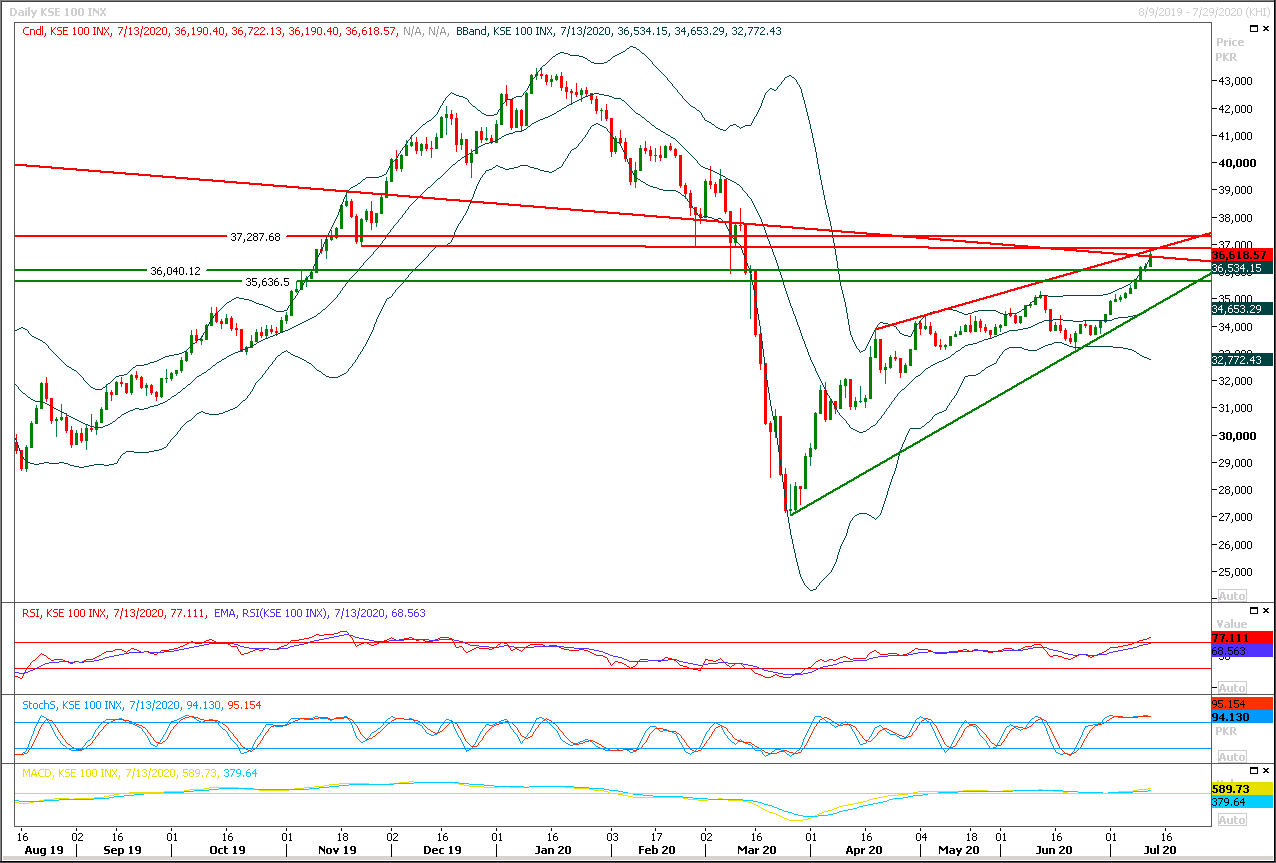

Technical Overview

The Benchmark KSE100 index is moving in a rising wedge on daily chart to complete its bearish correction and its going to complete that correction at 37,280pts on daily and weekly charts. As of now it's expected that index would face strong resistances at 36,880pts and 37,280pts region from a descending trend line along with resistant trend line its rising wedge and strong horizontal resistant regions. Daily momentum indicators have reached overbought region and it's expected that index could start its bearish sentiment any time. For current trading session index is being capped by strong resistant regions at 36,880pts 37,000pts therefore selling on strength with strict stop loss of 37,280pts could be beneficial. In case index would try to create a cheat pattern be penetration above its correction level then it would be recommended to stay cautious and trail selling stop losses towards 37,860pts but being remained on selling side would be beneficial until index take a dip to complete its correction. While on the other side in case of facing rejection from its resistant regions index would try to slide downward and would find some ground at 36,000pts and breakout below that region would call for 35,860pts.

