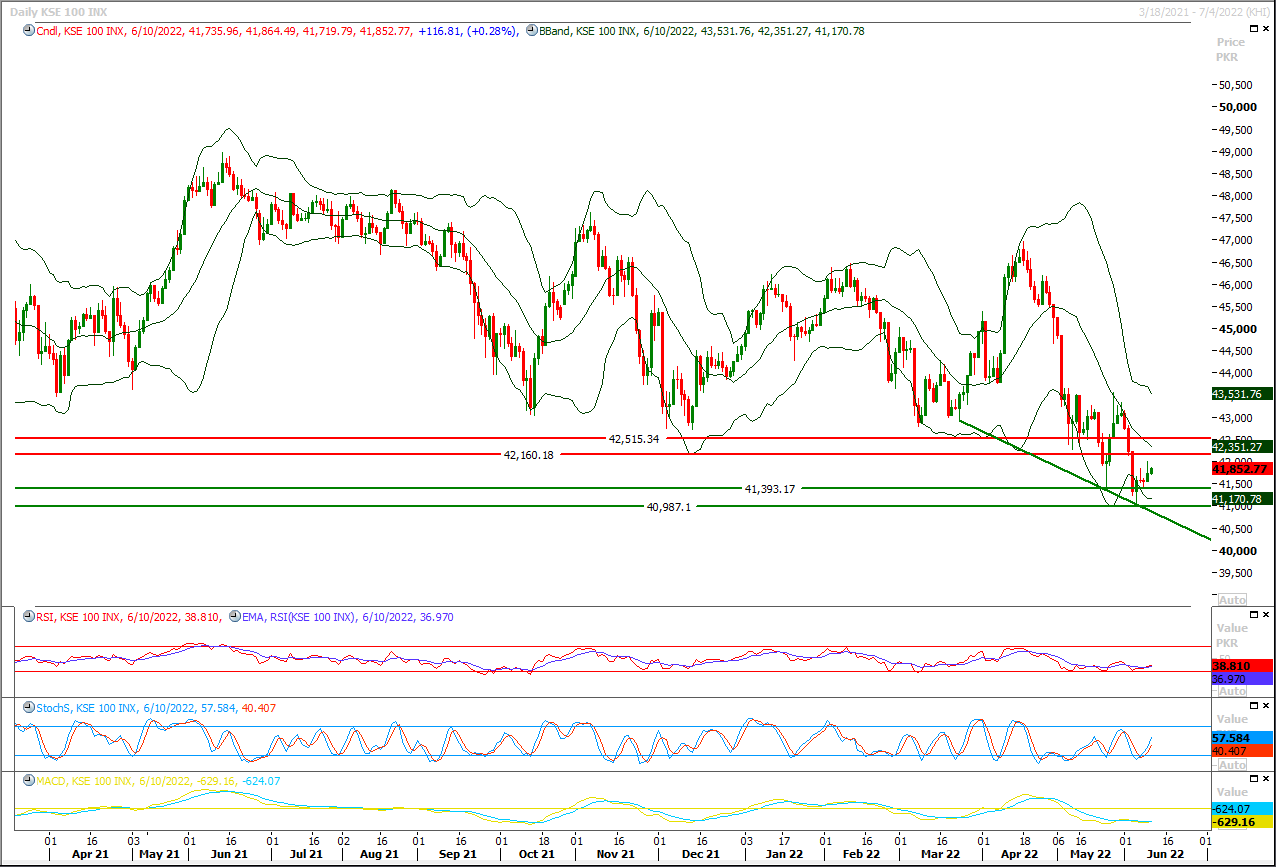

The Benchmark KSE100 index had continued its bullish sentiment during last trading session and it succeeds in maintaining above 41,500pts at day end. As of now it's expected that index would try to target 42.160pts on intraday basis where it would face initial resistance from a horizontal resistant region. Meanwhile its being caged inside a descending wedge on daily chart and if it would succeed in closing above 42,160pts then bullish breakout of this wedge would take place therefore it's recommended to stay on long side and add long positions on every dip with strict stop loss. While on flip side index would find initial supportive region at 41,390pts where a horizontal supportive region would try to add fresh volumes but breakout below this region would call for 40,987pts.

