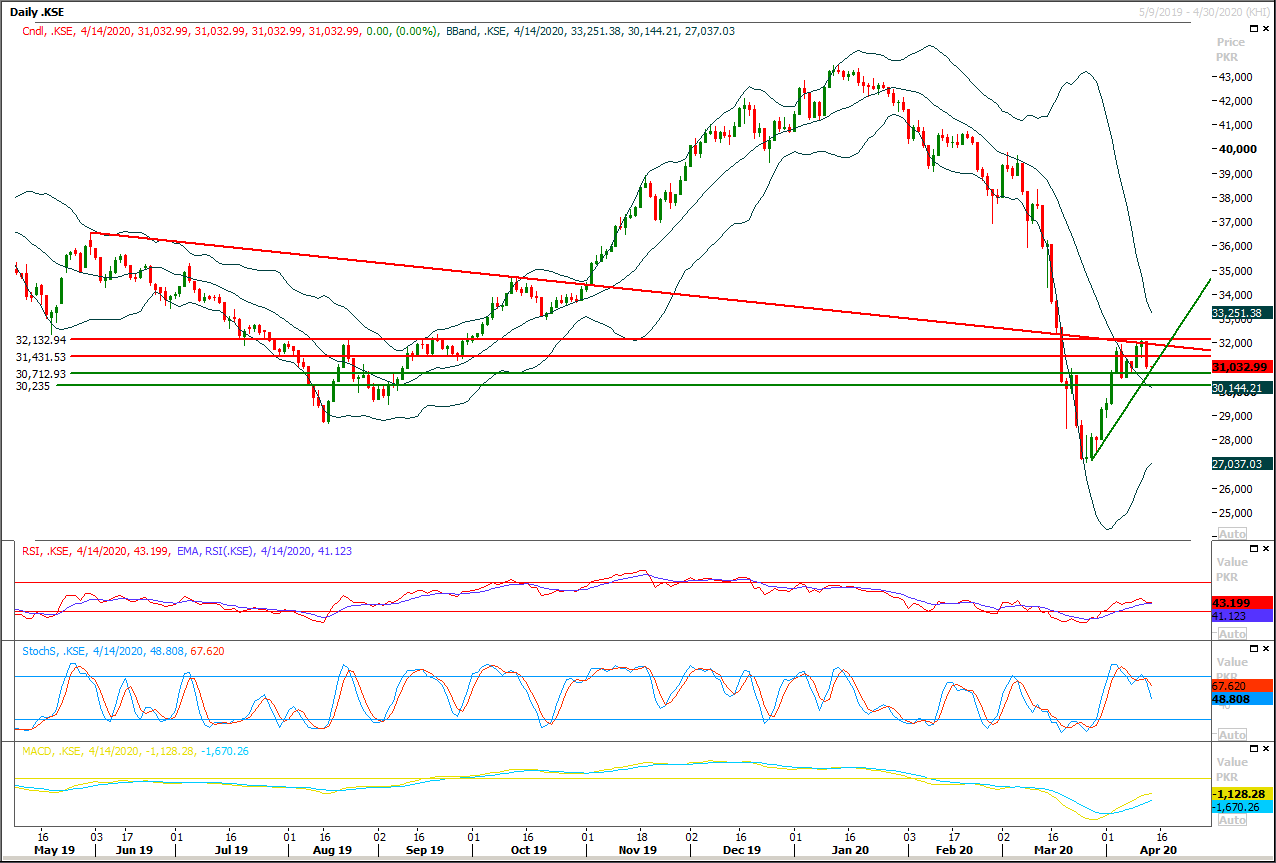

Technical Overview

The Benchmark KSE100 index have formatted an evening shooting star on daily chart after facing rejection from a strong horizontal resistant region and a descending trend line during last trading session. Mean while a gap is also completed which was left open while index was moving upward and an ascending trend line would try to support index during current trading session. As of now it's expected that index would try to find ground initially at 30,700pts while breakout below that region would call for 30,230pts. It's recommended to stay cautious because index is trying to generate bullish momentum and some volatile moves could be witnessed between 30,700pts and 32,300pts until it would not succeed giving a clear breakout of either side. Therefore remaining side line could be beneficial because index would try to generate a cheat pattern in response of daily evening shooting star.

