Technical Overview

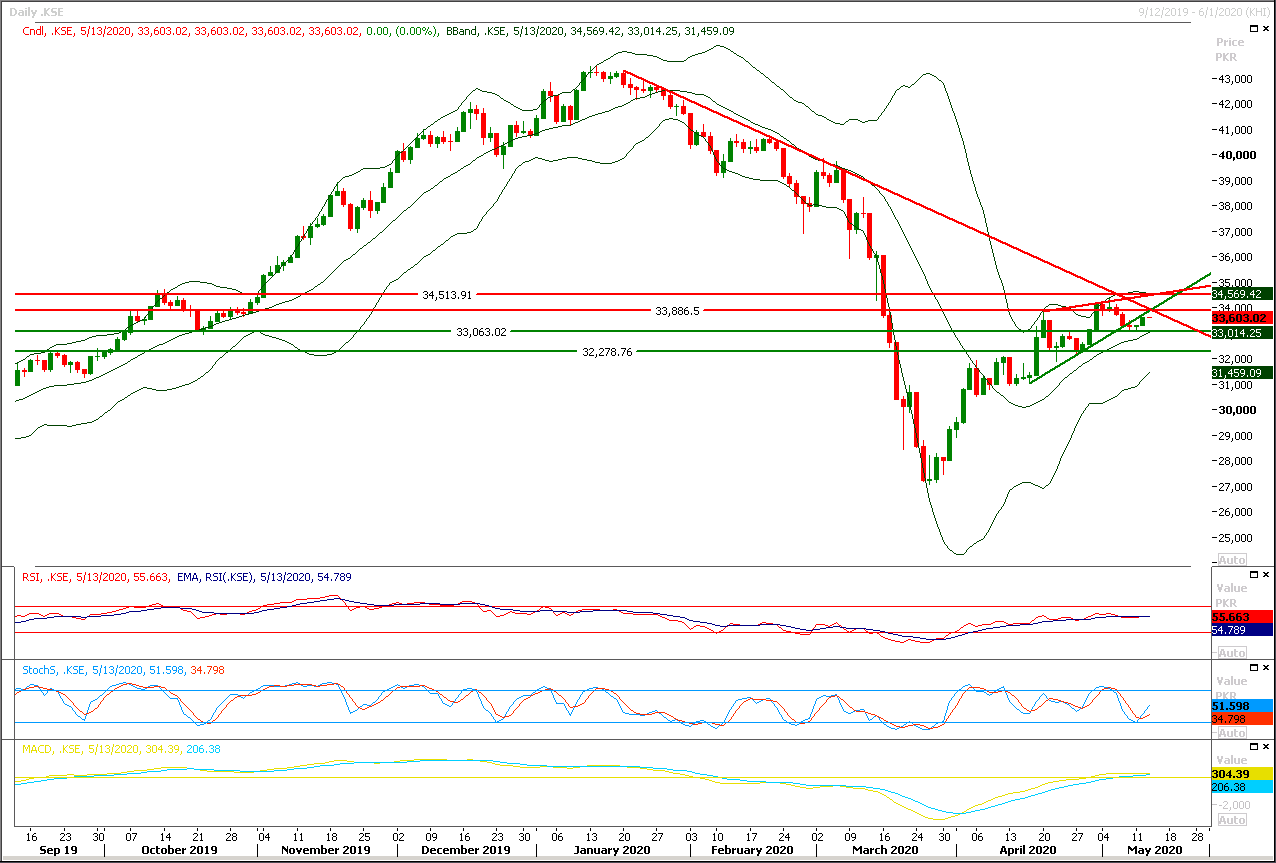

The Benchmark KSE100 index is trying to retest supportive trend line of its rising wedge after bearish breakout of that wedge on daily chart. As of now it's expected that index would face a strong resistance at 33,950spts where a crossover a descending trend line is taking place with supportive trend line of its rising wedge. Meanwhile a strong horizontal resistant region is also falling on same region therefore it's recommended to stay cautious and post trailing stop loss on existing long positions because if index would not succeed in closing above this region then bearish pressure would start piling up and index would start losing strength which may lead index initially towards 33,000pts. While today's closing about said region would invite some fresh buying volumes to push index towards 34,500pts. /p>

Regional Markets

Stocks fall on renewed virus fears, Powell speech in focus

Stocks and oil prices fell on Wednesday as fears about a second wave of coronavirus infections gripped financial markets. Leading U.S. infectious disease expert Anthony Fauci on Tuesday warned lawmakers that a premature lifting of lockdowns could lead to additional outbreaks of the deadly coronavirus, which has killed 80,000 Americans and brought the economy to its knees. Fauci’s comments hammered Wall Street stocks overnight, underlining fragile investor sentiment which has in recent sessions swung between optimism over some easing in lockdowns globally and anxiety about a fresh spike in virus cases. MSCI’s broadest index of Asia-Pacific shares outside Japan was down 0.4%. Shares in China, where the coronavirus first emerged late last year, fell 0.5%.

Read More...

Business News

Debt servicing declines to $2.72bn

External debt servicing in the third quarter of the current fiscal year declined by 30 per cent compared to second quarter, data released by the State Bank of Pakistan (SBP) showed on Tuesday. The country paid $2.728 billion in external debt servicing during the third quarter (January-March) compared to $3.907bn in the second quarter of this fiscal year. The country paid $11.589bn in external debt servicing including $2.95bn in interest during the current fiscal year. The total amount paid in debt servicing during the first three quarters was $9.713bn. Financial experts expect the total servicing costs to reach $12-13bn by the end of this fiscal year.

Read More...

10th National Finance Commission constituted

Amid a fresh political debate on constitutional and financial powers of the federation and its units, the government on Tuesday constituted the 10th National Finance Commission (NFC) to announce a new award for sharing of federal divisible resources between the Centre and the provinces. The Ministry of Finance formally notified the constitution of the 11-member commission after approval by federal and provincial members and its terms of reference by President Arif Alvi as required under Article 160 (1) of the Constitution. However, the commission will effectively comprise 10 members given the president has also authorised the adviser to the prime minister on finance and revenue to chair meetings of the NFC in the absence of the federal finance minister.

Read More...

Privatisation board to review PSM transaction structure

The Privatisation Commission (PC) on Tuesday started the process of evaluating draft transaction structure for the privatisation of the Pakistan Steel Mills. The details will be discussed by the transaction committee at its meeting on May 14. Financial advisers hired by the PC have completed due diligence and reports received in this respect are under review by concerned stakeholders. Based on due diligence, financial advisers formulated the draft transaction structure for inviting expression of interest from potential investors. Following the discussion on proposed transaction structure, it will be placed before the Board of Privatisation Commission and later to the Cabinet Committee on Privatisation for approval.

Read More...

Govt defers privatisation of 6 PSEs, 28 properties till next fiscal year

The federal government on Tuesday formally announced to defer the privatisation of 6 public sector entities and 28 state owned properties till next fiscal year, which would give a hit of Rs400 billion in terms of non-tax collection during ongoing financial year. Federal Minister Mohammedmian Soomro chaired a meeting, attended by Secretary Privatization Commission and other concerned officers, to review progress on privatisation program with special focus on some of the priority transactions. In the subject meeting targets were also set for the FY 2020-21.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.