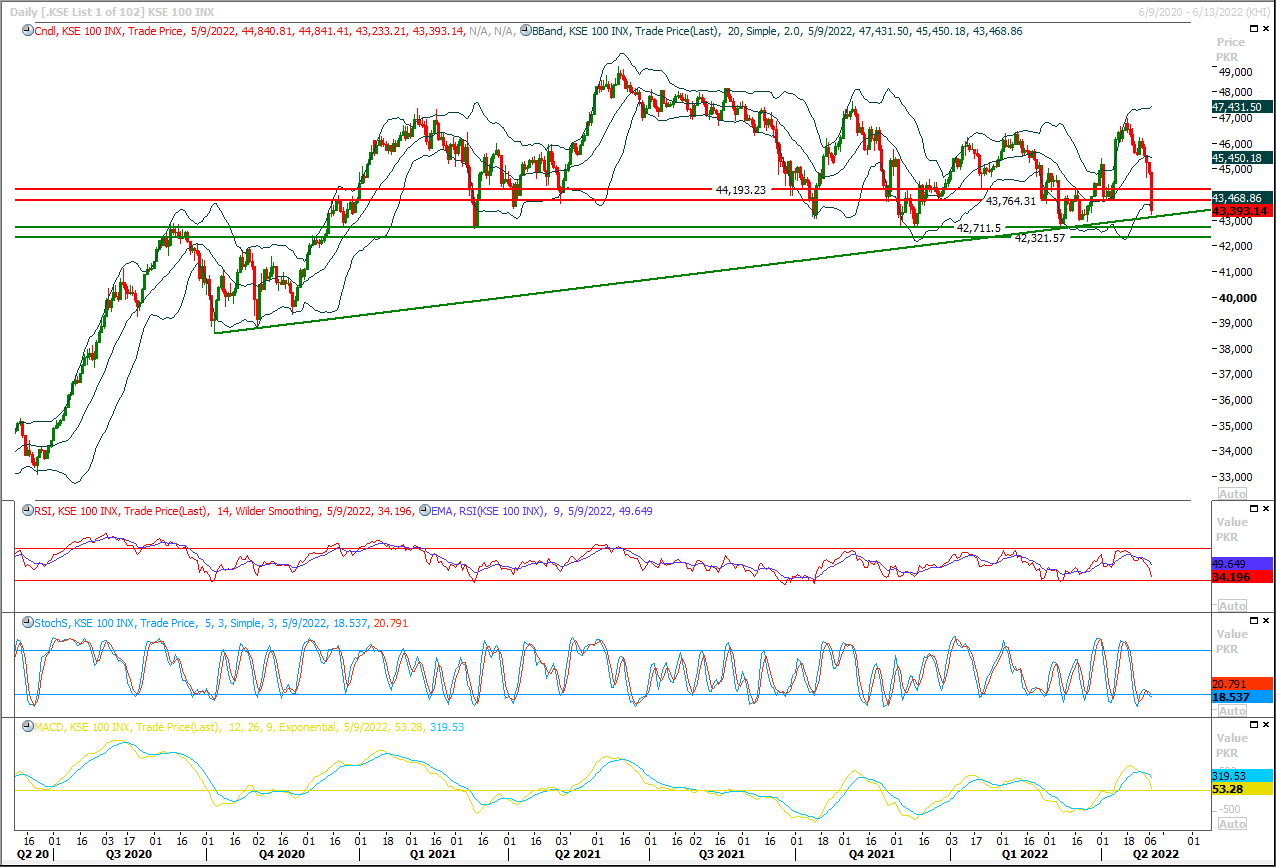

The Benchmark KSE100 index had continued its bearish trend after penetration inside its daily and weekly descending wedge and reached its major supportive region of 43,200pts. As of now it's trading at a major supportive trend line and it's expected that index would try to bounce back in bullish direction after a dip and a false penetration of said trend line would take place on daily chart therefore it's recommended to start buying on dip with strict stop loss of 42,700pts for day trading. Hourly momentum indicators are ready for a pull back and these would try to lead index towards 43,760pts after an intraday dip where index would face initial resistance. Bullish breakout above this region would call for 43,900pts and 44,200pts, overall sentiment would remain bearish as long as index is trading below 44,500pts. On flip side bearish breakout below 42,700pts on daily closing basis would push index towards a new bearish rally which may extend towards 42,300pts and 41,500pts.

