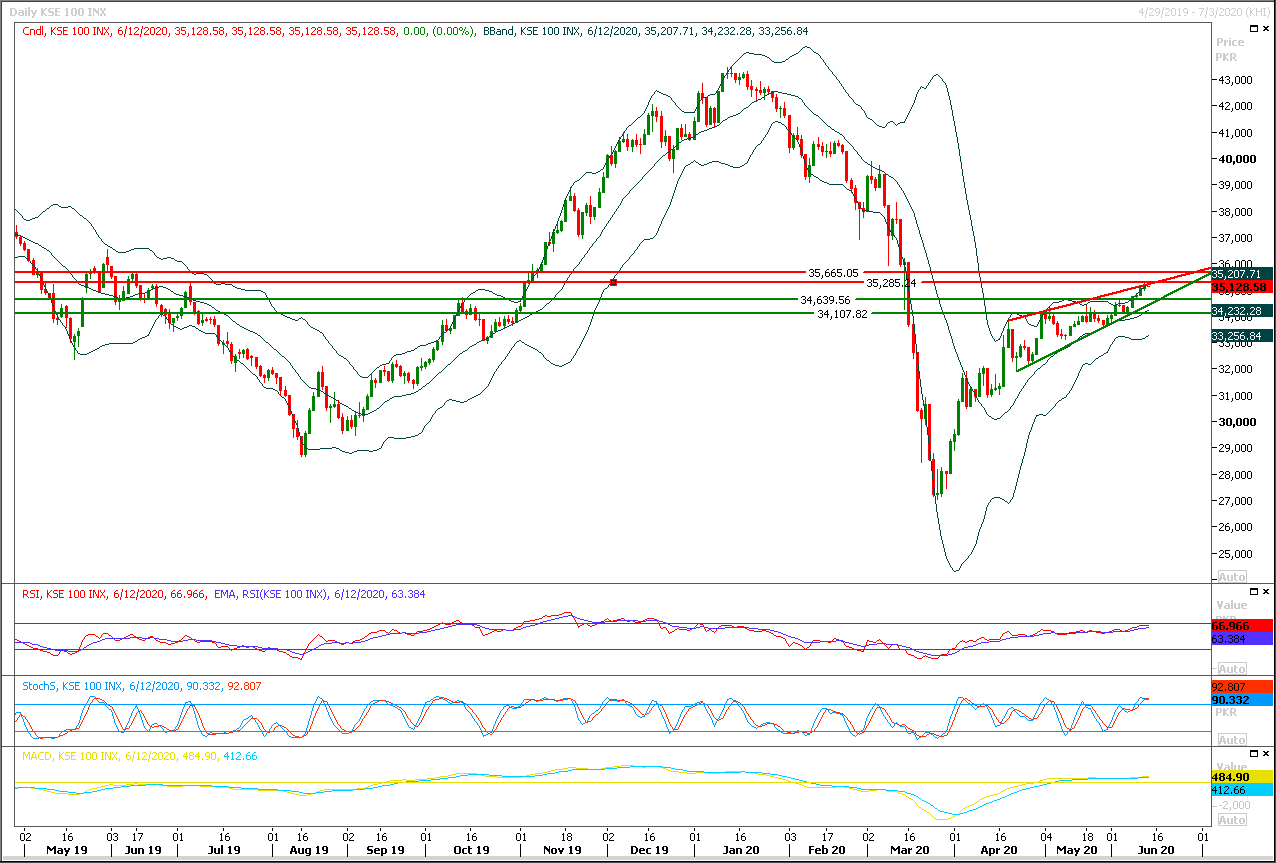

Technical Overview

The Benchmark KSE100 index is going to face a strong resistance from resistant trend line of its ascending wedge along with a strong horizontal resistant region during current trading session. It's expected that index would face its initial resistance at 35,400pts and in case of breakout above this region index would try to move forward and would continue its bullish momentum towards 35,660pts but it's recommended to stay cautious because in case of rejection from its resistant regions index would slide downward more quickly therefore it's recommended to post trailing stop loss on existing long positions and stay cautious until index gave a daily closing above 35,500pts. In case of facing rejection from its resistant regions index could slide towards 34,700pts or 34,500pts. Meanwhile index would remain bullish until index would not succeed in closing below 34,000pts on daily chart.

Regional Markets

Asian shares, oil slump as coronavirus fears take hold

Asian shares fell sharply on Friday after Wall Street and oil tumbled over growing concerns that a resurgence of coronavirus infections could stunt the pace of recovery in economies reopening from lockdowns. MSCI’s broadest index of Asia-Pacific shares outside Japan slid 1.3%. Australian stocks dropped 1.74%, while shares in China fell 0.67%. Oil futures slumped for a second consecutive trading session due to worries about weak global energy demand, which weighed on the currencies of oil producers and countries that rely on exporting commodities. The Chinese yuan headed for its biggest daily decline in two weeks, underscoring investors’ risk-averse mood in Asia.

Read More...

Business News

Hafeez blames Covid-19 for Rs3 trillion GDP loss

The data released by the government presented a dismal economic performance as all indictors painted broad-based setbacks and Adviser to the Prime Minister on Finance and Revenue Dr Abdul Hafeez Shaikh blamed Covid-19 for a loss of over Rs3 trillion to the national income. Presenting the Economic Survey of Pakistan 2019-20 at a press conference on Thursday — a day before the announcement of the federal budget for financial year 2020-21 — the adviser spent a large part of his speech building narrative around inheriting a troubled economy and putting it on road to recovery before the Covid-19 pandemic hit economies of the world and Pakistan.

Read More...

Ogra holds six OMCs responsible for petroleum shortage

The Oil and Gas Regulatory Authority (Ogra) on Thursday held six major oil marketing companies (OMCs) responsible for petroleum shortage across the country and imposed on them a cumulative fine of Rs40 million. The authority also issued fresh show-cause notices to Askar Petroleum, Byco Petroleum and BE Energy for similar violations of rules and licence conditions, resulting in petroleum shortage. Under six separate notifications, Ogra disposed of the proceedings under show-cause notices issued to these OMCs after finding their point of view unsustainable. It held that the companies were found in violation of the licence conditions and they had insufficient stocks.

Read More...

IHC stops action against sugar mills

The sugar industry heaved a sigh of relief as the Islamabad High Court (IHC) on Thursday stopped a possible crackdown against it for misuse of public money and cartelisation leading to massive price hike of the commodity. IHC Chief Justice Athar Minallah granted a stay order against the recommendation of the inquiry commission on the sugar scam that has called for registration of criminal cases against sugar mill owners on the condition that they would supply the commodity to consumers at the rate of Rs70 per kilogram till June 25, the next date of hearing. The petitioners in this matter are the leading sugar mill owners and known political figures.

Read More...

FBR urged to ease condition of mentioning details of ingredients on labels

Pakistan FMCG Importers Association (PFIA) has urged the Federal Board of Revenue (FBR) to ease the condition of mentioning details of ingredients on labels of imported items both in English and Urdu. In a letter to the FBR, PFIA said that following the issuance of SRO 237(I)/2019, importers requested global suppliers to dispatch their products with the full details of ingredients printed on the label both in English and Urdu as required by the SRO. However, they refused because the quantity of export to Pakistan not sufficient and not financially feasible for reprinting of labels. ‘We also import goods from the foreign wholesale cash and carry stores and they also intimated their unwillingness to meet our request on the same grounds. Consequently, our imports are stalled since June 2019,’ said Deputy Secretary PFIA Muhammad Ejaz Tanveer in the letter.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.