Technical Overview

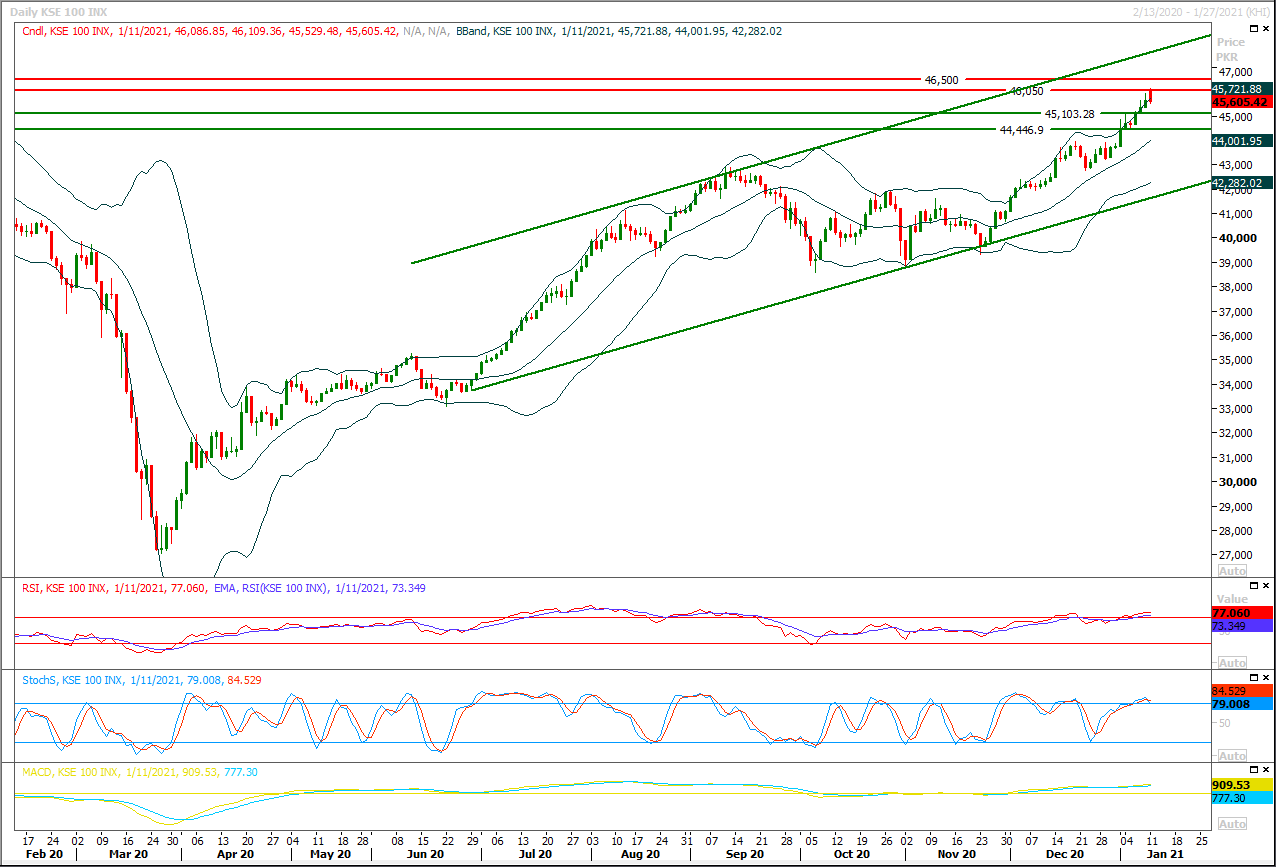

The Benchmark KSE100 index have faced rejection from a horizontal resistant region during last trading session and daily stochastic have created a bearish crossover which indicates start of an uncertain region in coming days if index would succeed in closing below 45,500pts during current trading session. As of now it's expected that index would face pressure initially during current trading session which may push index towards its supportive regions at 45,440pts while breakout below that region would call for 45,200pts-45,100pts region but later on a sharp recovery could be witnessed till day end. It's recommended to stay cautious because if index would slide below 45,100pts then a corrective wave may prolong towards 44,800pts. Overall sentiment would remain bullish as long as index is trading above 44,700pts but closing below that region would push index for deeper correction in coming days. Today a volatile session could be witnessed therefore swing trading could be beneficial otherwise buying on dip with strict stop loss of 44,900pts is recommended for day trading. On flip side index would face initial resistance at 45,900pts which would be followed by 46,100pts where it's being capped by strong horizontal resistant regions.

