Technical Overview

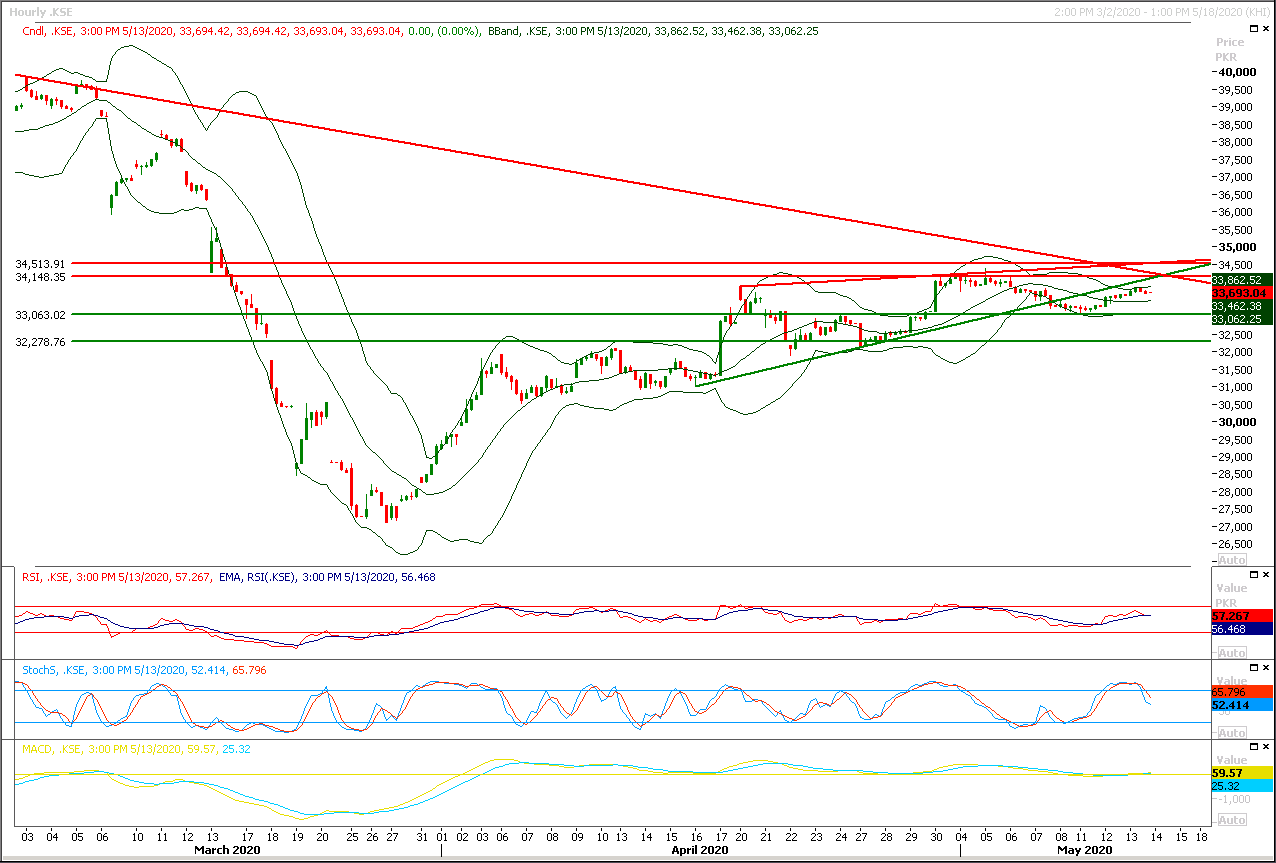

The Benchmark KSE100 index is trying to retest supportive trend line of its rising wedge after bearish breakout of that wedge on daily chart. As of now it's expected that index would face a strong resistance at 33,950spts where a crossover a descending trend line is taking place with supportive trend line of its rising wedge. Meanwhile a strong horizontal resistant region is also falling on same region therefore it's recommended to stay cautious and post trailing stop loss on existing long positions because if index would not succeed in closing above this region then bearish pressure would start piling up and index would start losing strength which may lead index initially towards 33,000pts. While today's closing about said region would invite some fresh buying volumes to push index towards 34,500pts. /p>

Regional Markets

Asian stocks drop as virus recovery begins to look distant

Asia’s stock markets fell and gold hit a one-week high on Thursday as worries about a second wave of coronavirus infections and a dour assessment of the way back from the head of the U.S. Federal Reserve dashed hopes for a quick recovery. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 1%, while Japan's Nikkei .N225 fell about 0.7%. U.S. stock futures ESc1 fell 0.2%, after the S&P 500 index’s worst two-day drop in nearly a month. Benchmark indexes in Australia , Hong Kong .HSI, Korea .KS11 and China .SSEC all fell about 1%.

Read More...

Business News

Rs442bn accord for construction of Diamer-Bhasha dam signed

The government on Wednesday signed a Rs442 billion contract with a joint venture of China Power and Frontier Works Organisation (FWO) for the construction of the Diamer-Bhasha dam. The Chinese state-run firm holds 70 per cent and the FWO, a commercial arm of the Armed Forces of Pakistan, 30pc share in the consortium. The contract covers construction of a diversion system, main dam, access bridge and the 21MW Tangir hydropower project. The eight million acre feet (MAF) reservoir with 272-metre height will be the tallest roller compact concrete (RCC) dam in the world. It will have a spillway, 14 gates and five outlets for flushing out silt.

Read More...

Trade resumes with Iran after Zero Point opens in Taftan

Trade activities between Pakistan and Iran resumed on Wednesday after two more trade crossing points were reopened in Taftan following a decision taken by the National Command and Operations Centre last month. According to official sources, these trade gateways were closed two-and-a-half months ago after the coronavirus outbreak in Iran and later their closure was extended as the pandemic penetrated in Pakistan as well. As many as 17 Iranian trawlers loaded with food items and LPG gas tankers arrived in Pakistan through transit gate, besides import of edible commodities commenced after the reopening of Zero Point Gate in Taftan.

Read More...

Govt plans to lay off 8,000 PSM employees, ECC told

The government plans to terminate the services of over 8,000 remaining staff of the Pakistan Steel Mills (PSM) — the country’s largest but closed industrial unit — through a compensation package of about Rs19 billion. A meeting on Wednesday of the Economic Coordination Committee (ECC) of the cabinet presided over by Prime Minister’s Adviser on Finance and Revenue Dr Abdul Hafeez Shaikh had an initial discussion on the “Human Resource Rationalisation Plan” for PSM, worth Rs18.74bn. The ECC also took up a proposal of the petroleum ministry for hedging of oil imports, but the summary was withdrawn by the ministry.

Read More...

Amid slowdown in agricultural sector, urea inventory could surge to 1 MT by year-end

Based on latest sales data from the National Fertilizer Development Centre, the urea market seems to be under significant pressure with the accumulation of 850,000 tonnes inventory due to a slowdown in the country’s agricultural sector. The fertilizer industry had started the year with an opening inventory of 600,000 tonnes, but the inventory has continued to soar on the back of highest-ever quarterly production of 1.42 million tonnes by the manufacturers and declining sales volume. If the same trend continues, the urea inventory could surge to an estimated 1 million tonnes by the year-end. Compared to the same period last year, the urea sales in April registered a decline of 18 per cent to 240,000 tonnes. At the same time, the sales fell by 12 per cent against last month’s figure of 303,000 tonnes.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.