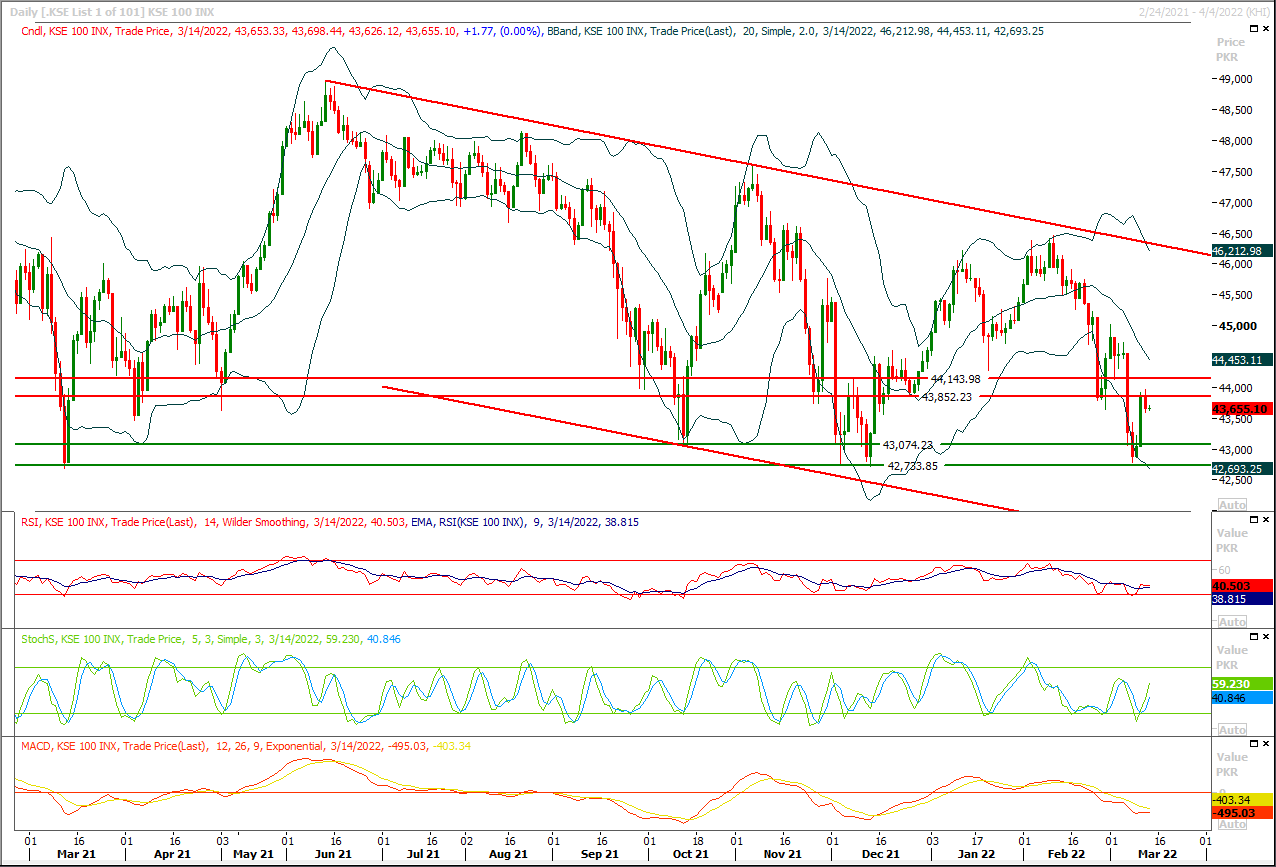

The Benchmark KSE100 index have penetrated below supportive trend line of its daily ascending wedge on intraday basis during last trading session but succeeded in recovering above this region before day end. As of now it's expected that index may face some serious pressure therefore it's recommended to stay cautious and post strict stop loss on existing long positions. Meanwhile being last trading day of the week today's closing matters a lot and if index would slide below 45,370pts at day end then it would start a bearish rally in coming days. Currently index is standing at edge as its ready for bearish breakout of its ascending wedge and once index would succeed in giving this breakout then it may start sliding towards 44,500pts and 42,800pts. While on flip side in case of bullish pull back on intraday basis index would face initial resistance at 45,620pts where its being capped by a horizontal resistance region on hourly while breakout above this region would call for 45,730pts and 45,860pts. Hourly momentum indicators are trying to create attraction for bullish pull back but it's recommended to wait for today's closing instead of initiating new long positions on immediate basis.

