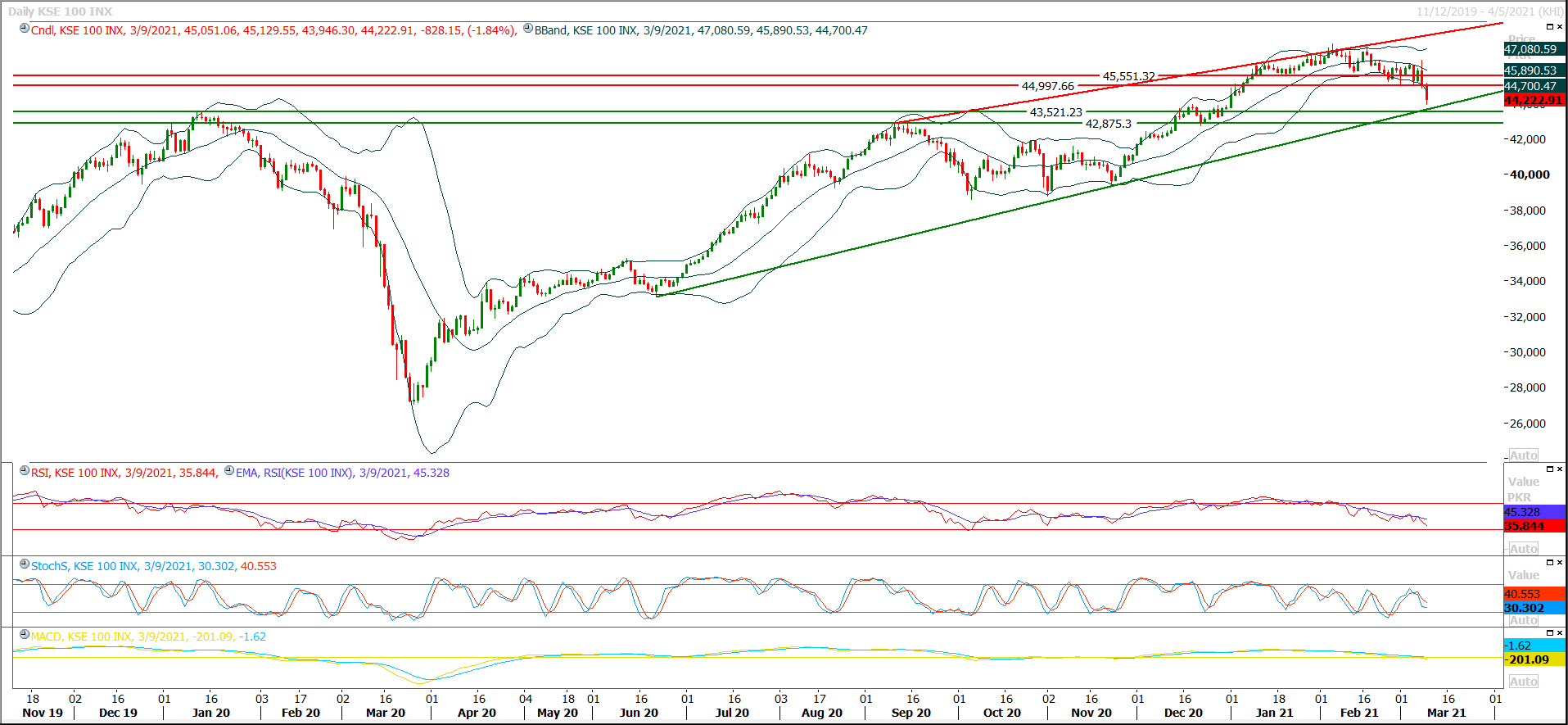

The Benchmark KSE100 index had initially expanded its previous 61.8% correction by 100% during last trading in first half of the day and later on it again complete 50% correction of that expansion therefore it's expected that index may again start sliding downward during current trading session for another expansion but its recommended to stay cautious because index have a strong supportive region ahead at 43,750pts where supportive trend line of its rising wedge would try to support index against current bearish pressure, while this region is being followed by 45,500pts where a strong horizontal supportive region would try to pump some fresh volumes, meanwhile 50% correction of last bullish rally would also complete at this region. While on flip side in case of bullish pull back index would face initial resistance at 45,000pts which would be followed by 45,500pts. In case of bullish pull back it would be considered a retesting of its previous supportive regions therefore it's recommended to wait for a breakout either above 45,000pts or 43,500pts to initiate new positions. While for current trading session its recommended to adopt swing trading.

