Technical Overview

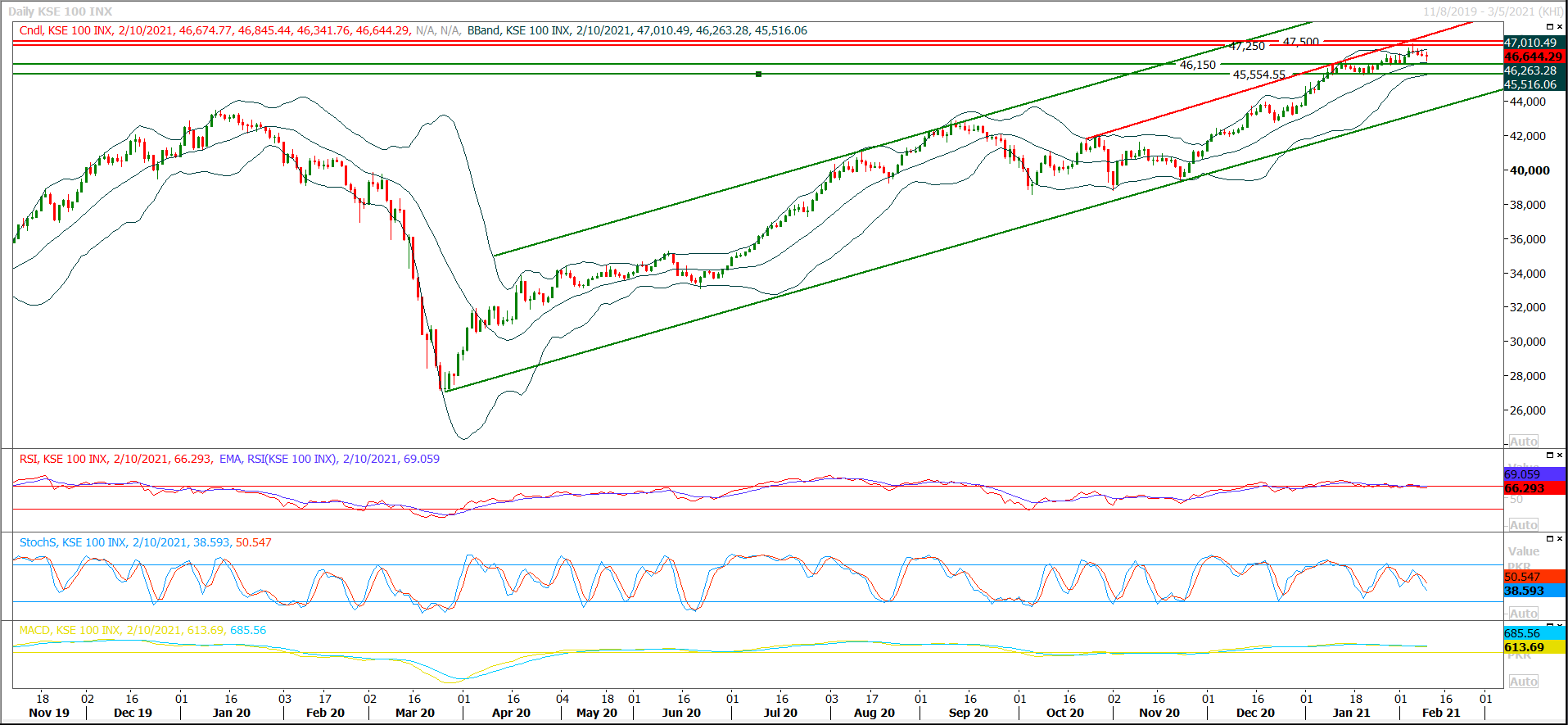

The Benchmark KSE100 index had tried to establish ground above its major supportive region of 46,350pts during last trading session and have succeeded in maintaining above 46,500pts at day end. As of now bollinger bands have squeezed on both daily and hourly timeframes therefore it can be said that index is ready for a breakout on either side. Currently index have major supportive region ahead at 46,350pts which is being followed by 46,150pts and 46,000pts where strong horizontal supportive regions would try to pump fresh volumes in market, but its recommended to stay cautious because daily and hourly momentum indicators are losing strength which may lead index towards an uncertain region. For day trading it's recommended to adopt swing trading with strict stop loss on both sides. On flip side index would face initial resistance at 46,860pts which would be followed by 47,000pts and 47,250pts. Investor sentiment would remain uncertain until index would not succeed in closing above 47,500pts on daily or weekly chart.

