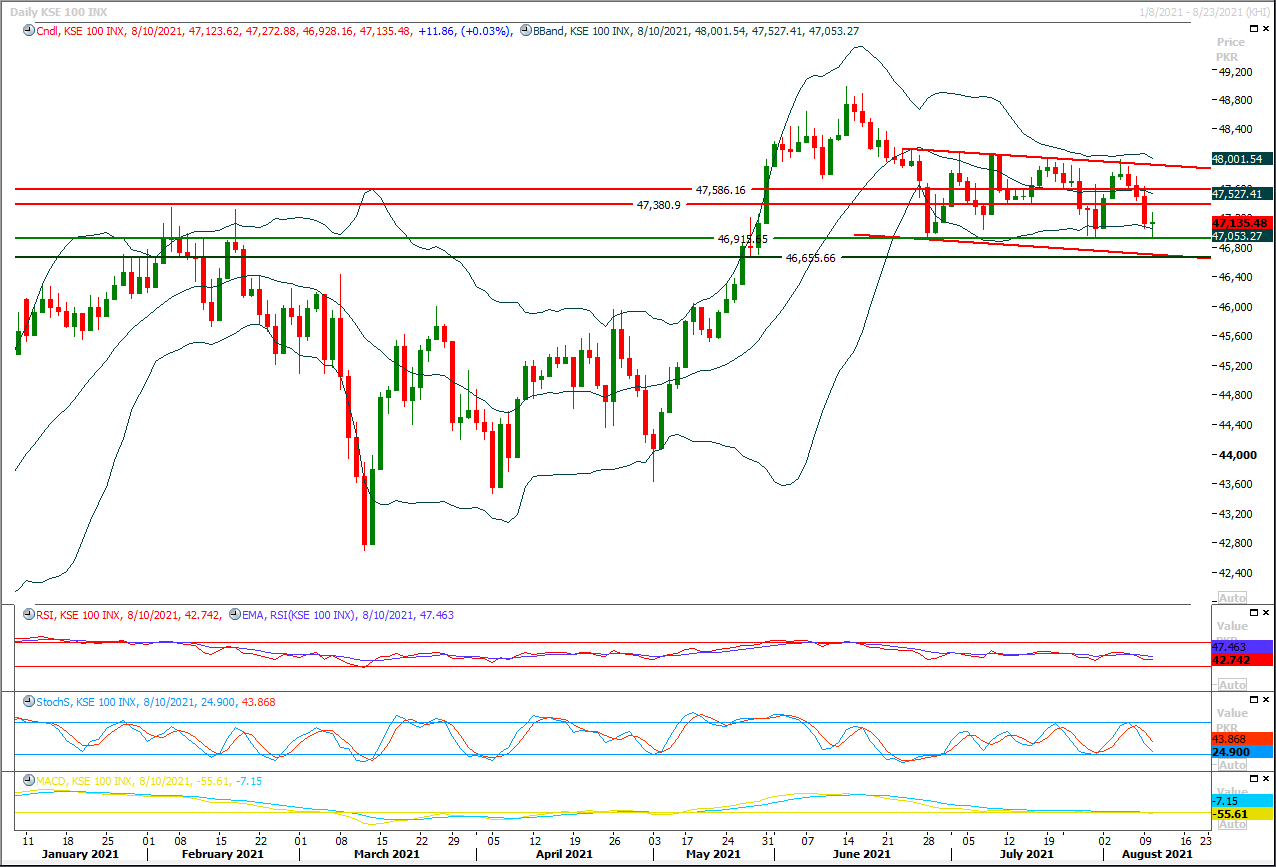

The Benchmark KSE100 index had succeeded in establishing ground above 46,900opts where a strong horizontal supportive region tried to push index back into positive zone during last trading session and a doji formation was created on daily chart. As of now index have supportive region at same level where it would try to establish triple bottom on daily chart but breakout below this region would call for 46,660pts and 46,200pts. While on flip side index would face initial resistance at 47,380pts where its being capped by a horizontal resistant region and breakout above this region would format a daily morning shooting star and would call for 47,600pts. Daily momentum indicators are still in bearish mode while hourly stochastic and MAORSI have changed their direction towards bearish side once again after a pullback therefore its recommended to stay cautious as a volatile session could be witnessed. It's recommended to stay on long side with strict stop loss of 46,900pts for day trading and it's recommended to adopt cut and reverse strategy on bearish breakout of this region. Overall index would remain under pressure until it would not succeed in closing above 48,065pts on daily chart.

Regional Markets

Australia's Leigh Creek says fertiliser project to become carbon neutral by 2022

Australia's Leigh Creek Energy Ltd said on Wednesday its flagship fertiliser project would become carbon neutral from 2022, eight years ahead of plan, as it worked to curb greenhouse gas emissions and elevate environmental standards.Companies around the world are vying to become carbon neutral to tackle the rising global warming concerns, coupled with pressure from banks and global insurers that favour funding firms with more renewable alternatives.The gas producer said its project in Southern Australia will likely be the first large-scale fertiliser project in the world to be carbon neutral.

Read More...

Business News

Lucky gets permission to set up assembly plant for Samsung mobile devices

The Pakistan Telecommunication Authority (PTA) has formally allowed Samsung, a South Korean electronics giant, to start production of its mobile phone devices in the country through its local partner Lucky Motor Corporation Ltd.The PTA on Tuesday issued a Mobile Device Manufacturing (MDM) authorisation to Lucky Motor to set up an assembly plant in Karachi for producing Korean mobile devices.The PTA has so far issued around 25 MDM authorisations to foreign and local companies for the production of mobile devices (2G/3G/4G).

Read More...

Investment by banks in govt papers up by 30pc

The stock of investments held by scheduled banks at the end of July amounted to Rs14.1 trillion, up 30.4 per cent from a year ago, data released by the State Bank of Pakistan (SBP) on Tuesday showed.The sharp increase in banks’ lending to the government through risk-free instruments like Treasury bills (T-bills) and Pakistan Investment Bonds (PIBs) is partly a result of Islamabad’s inability to borrow from the central bank under the International Monetary Fund (IMF) loan programme.Government borrowing from the central bank for budgetary purposes is inflationary and thus restricted by the IMF.

Read More...

Pakistan LNG to provide KE gas for new plant

The state-owned Pakistan LNG Ltd (PLL) and private power utility K-Electric on Tuesday signed a formal agreement under which the former would supply 150 million cubic feet per day of regasified liquefied natural gas (RLNG) to the KE’s upcoming 900-megawatt power plant at Bin Qasim.The gas supply agreement (GSA) was signed by KE Chief Executive Officer Moonis Alvi and PLL Chief Executive Masood Nabi. Energy Minister Hammad Azhar, SAPM on Power and Petroleum Tabish Gauhar and Petroleum Secretary Dr Arshad Mahmood also attended the signing ceremony.

Read More...

Remittances decline by 2pc in July, but still over $2bn

Overseas Pakistanis working around the world sent $2.71 billion last month.The State Bank of Pakistan (SBP) on Tuesday said that this was the second highest level of remittances reported in the month of July.The inflow of remittances continued with over $2bn for the 14th consecutive month.“In terms of growth, remittances increased by 0.7 per cent over previous month and showed a decline by 2.1pc over the same month last year,” said the SBP.The central bank said this marginal year-on-year decline was largely on account of Eidul Azha, which resulted in fewer working days in July compared to the same month last year.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.