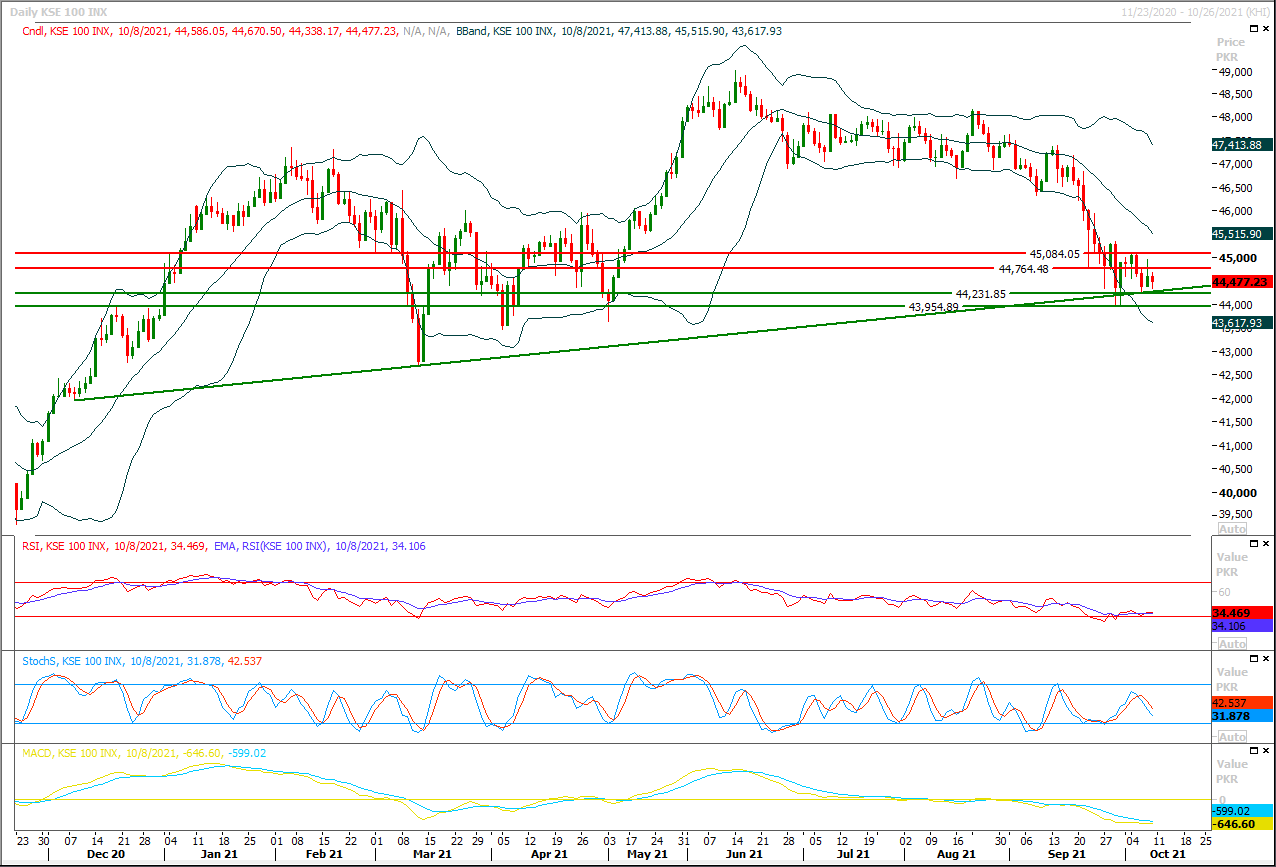

The Benchmark KSE100 index is being caged in a triangle on hourly chart and had penetrated below its major supportive region of 44,500pts during last trading session. As of now it needs to stay cautious because pressure seems piling up and if it would succeed in giving a bearish breakout of this triangle then it may slide further downward to extend its previous low. Currently index have initial supportive region ahead at 44,290pts where its being supported by a horizontal supportive region and it may create a cheat pattern by penetration below supportive trend line of its triangle and then maintaining above said supportive region therefore it's recommended to post stop losses below 44,290pts. But once it would succeed in closing below this region on hourly chart then it would start sliding further downward till 43,950pts. While on flip side in case of bullish pull back index would face initial resistance at 44,660pts where its being capped by a horizontal resistance region and breakout above this region would call for resistant trend line of current triangle which falls at 44,850pts. Overall index seems to remain range bound and may show some volatile moves between 43,950pts to 45,000pts. Meanwhile on daily charts it's trying to establish ground above an ascending trend line which falls at 44,230pts and daily closing below this region may change market sentiment for short term basis and may lead index towards 43,500pts and 42,800pts.

Regional Markets

US stock futures lead Asia lower, dollar gains on yen

Asian shares slipped on Monday as global inflation angst favoured commodities as a hedge over U.S. equities, while rising U.S. bond yields lifted the dollar to two-and-a-half year peaks against the Japanese yen.Nasdaq futures and S&P 500 futures were both down around 0.5% in early trade, as oil prices extended their bull run."Bond yields continue to push higher, inflation expectations are rising and monetary tightening in various guises is becoming more prevalent," said ANZ analysts in a note."The global chips shortage will extend well into next year.

Read More...

Business News

CPEC power project in Sindh making steady progress

The 330MW Thar Energy Limited (TEL) Power Project in Thar Block-II being completed under China-Pakistan Economic Corridor (CPEC) in Sindh province was making steady progress, said a senior Chinese official.The TEL power plant was a 330MW mine-mouth lignite-fired power project being built by Thar Energy, which was owned by Hub Power Company (Hubco), China Machinery Engineering Corporation (CMEC), and Fauji Fertilizer Company (FFC).The TEL power plant would supply electricity to the national grid under a 30-year Power Purchase Agreement (PPA).

Read More...

Gwadar Eastbay Expressway completion likely by October end

Gwadar Eastbay Expressway the most important mega connectivity and road infrastructure project worth $168 million is likely to be completed this month.The completion of the Gwadar Eastbay Expressway being constructed under China Pakistan Economic Corridor (CPEC) would trigger a major jump in the development of the Coastal City, a senior official of Gwadar Development Authority told media on the mega project status.He said the project was envisaged under the Early Harvest Scheme during the first phase of CPEC. The project was part of a wider $1.1 billion development package for the city and Port of Gwadar.

Read More...

Nepra opposes govt’s plan to amend MO

The National Electric Power Regulatory Authority (NEPRA) has opposed the government’s move, for a new policy direction for the operation of RLNG power plants out of Merit Order (MO), under which the cost of the deviation from MO will be passed on to the energy consumers.The Power Division (Ministry of Energy) wants to transfer the burden of the running the RLNG power plants out of merit order to the electricity and gas consumers, however, the move was not supported by NEPRA, official source told The Nation here on Sunday.

Read More...

Pakistan facing impact of two Afghan wars: Tarin

Federal Finance Minister Shaukat Tarin has said that participation in the Afghan war during the 1980s and the ‘war on terror’ after 9/11 resulted in destabilising the country’s economy, which is still facing repercussions of those decisions.However, he added, the present government had devised short-, mid- and long-term plans for national development. The minister was addressing the annual dinner of Punjab University Institute of Business Administration’s alumni association on Saturday night.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.