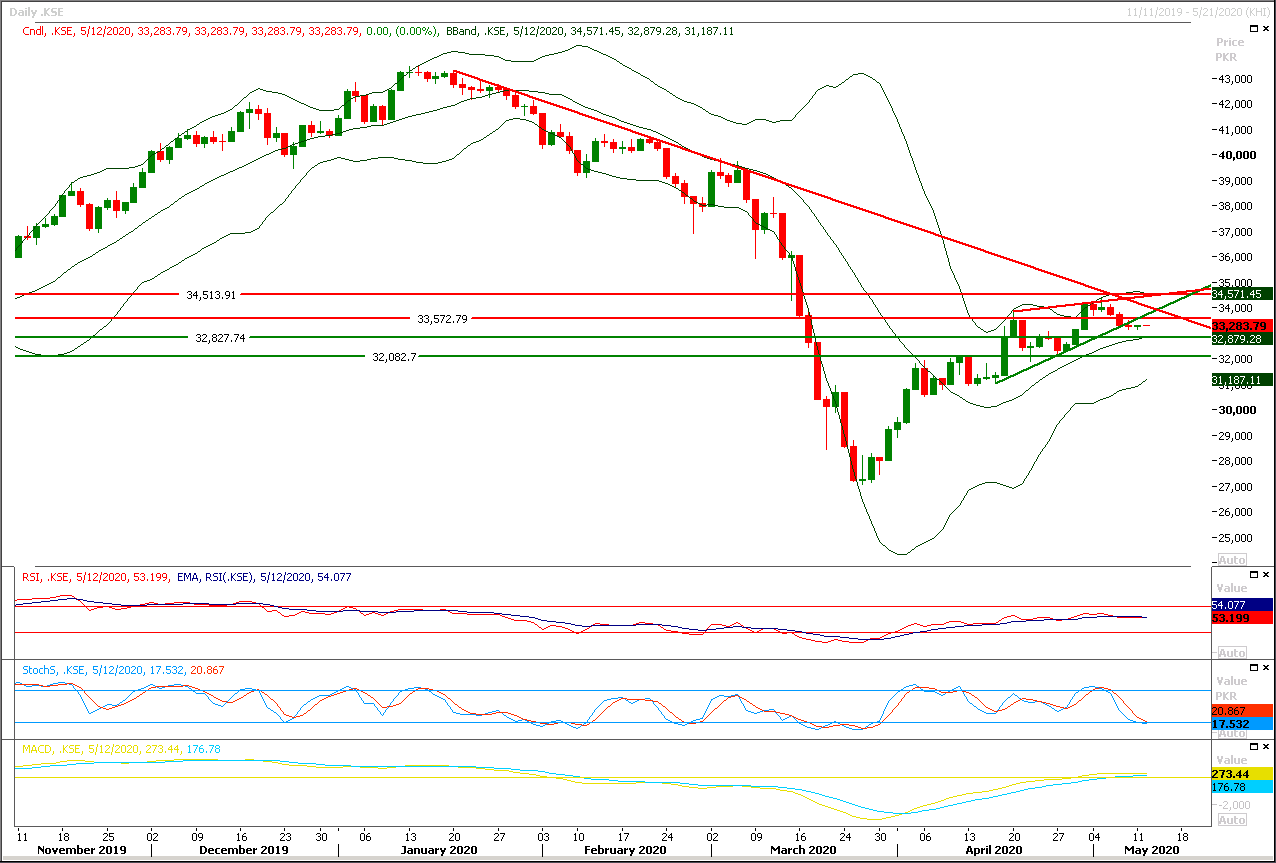

Technical Overview

The Benchmark KSE100 index have closed below supportive trend line of its rising wedge during last trading session and it's expected that now it would face strong resistance from same trend line in case of reversal, meanwhile it would be capped by a strong horizontal resistant region at 33,500pts. It's expected that index would continue its bearish momentum during current trading session and pressure would start piling up in case index would succeed in closing below 33,000pts. Index have succeeded in avoiding a weekly bearish engulfing pattern but a dark cloud have been formatted on weekly chart which would try to push index downward during this week. Daily closing below 33,000pts would call for 32,100pts and then 30,000pts in case of breakout below that region.