Regional Markets

Asia shares mostly lower amid rising coronavirus cases, Washington turmoil

Asian stocks were mostly lower on Tuesday, tracking Wall Street declines as political turmoil in Washington and rising coronavirus cases worldwide weighed on sentiment ahead of the start of the quarterly earnings season. Japan’s Nikkei slipped 0.48%, South Korea’s KOSPI fell 0.91% and Hong Kong’s Hang Seng index futures lost 0.54%. Defying the broader selloff, Australia’s S&P/ASX 200 rose 0.24%. On Wall Street, the Dow Jones Industrial Average fell 0.29%, the S&P 500 lost 0.66% and the Nasdaq Composite dropped 1.25%. Investors are expecting guidance on the extent to which executives see a rebound in 2021 earnings and the economy from results and conference calls from JP Morgan, Citi and Wells Fargo Friday.

Read More...

Business News

Sugar production likely to soar this year

National Price Monitoring Committee (NPMC) on Monday was informed that production of sugar is likely to increase this year due to improved sugarcane crushing activity and would eventually release pressure on the upward price trend. After a decline in the past month and reached Rs81 per kg, sugar prices have once again increased in different markets during the past week. Sugar prices have surged up to Rs90 to Rs95 per kg in different cities of the country. There are rumours that prices might rise up to Rs100 per kg. The NPMC has noted that sugar prices would reduce after sugarcane crushing activity. Federal Minister for Finance & Revenue, Dr Abdul Hafeez Sheikh, chaired the meeting of the National Price Monitoring Committee (NPMC).

Read More...

Nepra to investigate countrywide power outage

The National Electric Power Regulatory Authority (Nepra) on Monday decided to conduct an independent investigation into the countrywide power outage on Saturday night through private sector engineering experts. In a statement, Nepra said it had taken serious notice of the recent nationwide power blackout and “decided to constitute a high-powered committee of top professionals from Nepra and renowned protection engineers from the private sector to ascertain the reasons and facts about this incident”. It said the committee would also be required to give recommendations to avoid such incidents in future.

Read More...

Services trade deficit shrinks 38.02pc, exports increase 12.90pc

The country’s services trade deficit contracted by 38.02 per cent during the first five months of the current financial year (2019-20) as compared to the corresponding period of last year. The services trade deficit during July-November (2020-21) was recorded at $925.20 million against the deficit of $1492.85 million in July-November (2019-20), according to the latest data of Pakistan Bureau of Statistics (PBS). The services exports during the five months under review were recorded at $2158.06 million against the exports of $2284.36 million last year, showing negative growth of 5.53 per cent. The imports into the country shrunk by 18.37 per cent by falling from $3777.21 million to $3083.26 million, the PBS data revealed.

Read More...

CDWP approves four health sector projects worth Rs20 billion

The Central Development Working Party (CDWP) on Monday approved four projects of health sector worth of over Rs20 billion. The meeting of the CDWP was held, which was presided over by Deputy Chairman Planning Commission Mohammad Jehanzeb Khan. Senior officials from federal governments also participated in the meeting while representatives from provincial governments participated through video links. The meeting approved a project namely “Establishment of 200-bed Mother & Child Hospital and Nursing College, Attock district, Punjab” worth Rs 5.82 billion. While it also approved another project namely “Establishment of 200-bed Mother & Child Hospital and Nursing College” worth Rs8.1 billion.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.