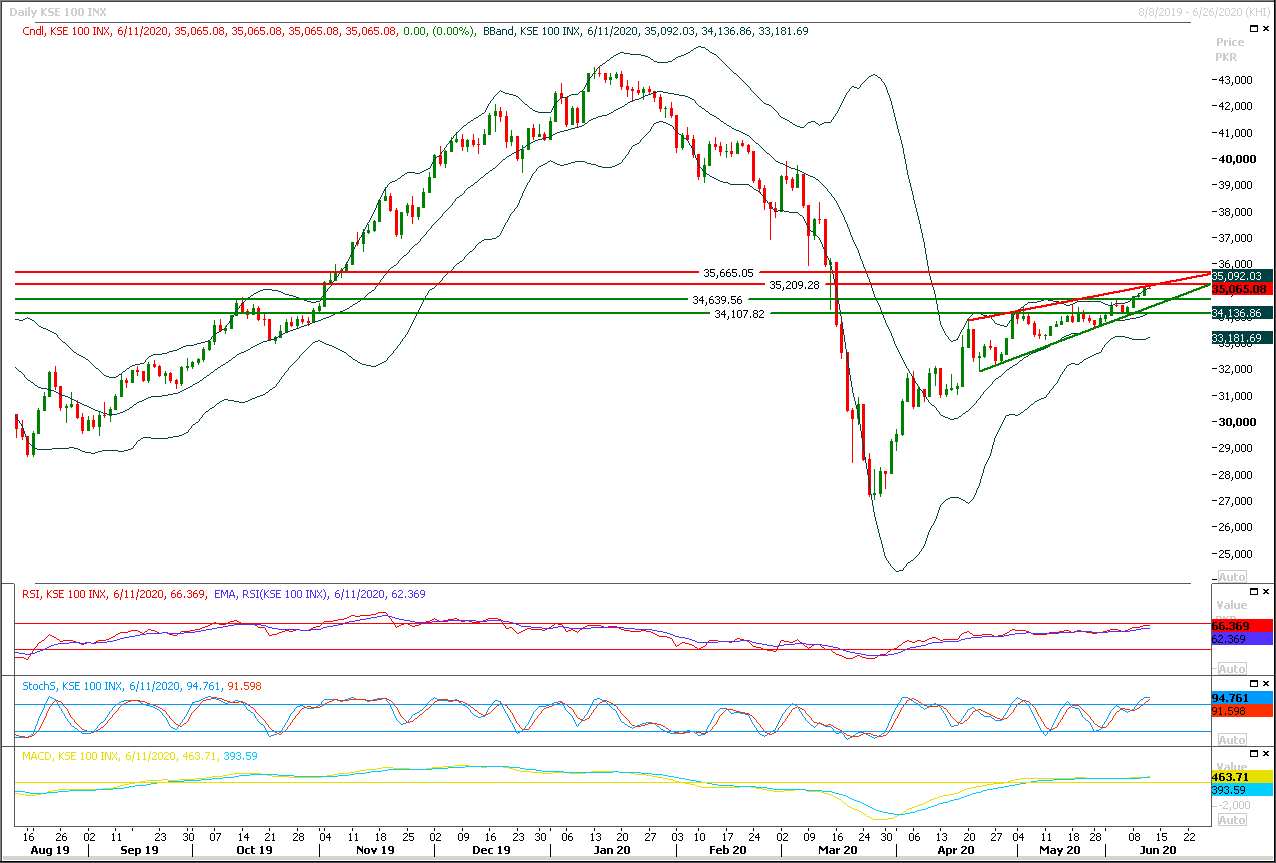

Technical Overview

The Benchmark KSE100 index is going to face a strong resistance from resistant trend line of its ascending wedge along with a strong horizontal resistant region during current trading session. It's expected that index would face its initial resistance at 35,200pts and in case of breakout above this region index would try to move forward and would continue its bullish momentum towards 35,500 and 35,660pts but it's recommended to stay cautious because in case of rejection from its resistant regions index would slide downward more quickly therefore it's recommended to post trailing stop loss on existing long positions and stay cautious until index gave a daily closing above 35,200pts. In case of facing rejection from its resistant regions index could slide towards 34,700pts or 34,500pts. Meanwhile index would remain bullish until index would not succeed in closing below 34,000pts on daily chart.