Regional Markets

Asian markets dip as virus and Sino-U.S. tensions flare

Asian stock markets slipped on Tuesday, oil sagged and a safety bid supported the dollar as simmering Sino-U.S. tensions and fresh coronavirus restrictions in California kept a lid on investor optimism as earnings season gets underway. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 1.2%. Japan’s Nikkei retreated from a one-month high touched on Monday, dropping 0.8%. A firm dollar put pressure on the Aussie and kiwi. [AUD/] The moves came after a selloff on Wall Street that followed reopening rollbacks in California, where Governor Gavin Newsom ordered bars closed and restaurants and movie theatres to cease indoor operations. S&P 500 futures were flat in Asia after the index lost 0.9% on Monday. [.N] Meanwhile tension grew between the United States and China. The United States on Monday rejected China’s disputed claims to offshore resources in most of the South China Sea - a shift in tone which prompted a rebuke from Beijing.Read More...

Business News

Auto sector posts gloomier sales in 2019-20

Auto sector ended 2019-20 on a dismal note as production and sales of various vehicles suffered declines in the range of 23-55 per cent. Production and sales of cars plunged 55pc and 53.5pc to 94,325 units and 96,455 while those of two/three-wheelers by 23pc to 1.370 million, respectively. The low annual car figures were led by sales and production grinding to a halt during April on account of lockdown to prevent spread of coronavirus even as the sector staged a recovery in volumes during May at 3,800 units and June 7,325. Output and volume of trucks were down by 51pc and 47pc to 2,945 and 3,088 units in FY20 while bus production and sales dipped by 42pc and 40pc to 3,477 and 3,647, respectively.

Read More...

FY20 remittances soar to record $23bn

Pakistan received record $23 billion in remittances in 2019-20 while the inflows jumped by 51 per cent year-on-year to $2.466bn in June, data released by the State Bank of Pakistan (SBP) showed on Monday. Despite economic slowdown caused by the Covid-19, the remittances in the last quarter of the fiscal year 2019-20 i.e. March-June increased significantly helping the country get more than expected inflows. “Workers’ remittances rose by a significant 50.7pc during June to reach record high of $2.466bn compared with $1.636bn in June 2019,” said the SBP press release. The inflows in the month grew significantly compared to May when the country received around $1.866bn, rising despite the negative outlook due to the impact of coronavirus on the global economy.

Read More...

IMF warns of aggravated regional slowdown

In a report covering the Middle East, North Africa, Afghanistan and Pakistan (Menap) region, the International Monetary Fund (IMF) on Monday downgraded its growth forecasts even further from April, the last time such forecasts were issued at the outset of the Covid-19 challenge. Referring to the countries in the Middle East and Central Asia Division (MCD) of the IMF, the report says “real GDP in the MCD region is projected to fall by 4.7 per cent in 2020, which is two percentage points lower than in the April 2020 Regional Economic Outlook, in line with revisions to global growth over this period.” Most of the downgrade in growth forecast for the second half of 2020 owes itself to a worsening outlook for oil exporters, that are likely to see their export proceeds fall by $270 billion from 2019, which is larger than expected.

Read More...

Afghan exports to India via Wagah resume tomorrow

The Foreign Office on Monday said that Afghan exports to India through the Wagah border would resume from July 15. The decision, the FO said, had been taken on Afghanistan’s request for facilitating its transit trade. The trade would be conducted under the Covid-19 protocols. “With this step, Pakistan has fulfilled its commitments under the Pakistan-Afghanistan Transit Trade Agreement (APTTA). Pakistan has restored bilateral trade and Afghan transit trade at all border crossing terminals to pre-Covid-19 status,” the FO said. Under the 2010 bilateral trade agreement between Pakistan and Afghanistan, Afghan exports to India are allowed through the Wagah border. The agreement, however, does not allow Indian exports to Afghanistan through Pakistani territory.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.