While in case of reversal index would face strong resistances at 33,500pts and 33,730pts on intraday basis where a strong horizontal resistant line and supportive trend line of its previous rising wedge would resist against any bullish spike while breakout above these regions would call for 34,200 & 34,500pts in coming days. Index would remain bearish until it would not succeed in closing above 35,200pts.

Regional Markets

Asian stocks stumble on fears of second coronavirus wave, oil up

Asian shares skidded on Tuesday on growing worries about a second wave of coronavirus infections after the Chinese city where the pandemic originated reported its first new cases since its lockdown was lifted. The central Chinese city of Wuhan reported five new cases on Monday, casting doubts over efforts to lower coronavirus-related restrictions across the country as businesses restart and individuals went back to work. MSCI’s broadest index of Asia Pacific shares outside of Japan .MIAPJ0000PUS stumbled more than 1%, snapping two straight sessions of gains. Hong Kong's Hang Seng index was among the hardest hit .HSI, down 1.4% followed closely by Australia , off 1.3%. Chinese shares dithered in early trade with the blue-chip CSI300 index .CSI300 off a shade. South Korea's KOSPI .KS11 faltered 0.9%.

Read More...

Business News

Ferozsons in talks to produce Remdesivir

Ferozsons Laboratories announced on Monday that its subsidiary BF Biosciences Ltd (BFBL) was in negotiations to enter into a non-exclusive license agreement with Gilead Sciences Inc for the manufacture and sale of Remdesivir to supply Pakistan and 126 other countries. “There is no obligation at this time for any party to execute any transaction,” Ferozsons told the PSX in a notice. Ferozsons share hit the upper circuit in trading on Monday as investors fell for the company stocks which also saw several other pharma companies’ record substantial gains. It went on to say in the notice that “If an agreement is executed by Gilead and BFBL, once production starts, we are confident that we will have sufficient quantities over time to serve the needs of the patients in Pakistan.”

Read More...

SBP to finance 100pc of payroll up to Rs500m

The State Bank of Pakistan (SBP) under the banner of Rozgar Scheme will now finance up to 100 per cent of payroll of businesses with an average 3-month wage bill of up to Rs500 million from Rs200m, said a central bank circular issued on Monday. This can be used for the onward payment of wages and salaries for the months of April, May and June. The circular also disclosed that up to May 8 banks have so far approved Rs47 billion loan applications to help save 450,000 jobs and they have received requests from over 1,440 businesses for financing of over Rs103bn to support around 1m employees.

Read More...

Drug-makers warn against banning raw material import from India

Given Pakistan’s high dependence on Indian raw material for manufacturing drugs, the government must not ban its import. Otherwise, there would be a 50 per cent loss in drug production. The situation would not only cause shortage of drugs and increase in their prices, but also weaken the country’s capability to fight Covid-19. This warning was given by representatives of the Pakistan Pharmaceutical Manufacturers’ Association at a news conference held on Monday at the press club. Highlighting concerns of the pharmaceutical industry, PPMA senior vice chairman Syed Farooq Bukhari said the federal cabinet should not take any decision against the import of medicine raw material from India or from any other country when there had been an unabated increase in Covid-19 patients in the country.

Read More...

Against mandatory stocks of 20 days, only 7 days diesel reserves left in country

Against the mandatory stocks of 20 days oil reserves by Oil Marketing Companies, the country has left with the High Speed Diesel reserves of only seven days. The total demand of HSD for the month of May was 711013 Metric Tonnes while the refineries product was 435000 Metric Tonnes, a spokesman for the Petroleum Division said here Monday. There is total deficit of 276013 Metric Tonnes but to meet the deficit the planned import is 394000 Metric Tonnes, said the spokesman. After the arrival of planned import the country will have 112987 Metric Tonnes of HSD. Spokesperson for Petroleum Division negates the speculation over severe diesel supply in country amid wheat harvesting season in the most of areas of the country. Spokesperson says that presently, country has an ample HSD stocks around 265,000 MTs which are sufficient for seven to ten days demand of entire country.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.