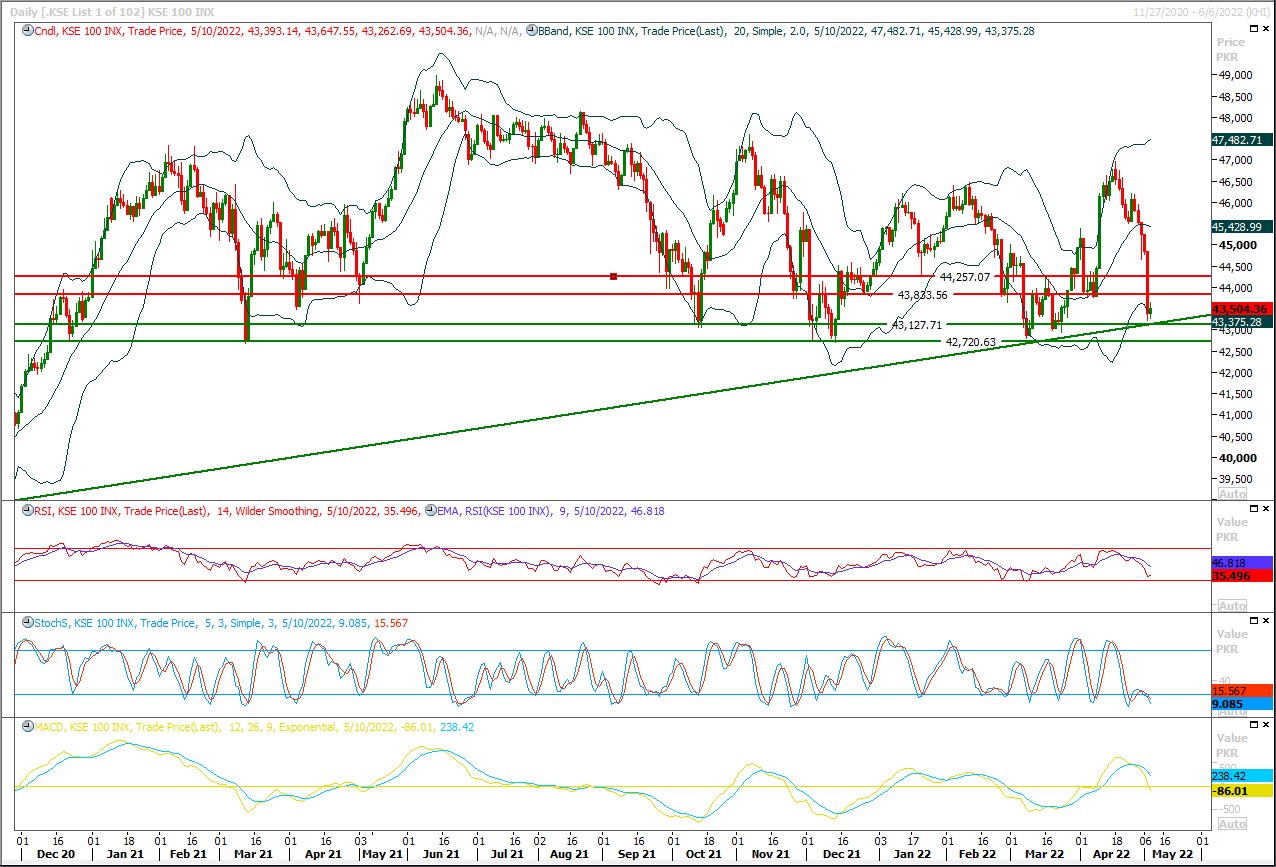

The Benchmark KSE100 index is trying to establish ground above an ascending trend line and after occurrence of a spinning top on daily chart during last trading session now chances of a morning shooting star have started looming but it's recommended to stay cautious and post strict stop loss on new long positions or post trailing stop losses on existing long positions, because if index would not succeed in maintaining above 42,700pts then it may face some serious pressure in coming days. For day trading buying on dip is recommended with strict stop loss of 42,700pts. Overall a volatile session could be witnessed today and index would remain range bound. Hourly momentum indicators are in positive mode and it's expected that index would start the day with a positive note and it would face strong resistance between 43,760pts to 43,830pts where it's being capped by a strong horizontal resistant region and rejection from this region would push index for a new low between 43,200pts-43,130pts. In case of formation of a morning shooting star it's still recommended to wait for confirmation before initiating new long positions.