Regional Markets

Asia stock rush pauses, bonds rally on sober Fed

Asian shares eased on Thursday while bonds rallied after a downbeat economic outlook from the U.S. Federal Reserve stoked speculation it would have to add to already historic levels of stimulus to safeguard recovery. Still, stock losses were modest given the scale of their recent rise. MSCI’s broadest index of Asia-Pacific shares outside Japan dipped 0.3%, a natural pause after 10 straight sessions of gains. Japan’s Nikkei slipped 1.1% as the yen firmed, while Chinese blue chips were off 0.4%. E-Mini futures for the S&P 500 fell 0.4%. The Dow had ended Wednesday down 1.04%, while the S&P 500 lost 0.53%. Bucking the trend, the Nasdaq Composite added 0.67% to a fresh record helped by gains in Microsoft and Apple. In a challenge to the stock market’s recent optimism, the Fed predicted the U.S. economy would shrink 6.5% in 2020 and unemployment would still be at 9.3% at year’s end.

Read More...

Business News

Rs1.32tr approved for national development programme

As the provinces drastically cut their development plans, the National Economic Council (NEC) on Wednesday approved Rs1.32 trillion worth of consolidated development programme for next year — about 12pc lower than current year’s Rs1.5tr — to achieve an economic growth rate of 2.1 per cent. The meeting of the NEC — the country’s highest constitutional forum on economy — was presided over by Prime Minister Imran Khan and attended by its federal members. All provincial chief ministers and other members participated via video-link. The meeting approved Rs650 billion federal Public Sector Development Programme (PSDP) for next year, down about 7.3pc when compared to current year’s Rs701bn. This includes Rs70bn allocation for short-term Covid-19 response projects.

Read More...

Covid-19 to worsen global inequality, says Baqir

The Covid-19 has had a devastating effect on most countries which will increase global inequality across the world, said State Bank of Pakistan Governor Reza Baqir on Wednesday. Speaking in a virtual panel discussion ‘Lasting Scars: The Global Impact of the Pandemic’, hosted by the World Bank, he said the multilateral institution is good in a normal situation but now the time has come to revisit it. “Lockdown is a luxury for rich countries which economies like Pakistan can not sustain,” he remarked. Baqir said the International Monetary Fund had introduced drastic changes with elasticity in its credit lending after the financial crisis in 2007-08 and it is now time for the lender to show its leadership.

Read More...

ECC allows duty-free import of wheat

The Economic Coordination Committee (ECC) of the Cabinet on Wednesday allowed tax and duty- free import of wheat. The committee placed a complete ban on wheat export as the commodity’s price in local markets shot up. The ECC “allowed import of wheat by the private sector for unlimited period after waiving different taxes and duties”, said an official statement after the meeting. It further issued directives to remove restrictions on the movement of wheat and flour within the country. The ECC meeting, presided over by Finance Adviser Dr Abdul Hafeez Shaikh, also rejected the Ministry of Petroleum’s request for quarterly fuel price adjustment to bailout out the oil industry. It approved about Rs29 billion worth of additional funds for 12 ministries and divisions just two days ahead of the new budget.

Read More...

ADB okays $500m loan to Pakistan

The Asian Development Bank (ADB) has approved a $500 million loan to Pakistan for social protection, health and fiscal stimulus for growth and job creation. In a statement, the ADB said the loan would deliver social protection programmes to the poor and vulnerable, expand health sector capabilities, and deliver a pro-poor fiscal stimulus to boost growth and create jobs as the country fights the novel coronavirus. “The Covid-19 pandemic hit Pakistan at a critical point in its ongoing economic recovery programme,” said ADB President Masatsugu Asakawa.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.