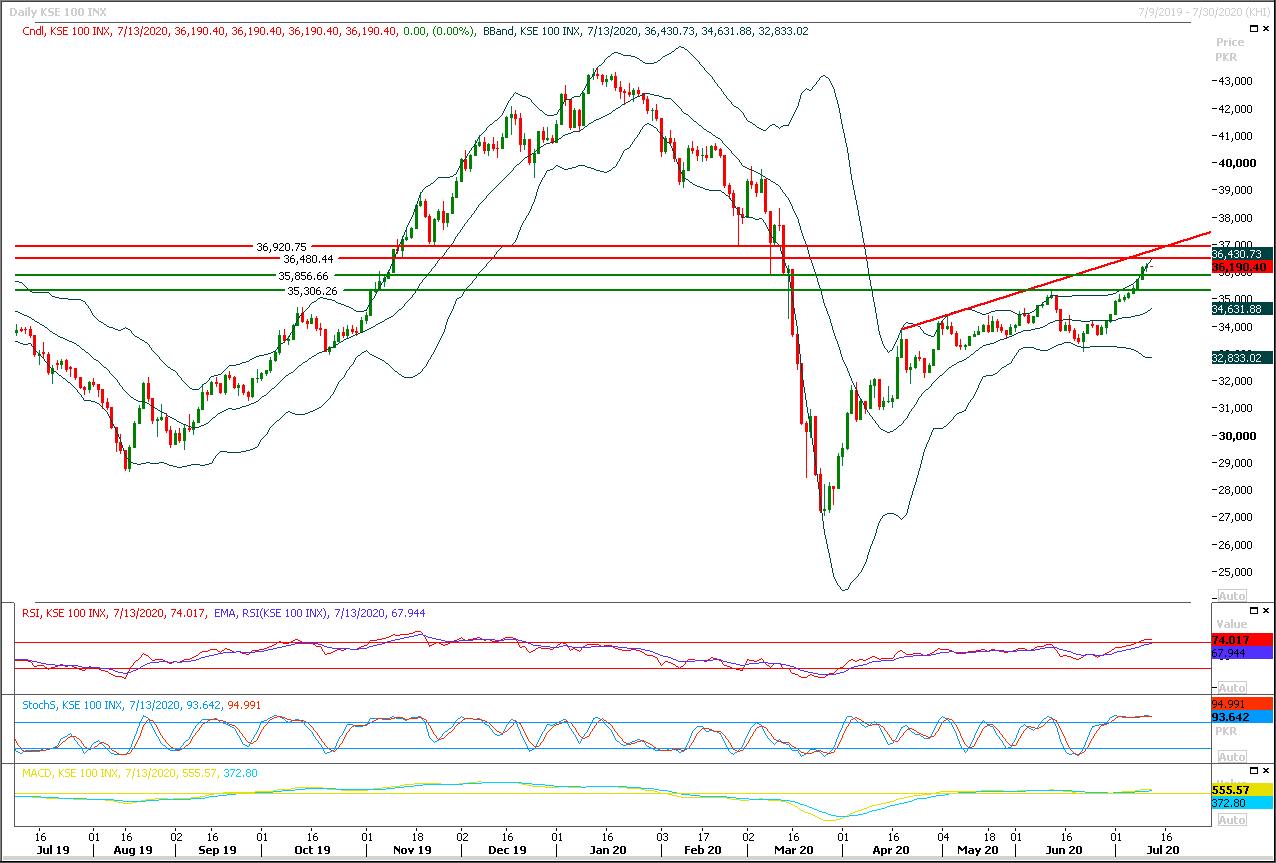

Technical Overview

The Benchmark KSE100 index have recovered about 61% of its last bearish rally on weekly and daily chart and now it's going to face major resistant region in next 500-1000 points. For current trading session it's expected that index would face major resistances at 36,500pts and 36,900pts from two strong horizontal resistant regions therefore it's recommended to start profit taking from existing long positions. Mean while index would be capped by its correction level at 37,200pts. If index would face rejection from said regions then it would slid downward and bearish pressure would be witnessed on intraday basis which would try to push index towards 35,800pts where index would try to find some ground against bears. It's expected that index would try to create a bearish reversal pattern on daily chart and in case it would succeed in doing so then bears would start riding the market and daily closing below 35,760pts would increase bearish momentum. While on flip side in case of bullish breakout above 36,500pts index would face major resistances at 37,000pts and 37,200pts where it's being capped by a strong resistant trend line and its weekly correction level. Selling on strength with strict stop loss could be beneficial for day trading today.