Regional Markets

Asia shares jump but pandemic hangs heavy over outlook

Asian stocks bounced on Tuesday on hopes the coronavirus outbreak may be peaking, though sentiment was cautious ahead of Chinese trade data and corporate earnings as investors worried about a deep global recession. Chinese shares started firm with the blue-chip index .CSI300 up 0.7%. Australian shares were up 0.6% while South Korea's KOSPI index .KS11 and Japan's Nikkei .N225 each gained 1.4%. Hong Kong's Hang Seng .HSI rose 0.2%. That left MSCI’s broadest index of Asia-Pacific shares excluding Japan .MIAPJ0000PUS up 0.6%. E-Mini futures for the S&P 500 ESc1 were modestly higher, up 0.2%. All eyes will be on China’s trade data, which is expected to show exports tumbling 14% in March from a year ago, as the coronavirus shutters businesses around the world, crippling demand and economic growth.

Read More...

Business News

Independent power producers summoned for crucial talks

The government on Monday made first formal contact with the managements of all power plants, particularly Independent Power Producers (IPPs) for a structured dialogue on possible options to reduce immediate liabilities amid constrained electricity demand. A senior government official told Dawn that a high-level inter-ministerial committee led by Energy Minister Omar Ayub Khan would hold its first meeting on April 15 with the public sector generation companies formerly part of the Water and Power Development Authority and the government-run power plants set up more recently mostly in Punjab for their input and brainstorming. Formal letters have been issued for separate meetings on April 16 with IPPs set up under 1994 and 2002 Power Policies.

Read More...

ECC sets aside 200,000 tonnes of wheat for utility stores

The Economic Coordination Committee (ECC) of the cabinet on Monday approved allocation of additional 200,000 tonnes of wheat from public sector stocks for supply to the Utility Stores Corporation (USC) at a cost of Rs8.7 billion. This is part of the Rs50bn earmarked for supply of essential kitchen items to people at subsidised rates under the relief package announced by Prime Minister Imran Khan in response to the Covid-19 outbreak. The ECC meeting, presided over by Adviser to the PM on Finance Dr Abdul Hafeez Shaikh, discussed measures to ensure uninterrupted wheat flour sale to people at the USC.

Read More...

IMF acknowledges Pakistan’s response to pandemic

The International Monetary Fund (IMF) on Monday noted the rapid pace at which Covid-19 has been spreading in Pakistan and acknowledged the Rs1.2 trillion relief package announced by the government. “Covid-19 has been spreading rapidly in the past month in Pakistan, with 4,489 confirmed cases claiming 63 deaths, as of April 9”, the IMF said in its new publication Policy Tracker of its 193 member states. The fund said both the federal and provincial governments, in response, have implemented a range of measures to delay and contain the spread of the virus. These included quarantining more than three thousand travelers from Iran, closing borders with neighboring countries, international travel restrictions, school closures, social distancing measures, and lockdowns in cities and provinces across the country.

Read More...

Broad money jumps by 8.6pc

While trade and industry is badly hit amid the ongoing lockdown, monetary expansion witnessed a sharp increase of 8.59 per cent over end of FY19 level, suggesting that liquidity is being pumped mostly for non-productive areas. According to data released by the State Bank of Pakistan (SBP) on Monday, a total of Rs1,529bn of broad money (M2) was added to the economy as of April 3. The government borrowed Rs1,081bn for budgetary support during July to April 3, higher by 28.54pc or Rs231.915bn over Rs841bn in the same period of last fiscal year.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.