Asian shares tracked Wall Street lower on Friday, while the dollar held on to its overnight gains, after rate hike guidance from the European Central Bank and upcoming U.S. inflation data unnerved investors.MSCI's broadest index of Asia-Pacific shares outside Japan fell 1.2% in early Asian trade, weighed down by drops of 1.5% in Hong Kong, 0.8% in resources-heavy Australia and 1.6% in South Korea.Japan's Nikkei fell 1.2%.Tech giants listed in Hong Kong were hit hard, with their sub-index opening 2.9% lower. Hong Kong shares of Alibaba fell 3.3% after affiliate Ant Group said it had no plan to initiate an initial public offering. This was a response to media reports that Beijing had approved relaunching the IPO.

Read More...The Economic Survey 2021-22 was unveiled here yesterday showing that the government has achieved most of the economic targets during the ongoing financial year. However, it missed targets like inflation, budget deficit, current account deficit and others.The Gross Domestic Product (GDP) growth has projected at 5.97 percent as compared to the target of 4.8 percent. The government also achieved other targets of agriculture, industrial sector and service sectors growth during the year 2021-22.The growth of agricultural, industrial and services sectors is 4.40 percent, 7.19 percent and 6.19 percent respectively as against target of 3.5 percent, 6.5 percent and 4.7 percent respectively.Federal Minister for Finance and Revenue Miftah Ismail launched the Economic Survey at a joint press conference along with Federal Minister for Planning Development and Special Initiative Ahsan Iqbal, Federal Minister for Power Khurram Dastgir Khan and Minister for State for Finance Ayesha Ghous Pasha.

Read More...

Pakistan’s Public Debt Stands At Rs44.366tr

Pakistan’s public debt has recorded at Rs44.366 trillion as the successive governments heavily depended on the borrowing to run the affairs instead of enhancing the tax to GDP ratio of the country.The total public debt was recorded at Rs 44.366 trillion at the end-March 2022 registering an increase of Rs 4,500 billion during the first nine months of current fiscal year. Pakistan’s debt has increased by Rs19.413 trillion during PTI’s tenure from 2018 to March 2022.Meanwhile, the country’s debt enhanced by Rs10.661 trillion in PML-N’s tenure from 2013 to 2018. It increased by Rs8.165 trillion in PPP’s tenure from 2008 to 2013. The country’s loan was only Rs6.127 trillion till 2008.According to the latest Economic Survey 2021-22, the breakup of Rs44.366 trillion showed that the domestic debt stood at Rs28.076 trillion and external debt at Rs16.29 trillion. Domestic debt was recorded at Rs 28,076 billion at end-March 2022, registering an increase of Rs 1,811 billion during the first nine months of the current fiscal year.

Read More...

Agri sector surpasses target, grows 4.4pc; big industry up 10.4pc

The country’s agriculture sector recorded a remarkable growth of 4.4 per cent during the outgoing fiscal year, surpassing the target of 3.5pc and last year’s growth of 3.48pc, while during July-March 2021-22, large-scale manufacturing (LSM) also recorded a staggering growth of 10.4pc against 4.24pc in the corresponding period last year, according to the Pakistan Economic Survey released on Thursday.Growth in the agri sector, the document says, was mainly driven by high yields, attractive output prices and supportive government policies, better availability of certified seeds, pesticides and agricultural credit.The five important crops contributed 19.44pc to value addition of the sector and 4.41pc to the gross domestic product (GDP), while other crops accounted for 13.86pc in value addition and 3.14pc GDP.

Read More...

Import bill surges on higher global commodity prices

Pakistan’s trade deficit widened 57.85 per cent in 11 months of FY22 to $43.33 billion year-on-year on account of a broad-based surge in global commodity prices, Covid-19 vaccine imports, and demand-side pressures, all contributed to the rising imports.The imports surged mainly by an increase in energy prices as well as imports of food items to bridge the shortages in the local production of agriculture yields, showed Economic Survey 2021-22 on Thursday.Remittances, which always supported in easing out pressure of trade deficit recorded a 7.1pc growth to $22.9bn on a year-on-year basis. This ever-highest level of workers remittances was not sufficient to offset trade deficit.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.