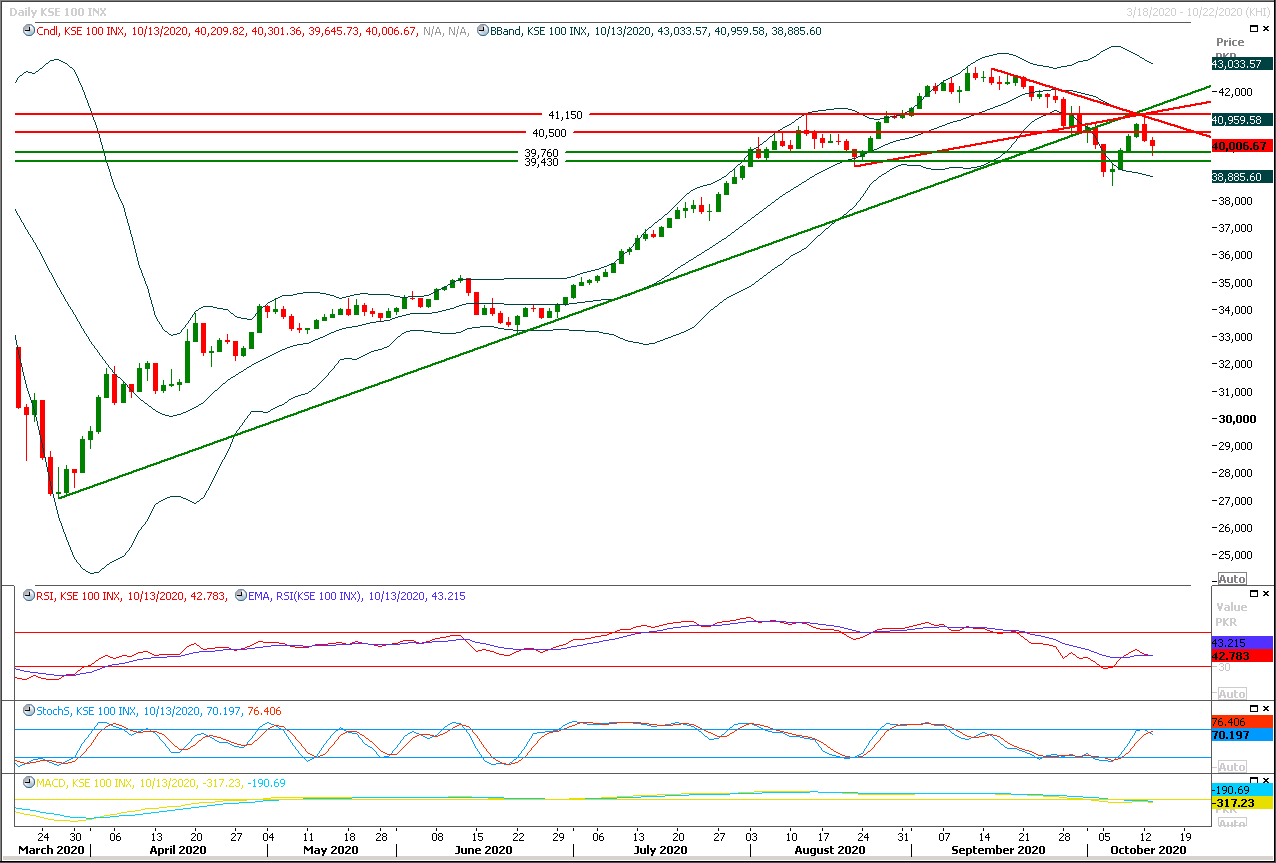

Technical Overview

The Benchmark KSE100 index have faced rejection from supportive trend line of its previous bullish price channel on daily chart and have taken correction of its last pull back during last two trading sessions, as of now it's expected that index would try to continue its bullish sentiment once again initially because its coming back after completing bullish correction of its last rally and if it would succeed in penetration above 40,300pts then it would try to target 40,500pts and closing above this region would call for 40,900pts. It's recommended to stay cautious because in case of rejection from its resistant region index would start sliding downward again because daily momentum indicators are still in bearish mode and rejection from 40,200-40,300pts or 40,500pts could result in expansion of its previous bearish correction which may lead index towards 39,700pts and breakout below that region would call for 39,450pts. A descending wedge is being formatted on daily chart which could pump some fresh volumes on bullish breakout. Daily closing above 40,900pts would gave a bullish breakout of this descending wedge but it's recommended to wait for daily closing above this region before initiating new long positions for short term trading.

