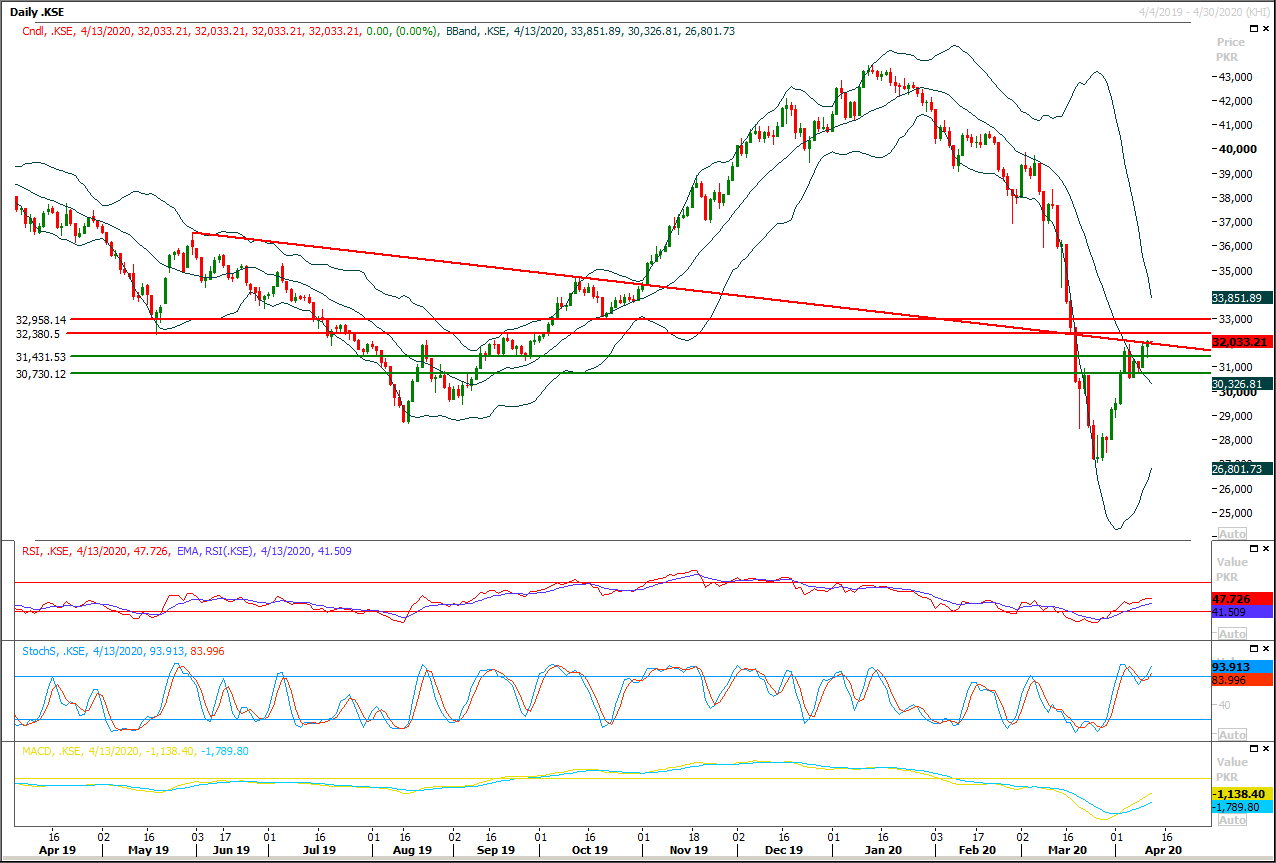

Technical Overview

The Benchmark KSE100 index is being capped by multiple resistant regions between 32,180pts-32,500pts. Initially a strong descending trend line would try to cap current bullish sentiment and if index would succeed in penetration of said trend line at 32,180pts then index would face next resistance at 32,380pts where a strong a horizontal resistant region would try to push index downward again. It's expected that index would remain volatile therefore swing trading between 32,350pts 31,430pts would be beneficial. If index would not succeed in closing above 32,500pts during current trading session then it would face bearish pressure during the week. It's recommended to stay on selling side with strict stop loss of 32.500pts. Bearish pressure would start increasing once index would succeed in sliding below 31,640pts on hourly closing basis. While on flipside daily closing above 32,500pts would call for 33,500pts in coming days.

Regional Markets

Oil agreement could support stocks, providing a floor

An agreement by oil-producing nations on Sunday to cut output by a record amount may sustain a recent bounce in stocks, although stay-at-home restrictions and closures tied to the coronavirus pandemic still weigh on the global economy. OPEC and allies led by Russia agreed to cut oil output by a record amount - representing around 10% of global supply - to support oil prices amid the pandemic, although sources told Reuters that effective cuts could amount to as much as 20%. S&P futures ESC1 were down on Sunday evening, while U.S. crude futures CLc1 and Brent LCOc1 opened higher before paring gains. The deal could buoy oil prices over the longer term and boost stocks, since talks between producers had hit roadblocks late last week, some analysts said.

Read More...

Business News

Growth to plummet, fiscal deficit to skyrocket: WB

Pakistan faces sharp economic recession along with a skyrocketing fiscal deficit as fallout from the prevailing global coronavirus pandemic, the World Bank said on Sunday. In addition, the country’s external position will come under serious stress as remittances can see a significant fall while portfolio outflows continue and the “non-traditional debt” from countries like Saudi Arabia, China and the United Arab Emirates has to be renegotiated. Provision of support systems for the unemployed as well as small businesses, along with massive investments in healthcare infrastructure, are likely to place a steeply rising burden on fiscal resources as the country grapples with the continuing fallout. Growth will remain subdued all through next year as well, according to projections contained in the World Bank’s latest report.

Read More...

Independent power producers reject charges of unfair deals

The Independent Power Producers Advisory Council (IPPAC) has said neither the IPPAC nor any Independent Power Producer (IPP) was consulted or approached in preparing the inquiry committee’s report over alleged losses in the power sector. The allegations being levelled against the IPPs about unfair agreements and misappropriation in tariff and fuel consumption rates are ill-conceived, unfounded, baseless and disappointing, which are causing serious damage to their reputation, according to an IPPAC statement issued on Sunday.

Read More...

Remittances under clouds of uncertainty

Covid-19 is going to stall global economic growth. “Global growth will turn sharply negative in 2020,” International Monetary Fund (IMF) chief Kristalina Georgieva warned recently. “In fact we anticipate the worst economic fallout since the Great Depression,” she cautioned. Prospects for the global economy are too bleak. Trade, investment and remittances are apparently doomed. The World Trade Organisation (WTO) says trade can shrink by 13-32 per cent. About $100 billion worth of foreign investment has already fled the emerging markets. Flows of remittances into the developing countries are also expected to decelerate as joblessness grows in most host countries.

Read More...

FBR to begin electronic registration, monitoring in 12 business fields

The Federal Bureau of Revenue announced on Sunday that it is beginning electronic registration and monitoring of businesses in over 12 fields. Restaurants, courier services, transport, hotels and beauty parlors are included in the list, according to the bureau’s spokesperson. Private hospitals, medical practitioners, laboratories and pharmacies will be monitored online. Gyms, health clubs and fitness massage centres will be tracked through electronic registration systems. The order will be valid in eight big cities across the country, including Karachi, Lahore and Islamabad

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.