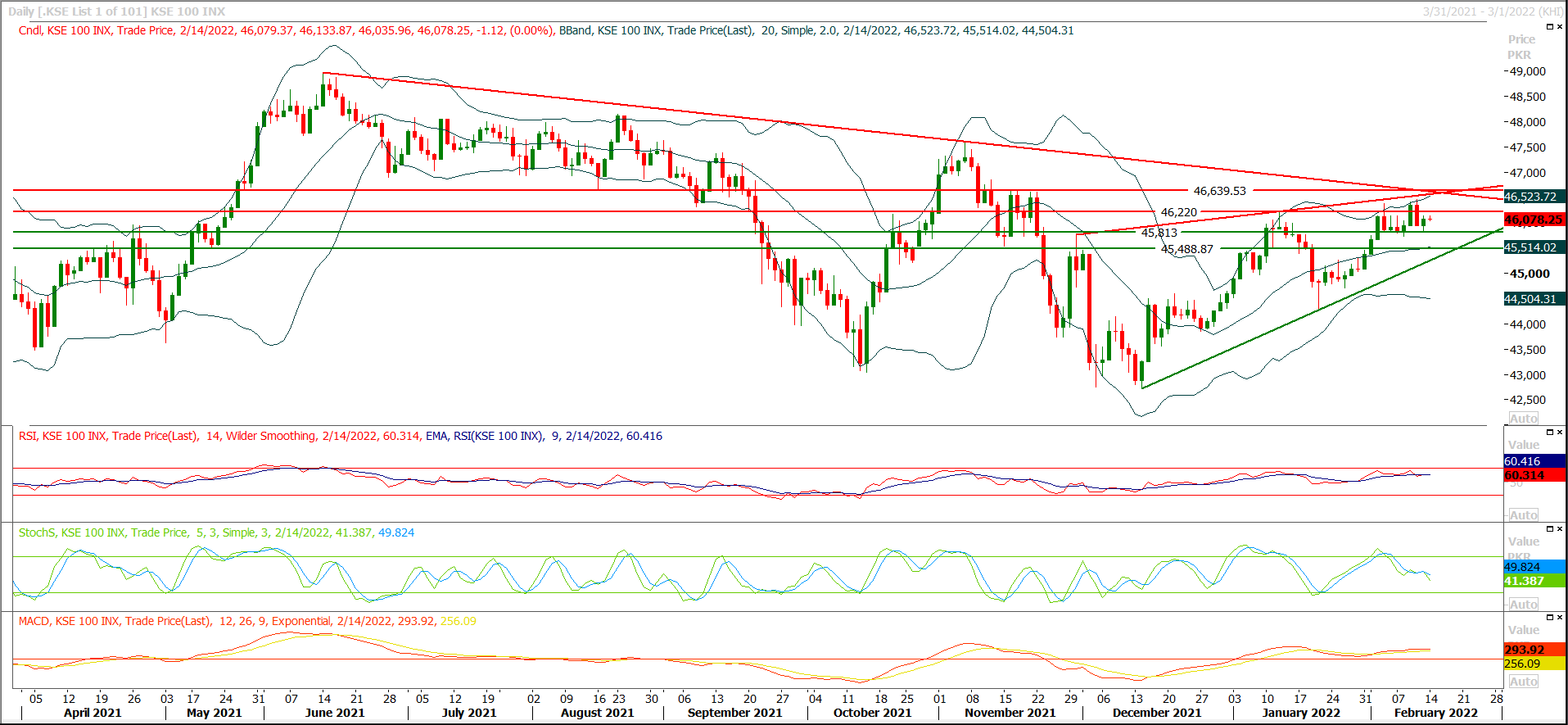

The Benchmark KSE100 index is facing rejection from resistant trend line of its ascending wedge on daily chart since last two trading sessions. As of now it's expected that index would try to target supportive trend line of said wedge in coming days which fall at 45,370pts, therefore it's recommended to stay cautious and post trailing stop loss on existing long positions because if index would not succeed in maintaining above 45,800pts till day end today than it would start losing strength which may push index towards 45,500pts initially. Overall a range bound situation would be witnessed in coming as long as index is trading above 45,370pts or it can be said that index would remain under pressure as long as its trading below 46,700pts but daily closing below this region would call for a free fall. Most likely scenario for ascending wedges is bearish breakout therefore it's recommended to start cut and reverse in case of daily closing below 45,370pts. While on flip side index would face initial resistance at 46,220pts where its being capped by strong horizontal resistant region and breakout above this region would call for 46,350pts and 46,500pts.