Regional Markets

Asian equities set to slip as vaccine trials, stimulus talks stall

Asian equities were set to slip on Wednesday as halted COVID-19 vaccine trials and an elusive U.S. stimulus agreement weighed on investor sentiment, while the dollar rose from Tuesday’s three-week low as demand firmed for safe-haven assets.MSCI's gauge of stocks across the globe .MIWD00000PUS shed 0.03%. Australian S&P/ASX 200 futures YAPcm1 were down 0.74% at 22:50 GMT, while Japan's Nikkei 225 futures NKc1 were up 0.13%. The Nikkei 225 index .N225 closed up 0.18% at 23,601.78 on Tuesday. The futures contract is down 0.16% from that close. E-mini futures for the S&P 500 EScv1 rose 0.09%. The pan-European STOXX 600 index .STOXX lost 0.55%.

Read More...

Business News

Senate body concerned over fake currency circulation

Senate Standing Committee on Finance and Revenue has expressed concerns over the fake currency circulation in different parts of the country. The committee, which met under the chair of Senator Farooq H Naik, has decided to summon the senior officials of the State Bank of Pakistan (SBP) on the issue of fake currency circulation in different parts of the country. Senator Mohsin Aziz has raised the issue of fake currency in the meeting. He said that SBP should take action against the fake currency. The committee has also discussed the issue raised by Senator Mohsin Aziz in Senate regarding discriminating credit and lending policies of the private banks in Khyber Pakhtunkhawa and Balochistan provinces. Deputy Governor SBP informed that they have taken measures to improve the credit and lending policies in aforesaid provinces in last three years.

Read More...

Against instalment of Rs20.5b, govt collects just Rs3.25b in lieu of GIDC

The government has collected only Rs 3.25 billion Gas Infrastructure Development Cess (GIDC) against the first billed instalment of Rs20.5 billion from various consumers. Following the Supreme Court of Pakistan decisions to collect GIDC from various sectors the petroleum division had directed various gas suppliers to start the collection of the arrears from their Industrial and commercial consumers in instalments and subsequently bills of first instalments worth Rs20.5 billion had been sent to the gas consumers, official sources told The Nation. However, in response of the first instalment of Rs20.5 billion only Rs3.25 billion was collected from the consumers.

Read More...

COVID-19, locust swarms disrupt food supply chain in Sindh: ADB survey

The Asian Development Bank (ADB) in its survey of farmers in Sindh has revealed that COVID-19 and locust swarms had a significant impact on the livelihoods they obtained through agricultural products, including wheat, vegetables, fruits, and dairy products. In June 2020, a survey was conducted under ADB technical assistance, using computer-assisted telephone interviewing. The survey attempted to contact 721 farmers across eight districts of Sindh and successfully completed interviews with 410 farmers. The survey collected information on how COVID-19-?related measures and disruptions affected the harvest and marketing of rabi (winter) season crops and dairy products, the availability and price of inputs, and the financial needs of farmers. The survey also sought to determine the impact of the locust invasion in the region.

Read More...

Govt urged to facilitate tyres industry

Tyres manufacturing sector of the country has urged the government to withdraw the decision of discontinuation of stamping of goods “In Transit to Afghanistan” at Karachi Ports and Port Qasim. This decision will hurt the local industry and reverse all the efforts of curbing illegal practices of smuggling. Spokesman of the General Tyre and Rubber Company of Pakistan (GTR) said the process will increase smuggling and pilferage of transit goods in the country. He said stamping must be mandatory for goods in transit to Afghanistan. Without the stamping, goods will again find their ways to the country and ultimately will weaken local industrial basis and resulting in billion of rupees revenue losses to the government.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.