Regional Markets

Asia stocks pause at peaks, sustained by stimulus promise

Asian shares rested at record highs on Thursday as investors digested recent meaty gains, though the promise of endless free money to sustain buying was reaffirmed by benign U.S. inflation data and a very dovish outlook from the Federal Reserve. Adding to the torpor was a lack of liquidity as markets in China, Japan, South Korea and Taiwan were all on holiday. MSCI’s broadest index of Asia-Pacific shares outside Japan eased 0.1%, having climbed for four sessions straight to be up over 10% so far this year. Japan’s Nikkei was shut after ending at a 30-year peak on Wednesday, while Australia’s main index held near an 11-month top. Futures for the S&P 500 and NASDAQ both dipped 0.1%, having again hit historic highs on Wednesday.

Read More...

Business News

NAB, Nepra to keep an eye on IPPs: minister

The government on Wednesday said the National Accountability Bureau (NAB), National Electric Power Regulatory Authority (Nepra) or Securities and Exchange Commission of Pakistan (SECP) would be free to proceed against independent power producers (IPPs) for any misdeed or criminality even after they agreed to give about Rs770 billion discount over the remaining 20-year life of their contracts. At the same time, the government is holding talks with banks to prolong their debt repayment tenure from existing 10 years to 20 years along with cut in interest rates. “The government has not cut its hands at all. We have protected our every right (in the revised agreement with IPPs).

Read More...

OGRA determines gas price at Rs644.84 per MMBTU on SNGPL network

Oil and Gas Regulatory Authority (OGRA) on Wednesday ‘provisionally’ determined the gas price at Rs644.84 per MMBTU (Million British Thermal Unit) against each category of consumers on the network of Sui Northern Gas Pipelines Limited (SNGPL) for the fiscal year 2020-21. Disposing of the SNGPL’s review petition for the Estimated Revenue Requirement for the year 2020-21, the authority also ‘provisionally’ determined the company’s shortfall in estimated revenue requirement at Rs4,352 million, and the revenue requirement at Rs228,703 million. The company had pleaded to fix the gas price at Rs1,404.92 per MMBTU with average increase of 123 percent, while the authority determined the price at 644.84 per MMBTU with an average surge of 2 percent.

Read More...

Provinces receive Rs1.28tr from Centre under NFC Award in first half of current FY

Provinces have received Rs1.28 trillion from federal government under National Finance Commission (NFC) Award in first half (July to December) of the current fiscal year. The federal government has transferred 44.5 percent of the annual share of Rs2,873.72 billion to provinces in first half. The federal government was supposed to transfer 50 percent of the annual share in July to December of the current fiscal year. The latest data of ministry of finance showed that four provincial governments have received Rs1.28 trillion from the centre. The federal government has not transferred the projected amount to provinces despite it has achieved the first half tax collection target. The Federal Board of Revenue (FBR) has achieved its six-monthly target of Rs2,210 for the current fiscal year from July to December. In annual budget, the federal government had projected to transfer Rs2,873.72 billion to the four provinces under the National Finance Commission (NFC) Award in the budget for the fiscal year 2020-2021.

Read More...

Record Rs51bn financing in a week under Temporary Economic Refinance Facility

The Temporary Economic Refinance Facility (TERF) has recorded the highest increase of Rs51 billion during one week, which ended on January 28, while the total amount has reached over Rs374bn. The TERF facility had been introduced to counter the negative impact of Covid-19 on the economy. The State Bank of Pakistan said the TERF had shown significant growth over the last 10 months, as reflected by increase in requested amount from Rs36.1 billion by the end of April 2020 to Rs687.4bn by Jan 28, 2021, while over the same period approved financing has reached Rs374.3bn. So far, 450 projects have been approved under the scheme.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.