Oil prices on Monday hit their highest in more than seven years on fears that a possible invasion of Ukraine by Russia could trigger U.S. and European sanctions that would disrupt exports from the world's top producer in an already tight market. Brent crude futures was at $95.61 a barrel by 0506 GMT, up $1.17, or 1.2%, after earlier hitting a peak of $96.16, the highest since October 2014. U.S. West Texas Intermediate (WTI) crude rose $1.41, or 1.5%, to $94.51 a barrel, hovering near a session-high of $94.94, the loftiest since September 2014. Comments from the United States about an imminent attack by Russia on Ukraine have rattled global financial markets. Russia could invade Ukraine at any time and might create a surprise pretext for an attack, the United States said on Sunday.

Read More...Minister of State for Information and Broadcasting Farrukh Habib said on Sunday that after the construction of Tarbela Dam, now Prime Minister Imran Khan was constructing ten big dams in Pakistan which would enable the country to generate cheap power. In his tweet, the minister of state said that these projects would increase the production of hydropower from 9,500 mw to 20,800 mw. He said that an international conference under the aegis of Water and Power Development Authority would be held tomorrow which would be attended by dams experts from many countries including Australia, Switzerland, United States, China and Turkey

Read More...

New SME policy to catalyse economic activities

New SME policy will catalyse economic activities and strengthen national economy besides providing impetus to educated youths to launch their businesses in addition to generating ample jobs opportunities. This was stated by Chief Executive Officer Pakistan Furniture Council Mian Kashif Ashfaq while talking to a delegation of SME experts led by Hassan Bukhari. He said new policy will play a key role in transforming our export based economy to a dynamic export oriented sector. He said that it will also encourage youth to produce imported quality products locally in order to discourage the ever increasing imports. He said more than one million small manufacturers are working across the country which contributes above 78 percent in growth.

Read More...

IMF wants govt to pass new law on state firms’ management

Highlighting contingent liabilities of the state-owned enterprises (SOEs) at almost eight per cent of GDP — or about Rs5 trillion — as a major fiscal risk, the International Monetary Fund (IMF) has linked the continuation of its ongoing programme with “parliamentary approval” of the new SOE law by the end of June to ensure transparent management of these companies. “Contingent liabilities from loss-making SOEs — to the extent not covered by government guarantees — continue to represent additional risks to debt sustainability,” the IMF has noted in a special chapter in a recent report on Pakistan’s economy. It said the authorities have recognised about 1pc of GDP contingent liabilities in the circular debt, but the remaining contingent liabilities from circular debt (amounting to less than 0.8pc of GDP) as well as “contingent liabilities from other loss-making SOEs (assumed to be in the range of 5-6pc of GDP) and/or from the financial sector are accounted for by a stress test to debt dynamics consisting of a contingent liability shock”.

Read More...

Nepra approves Rs3.10 per unit hike in electricity tariff

National Electric Power Regulatory Authority (Nepra) on Saturday approved the hike of Rs3.10 per unit in electricity tariff on account of fuel charges adjustment (FCA) for December 2021, which would further increase the inflation rate in the country. According to a notification, all consumer categories of distribution companies, except for lifeline customers and K-Electric consumers, would pay the 3.1 per unit hike under the FCA in the bills for February 2022. The Rs3.09 increase will put an extra burden of billions of rupees on the inflation-hit consumers. In a petition submitted to NEPRA, on the behalf of power distribution companies (XWDISOCs), the CPPA-G had said that for the month of December the reference fuel charges from the consumers were Rs 5.53/unit while the actual fuel cost was Rs 8.65/unit.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.