Most share markets firmed and oil slid on Monday on hopes for progress in Russian-Ukraine peace talks even as fighting continued to rage, while bond markets braced for rate rises in the United States and UK this week.While Russian missiles hit a large Ukrainian base near the border with Poland on Sunday, both sides gave their most upbeat assessment yet of prospects for talks.Just the chance of peace saw S&P 500 stock futures add 0.3%, while Nasdaq futures rose 0.2%. EUROSTOXX 50 futures gained 0.9% and FTSE futures 0.4%.Tokyo's Nikkei rose 0.8%, but MSCI's broadest index of Asia-Pacific shares outside Japan was dragged down 1.1% by losses in China.Chinese blue chips shed 1.1% after a jump in coronavirus cases saw the southern city of Shenzen locked down and stoked speculation about more policy easing.

Read More...As paracetamol painkillers continue to remain in short supply across the country, a pharmacists’ association has claimed that the shortage is being engineered to create space for a new, high-dosage variant of the medicine being sold at three times higher rates. In a letter to Prime Minister Imran Khan and available with Dawn, the Pakistan Young Pharmacist Association (PYPA) noted that the price of a 500mg paracetamol tablet had already been increased from Re0.90 to Rs1.70 during the last four years.

Read More...

Fake CNICs sore point in FATF talks

Transactions against fake identity cards make it difficult for the government’s negotiators to argue with the Financial Action Task Force (FATF), Federal Board of Revenue (FBR) chairman Dr Muhammad Ashfaq said on Sunday. He said cases related to Rs3.5 trillion taxes would soon be disposed of as the judiciary has promised to resolve this issue ‘out of the way’. “It becomes difficult to argue with the international community when business on such a large scale is done against fake CNICs. This situation complicates issues with the Financial Action Task Force (FATF),” the FBR chief said while speaking to the business community here at the Lahore Chamber of Commerce and Industry (LCCI) on Sunday.

Read More...

Sales Tax Rate To Be Rationalised In Due Course, Says FBR Chairman

Federal Board of Revenue Chairman Dr Muhammad Ashfaq has said that the sales tax rate would be rationalised in due course. He was speaking at a meeting at the Lahore Chamber of Commerce & Industry. LCCI President Mian Nauman Kabir presented the address of welcome. Senior Vice President Mian Rehman Aziz Chan and Vice President Haris Ateeq also spoke on the occasion. The chairman FBR said that we have to take the responsibility of cost of managing the country so that next generations don’t have to suffer. At present, tax-to-GDP ratio is around 12 per cent while the expenditure is around 20 of the GDP. He said that that the difference of 8 per cent has to be managed through loans which have to be owed by our generations. “We have to pay taxes to bridge the gap of 8 per cent”, he added.

Read More...

High Cost Of Doing Business Dangerous For Trade And Industry

The business community on Sunday said that the high cost of doing business has proved to be dangerous for Pakistan’s industry, discouraging investment both in capacity and capability, calling for lessening the burden of heavy taxes on the power sector. Pakistan Industrial and Traders Associations Front senior vice chairman Nasir Hameed and vice chairman Javed Siddiqi, in a joint statement issued here, condemned the National Electric Power Regulatory Authority (NEPRA) for shifting power distribution companies’ inefficiencies’ burden of almost Rs58 billion to the consumers by jacking up the tariff by Rs5.94 per unit under Fuel Charges Adjustment (FCA) to be charged through March 2022 electricity bills.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.