When Aarti and Gaurav Kathuria were saving for their first home, a three-bedroom townhouse in Auckland, they cut back on eating out and other expenses so they could put together the hefty deposit.Now, only months after paying NZ$875,000 ($560,000) for a home in one of the world's most unaffordable cities, they're faced with a new challenge: property prices are falling, while mortgage rates and living costs are going up.The declining property values are a product of policies designed to knock some of the heat out New Zealand's red-hot housing market. But for people like the Kathurias, the hit to household wealth has meant a tightening of the purse strings."All you can do is cut back on things," Aarti Kathuria said.House prices in New Zealand, which were already elevated before the COVID-19 pandemic, jumped 43% in the two years to December 2021, according to the Real Estate Institute of New Zealand said. They've fallen around 1% since December.

Read More...President Dr Arif Alvi has called for a thorough probe and investigations into the alleged regime change conspiracy by recording circumstantial evidence to reach a logical conclusion and provide clarity to the people of Pakistan.In a letter to former prime minister Imran Khan, the president insisted that a thorough probe into the regime change conspiracy should be conducted.The president informed Imran Khan that he was sending his letter to the prime minister of Pakistan as well as to the chief justice of Pakistan with the request that the latter may constitute an empowered Judicial Commission to conduct open hearing in this regard. He wrote that he had read the copy of the Cypher sent by the then ambassador of Pakistan to the United States of America, containing an official summary of a meeting held in the Pakistan Embassy between US Assistant Secretary of State Donald Lu, along with another US official, and our ambassador with a note-taker, together with other diplomats of the Pakistan Mission in US.

Read More...

PM Flies To London For Special Meeting With Nawaz

Former prime minister and supremo of Pakistan Muslim League-Nawaz (PML-N) on Tuesday summoned top party leaders for a special meeting in London to discuss some ‘important issues.’Federal Information Minister Marriyum Aurangzeb confirmed the development Tuesday while responding to a question during a press conference in Islamabad.Prime Minister Shehbaz Sharif, she said, will be travelling to London on Tuesday night as part of a PML-N delegation to meet party supremo Nawaz Sharif.She said the “politically unemployed” PTI leadership was trying to build a false narrative on the visit of a PML-N delegation to London for meeting party’s supreme leader Nawaz Sharif, which was part of the consultative process. Prime Minister Shehbaz Sharif would also accompany the delegation, she added.Consultation in the political parties was not an unusual thing, she said, adding those who were trying to give a false impression did not have any such culture in their own party which took all its decisions in line with the whims of a single person.

Read More...

Rupee hits all-time low against dollar

The rupee continued its slide against the dollar on Tuesday with the international currency hitting an all-time high of Rs188.66 in the interbank market.According to the State Bank of Pakistan (SBP), the rupee lost 0.6 per cent or Rs1.13 on a day-on-day basis. The US currency appreciated by Rs1.84 in the preceding two sessions.The rising exchange rate has rattled the economy. The rupee has been losing its value mainly because of an uncontrolled rise in imports and a relatively slower pace of growth in exports. This is reflected in the trade deficit, which reached $39 billion in July-April.Currency dealers say higher demand for dollars is the key reason for the bullish trend in the currency market. Political foot-dragging by the incumbent government on the reversal of fuel and electricity subsidies — a prerequisite for the resumption of the loan programme by the International Monetary Fund — has further eroded the confidence of stakeholders.

Read More...

Govt assures World Bank of reform push in upcoming budget

Amid a rising fiscal deficit because of heavy fuel and energy subsidies, Pakistan on Tuesday assured the World Bank (WB) it would push through reforms in the upcoming budget for fiscal consolidation to build economic resilience.The assurance was given by Minister of Finance Miftah Ismail to a WB delegation led by Hartwig Schafer, Vice President, South Asia Region, at the conclusion of a two-day visit during which they held meetings with Prime Minister Shehbaz Sharif and ministers for planning and energy.Critical of the tariff subsidies at the rate of Rs5 per unit announced by former prime minister Imran Khan on February 28 in the middle of a political crisis, WB has been asking the authorities to withdraw or phase out the fresh subsidy package because the circular debt was estimated to increase by more than Rs500 billion during the current fiscal year.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.