Asian shares fell to their lowest in nearly two years on Tuesday, as investors fretted about the toxic cocktail of rising interest rates and lower economic growth.Growing fears of recession and a slowdown in China dragged down commodity-linked currencies and oil prices, though safety flows kept the dollar near 20-year highs.MSCI's broadest index of Asia-Pacific shares ex-Japan tumbled as much as 2.3% to 515.7, sliding for a seventh straight session and extending losses to 18% so far this year. The benchmark later pared losses to trade down 1.3%.Across Asia, share indexes were a sea of red but traded above the day's lows in volatile markets. The Nikkei lost 0.9%, Australian shares shed 1.3%, Korean stocks lost 1.2% and Taiwan equities were down 0.3%."Chinese growth is facing significant headwinds, whether you look at official or private sector Purchasing Managers' Index," said Song Seng Wun, an economist at CIMB Private Banking.

Read More...The Islamabad High Court (IHC) Monday directed the Cabinet Division secretary to place the matter of appointment.of Pakistan Muslim League – Nawaz (PML-N) leader Hanif Abbasi as Special Assistant to Prime Minister (SAPM) before the PM Shehbaz.Sharif to reconsider it.A single bench of IHC comprising Chief Justice Athar Minallah issued the directions while hearing Sheikh Rashid’s petition wherein he stated that Abbasi.has been appointed Special Assistant (with status.of federal minister) to prime minister of Pakistan vide the notification dated 27.4. 2022. He adopted that both the notification and appointment are illegal, unlawful, unconstitutional and violative of the principles.of good governance and the rule of law.In its written order, the IHC bench directed respondent.

Read More...

Federal Govt De-Notifies Governor Punjab Omar Sarfraz Cheema

#Federal Government has de-notified Governor Punjab Omar Sarfraz Cheema. Cabinet Division has issued notification to de-notify the Governor Punjab.The notification states that in terms of Article 101 and Proviso of Article 48 (1) of the Constitution of Islamic Republic of Pakistan, read with serial No. 2D of Schedule V-B to the Rules of Business, 1973 and the Prime Minister s advice9s0 rendered on 17-04—2022 and 01-05-2022 for removal of Governor of the Punjab, Mr Omar Sarfraz Cheema ceases to hold the office of the Governor of the Punjab, with immediate effect.The Speaker of the Provincial Assembly of Punjab shall perform the function of Governor Punjab as Acting Governor till the appointment of a new Governor, in accordance with Article 104 of the Constitution.On the other hand, Omar Sarfraz Cheema has said that he will continue to perform his duties as long as the president wants.

Read More...

First $10m inflow in T-bills after two months

After a two-month pause, the foreigners started making investments in high-return treasury bills (T-bills).The latest data of the State Bank of Pakistan (SBP) issued on Monday showed that the foreigners invested $9.9 million in T-bills on Friday just after the government raised the profit rates.During March and April T-bills and Pakistan Investment Bonds (PIBs) didn’t attract any foreign investment due to highly uncertain political situation in Pakistan. In fact, the foreigners during this period withdrew their investments from the domestic bonds.Before the political crisis started, Pakistan received over $25m inflows in T-bills and $5m in PIBs in February.However, the new government on April 28 made an attempt to make the domestic bonds more attractive for investment especially for foreigners by increasing the benchmark six-month T-bills rates by 114 basis points to 14.99 per cent — a move beyond the expectations of the financial market.

Read More...

Chinese IPPs warn of closure if not paid Rs300bn

With more than Rs300 billion in stuck up dues, more than two dozen Chinese firms operating in Pakistan on Monday said that they would be forced to shut down their power plants this month unless payments were made upfront.This was the overwhelming theme of a meeting presided over by Minister for Planning and Development Ahsan Iqbal with more than 30 Chinese companies operating under the flagship multi-billion-dollar China-Pakistan Economic Corridor (CPEC) in various areas including energy, communication, railways and others.There was a plethora of complaints, including those relating to complex visa procedures for Chinese executives, taxation and so on, but there were also counter complaints from the Pakistani side as well, on delayed responses to their communications, informed sources told Dawn.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.