Regional Markets

Asian shares extend rally, U.S. earnings to test optimism

Asian shares crept toward five-month peaks on Monday as investors wagered the U.S. earnings season would see most companies beat forecasts given expectations had been lowered so far by coronavirus lockdowns. MSCI’s broadest index of Asia-Pacific shares outside Japan added 0.15%, having climbed sharply last week on the back of surging Chinese stocks, which added another 1% on Monday.. Japan’s Nikkei gained 1.7% and South Korea 1.2%. E-Mini futures for the S&P 500 rose 0.5% even as some U.S. states reported record new cases of COVID-19, a divergence that shows no sign of stopping. EUROSTOXX 50 futures added 1.1% and FTSE futures 0.8%.

Read More...

Business News

Pakistan may get some debt service relief

The Ministry of Energy on Sunday censured the K-Electric management for shifting responsibility to the government for power outages in Karachi. In a statement, a spokesperson for the Ministry of Energy said the fact was that KE had not made necessary investment in its distribution system that was incapable to off-take additional electricity from the national grid despite repeated offers. The ministry said the KE’s claims were totally wrong that non-supply of fuel by the federal government led to loadshedding in Karachi. It said the KE’s chief executive officer had conceded before a high-level meeting at Governor House in Karachi on July 11 that the federal government was providing 290 million cubic feet of gas per day (MMCFD) to the KE instead of the required 190 MMCFD.

Read More...

PIB wants coal, hydel projects to replace LNG-based plants

Raising objections over the long-term power plan, the Private Power & Infrastructure Board (PPIB) has advocated an end to LNG-based projects in future, proposing their replacement with hydropower and bulk induction of plants based on local coal with an additional Chinese investment. In its comments over the 27-year Integrated Generation Capacity Expansion Plan (IGCEP 2020-47), the PPIB has argued that coal-based power projects, particularly those on Thar coal, were being developed through Chinese financing as international multilateral financing agencies were reluctant to finance such base load power projects. “Therefore, this limited available opportunity of financing of coal-based power projects needs to be prioritised, for which sufficient block allocation in IGCEP is required,” said the PPIB — the power division’s one-window entity set up for private investments.

Read More...

Traders demand incentive package for all industrial sectors

The Pakistan Industrial and Traders Associations Front has welcomed the new incentive package for the construction industry, with allocation of Rs30 billion subsidy for the Naya Pakistan Housing Project, urging the government to announce the same relief for other industrial sectors with a view to promote economic activities and generate new employment in the post-corona slowdown economy. PIAF chairman Mian Nauman Kabir, in a joint statement with senior vice chairman Nasir Hameed and vice chairman Javed Siddiqi, termed the package announced by the PM for construction sector as historic, saying it would prove a turning point for the economy, besides providing financial flexibility to the low income people for building their own houses.

Read More...

Gas companies to provide 549,821 new connections in current FY

The two state-owned companies, Sui Northern Gas Pipelines Limited (SNGPL) and Sui Southern Gas Company (SSGC), would provide around 549,821 new connections to domestic, commercial and industrial consumers during the current fiscal year. The SNGPL would add 405,450 consumers in its network including 400,000 domestic, 5,000 commercial and 450 industrial, while SSGC has the plan to give 144,371 connections including 143,023 domestic, 1,164 commercial and 184 industrial, according to the Annual Plan 2020-21. During the last year, the companies awarded 430,145 connections of different nature, slightly exceeding against the target of 425,548, out of which SNGPL provided 300,000 domestic connections, 5,000 commercial and 450 industrial, making 100 per cent achievement against the target of 305,450. The SSSGC gave 123,900 domestic connections, 700 commercial and 95 industrial, commercial, exceeding 3 per cent against the overall target of 120,098.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.