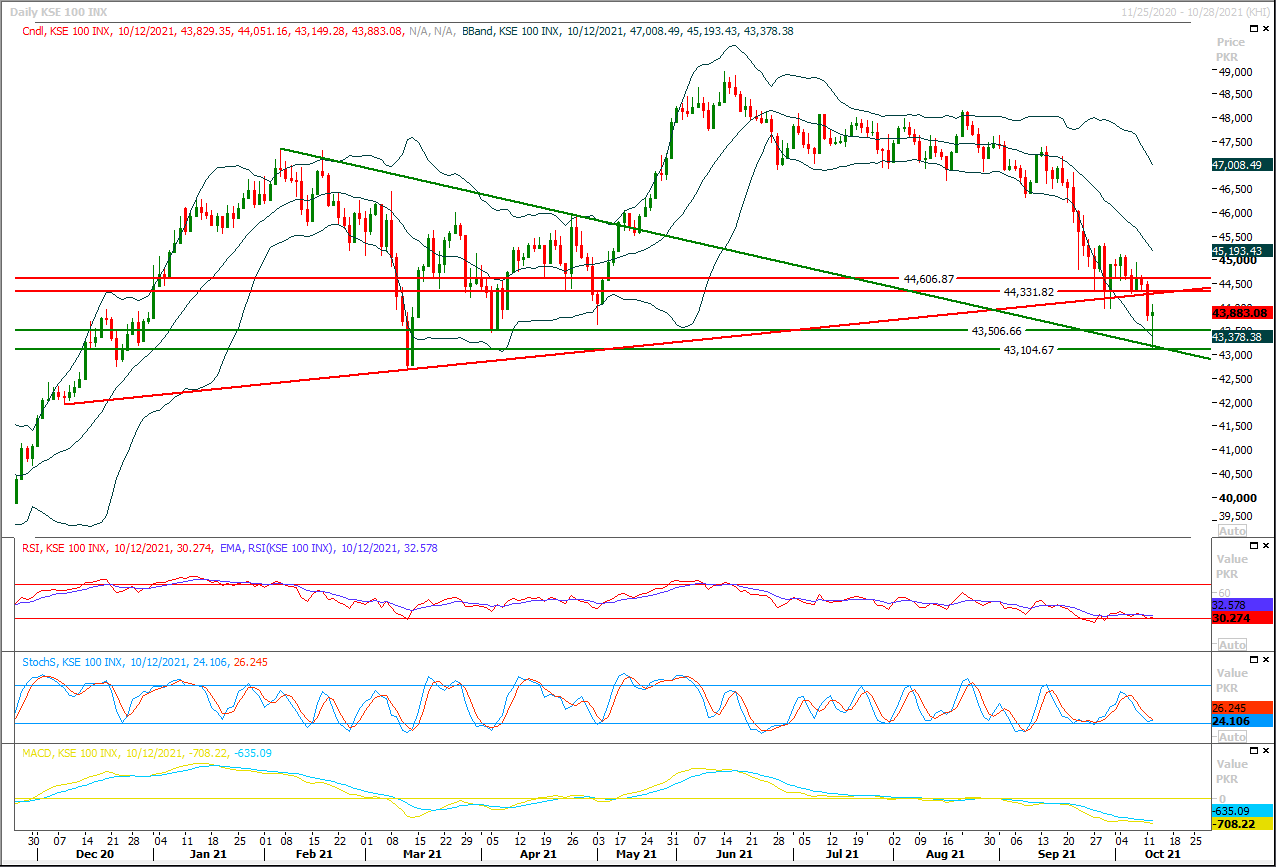

The Benchmark KSE100 index have bounced back after getting support from a descending trend line on daily chart during last trading session but it needs to stay cautious because current pull back may convert into correction of last bearish rally if index would not succeed in closing above 44,330pts where its being capped by a strong horizontal resistant region. Initially index would try to target 44,120pts where 50% correction of its last bearish rally would complete and if it would succeed in closing above this region on hourly chart then it may move further upside till 44,330pts. It's recommended to post trailing stop losses on existing long positions because if index would not succeed in closing above 44,330pts in coming days then current pull back would be considered as retesting of a previous supportive trend line as resistant one. Meanwhile there are chances of occurrence of a morning shooting star on daily chart if index would succeed in closing above 44,230pts till day end today, but in this case it would need a confirmation for this morning star in coming two days otherwise it would be converted into a cheat pattern. While on flip side, rejection from its resistant regions would push index towards new expansion of its current pull back which may prolong initially towards 43,200pts and then 42,760pts. Overall sentiment would remain bearish as long as index is trading below 44,500pts and current bearish sentiment may lead index towards 41,900pts if it would not succeed in recovering above 44,500pts in coming two days.

Regional Markets

Asian shares edgy amid inflation fears, dollar at one-year high

Asian shares were on edge on Wednesday as worries about soaring power prices fuelling inflation weighed on sentiment and drove expectations the United States would taper its emergency bond buying programme, holding the dollar at a one-year high.MSCI's broadest index of Asia-Pacific shares outside Japan rose 0.1% in early trading, steadying after falling over 1% a day earlier, in what was its worst daily performance in three weeks.Moves were muted in most markets. Chinese blue chips were flat, Australia eeked out a 0.06% gain, while Japan's Nikkei shed 0.2%.

Read More...

Business News

Govt takes stringent measures for uplift of minerals sector

The government has taken radical and innovative measures for uplift of the minerals sector with coordinated efforts of all stakeholders including provincial authorities.“The country is blessed with 92 minerals, out of which 50 are exploited on commercial basis. The new initiatives will greatly help exploit true potential of this sector,” a senior official privy to petroleum sector developments told media.As per constitutional provisions, he said, the federal government was mandated with geological surveys and regulation of mineral oil, natural gas and the minerals.

Read More...

IMF forecasts Pakistan’s growth rate at 4pc

The International Monetary Fund (IMF) on Tuesday forecast inadequate growth rate of four per cent for Pakistan coupled with elevated rate of inflation and stubborn unemployment rate during the current fiscal year.This growth rate is exactly the same as projected by the Asian Development Bank (ADB) about two weeks ago and significantly higher than 3.4pc forecast by the World Bank a few days ago, which was rejected by the government as unrealistic.

Read More...

FIA to investigate 100 people for ‘smuggling, hoarding’ of $63m

In a bid to check the rising value of US dollar, the Federal Investigation Agency (FIA) has decided to investigate about 100 individuals for allegedly buying over $63 million from different exchange companies in Lahore that are believed to have been either smuggled to Afghanistan or hoarded during the last 45 days.“The FIA Lahore on Tuesday served notices on some 100 individuals asking them to appear before it from Oct 15 for their alleged involvement in buying US dollars.

Read More...

Dollar roars past Rs171 in interbank market

The US dollar kept going high against the rupee hitting a fresh peak despite a number of measures taken by the State Bank of Pakistan (SBP) to cool down the demand for the greenback.Currency dealers in the interbank market said the dollar was traded as high as Rs171.13 during the session on Tuesday. However, it closed at Rs171.04, the SBP reported.“The exchange rate deterioration is much faster than market expectations.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.