Regional Markets

Asian stocks bounce off two-month low as bonds, China markets steady

Asian stocks bounced back from a two-month low on Wednesday after bond yields eased following a well-received auction and as Chinese shares found a footing after recent steep falls on policy tightening worries.MSCI’s ex-Japan Asia-Pacific shares index rose 0.4%, a day after it hit a two-month low. The CSI300 index of mainland China’s A-shares rose 0.7% in early trade. The rebound came after Chinese shares had fallen to their lowest levels since mid-December the previous day on the prospect of tighter policy and a slowing economic recovery. Japan’s Nikkei was little changed while e-mini futures for the S&P 500 shed 0.25%, erasing earlier gains. “Markets are giving full attention to bonds. As earnings are not growing that fast right now, the lofty stock prices we have now will become unsustainable if bond yields rise further and undermine their valuation,” said Hiroshi Watanabe, senior economist at Sony Financial Holdings.

Read More...

Business News

Eni exits Pakistan, sells assets to local JV

The Italian energy company, Eni, has sold its assets in Pakistan to Prime International Oil & Gas Company, a newly established joint venture (JV) between its local employees and Hub Power Company, in line with its 2021-24 business plan to dispose of its non-key assets to raise cash after the global downturn triggered by the Covid-19 pandemic and to move towards cleaner fuels. A statement posted by the oil and gas exploration firm on its website said the sale of its Pakistani assets aligned to its wider strategy of reshaping and simplifying the company’s portfolio, extracting additional value from its strategic assets and disposing non-core business as per its four-year strategic plan. The assets sold by the energy company interests in eight development and production leases in the Kithar Fold Belt, and the Middle Indus Basins, as well as four exploration licences in the Middle Indus and the Indus Offshore Basins. Eni’s main permits, according to the company statement, were in Bhit/Badhra in which it held 40pc stake and Kadanwari where it held 18.4pc stake. Other shares were in the permits for Latif (33.3pc), Zamzama (17.5pc) and Sawan (23.7pc). Prime International has also acquired Eni’s 10MW photovoltaic plant.

Read More...

KP govt, Chinese company sign agreement for 300MW Balakot Hydro Power Project

Khyber Pakhtunkhwa government Tuesday signed contract agreement with a Chinese company for construction of 300MW Balakot Hydro Power Project. The 300-megawatt project, the biggest-ever power project of Khyber Pakhtunkhwa, would be constructed with an estimated cost of Rs 85 billion in a period of six years with the financial assistance of Asian Development Bank. A ceremony to this effect was held here with Khyber Pakhtunkhwa Chief Minister Mahmood Khan as chief guest. The authorities concerned of Pakhtunkhwa Energy Development Organization and Chinese Construction Company signed the contract agreement to start practical work on the project. Besides, Provincial Minister for Finance Taimur Saleem Jhagra, Advisor to KP CM on Energy Himayatullah Khan, the event was also attended by the higher authorities of the Energy and Power Department.

Read More...

Nepra allows Re0.89 per unit in power tariff

The National Electric Power Regulatory Authority (Nepra) Tuesday allowed an increase of Re.0.8954 per unit in power tariff for ex-Wapda Discos under fuel charges adjustment (FCA) for the month of January. Nepra has also allowed the use of expensive furnace oil worth Rs12 billion for power generation during the month of January. Central Power Purchasing Agency-Guaranteed (CPPA-G) had requested a positive FCA of Rs.0.9270/kWh, having impact of Rs.7.1 billion. Nepra had conducted public hearing on February25, 2021 and reserved the judgment. The Authority has approved FCA of Re.0.8954/kWh, having impact of Rs.6.9 billion, said a decision issued here by Nepra. The FCA of January 2021 shall be charged in the billing month of March 2021 to all consumer categories of XWDISCOs, except life line consumers i.e. having consumption up-to 50 units, and would remain applicable only for one month. This FCA is not applicable to KE consumers.

Read More...

SBP to be made autonomous in line with IMF terms

In order to meet IMF conditions for revival of its stalled programme, the federal cabinet on Tuesday cleared for introduction in parliament three crucial bills, including the one allowing unprecedented autonomy to the State Bank of Pakistan to target inflation, rather than economic growth. “We will take these bills to fast-track legislation,” said Finance Minister Dr Abdul Hafeez Shaikh at a news conference after a meeting of the cabinet, adding that relationship with the International Monetary Fund, which had been under a “pause” for about a year, had formally started. He said the IMF board would soon meet to complete the review and its lending to Pakistan would resume immediately. The two other bills approved by the cabinet relate to withdrawal of corporate income tax exemptions (Income Tax Second Amendment Act 2021) to generate Rs70-140 billion in additional revenue with effect from July 1, 2021, and State Owned Enterprises (Governance and Operations) Bill 2021.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.