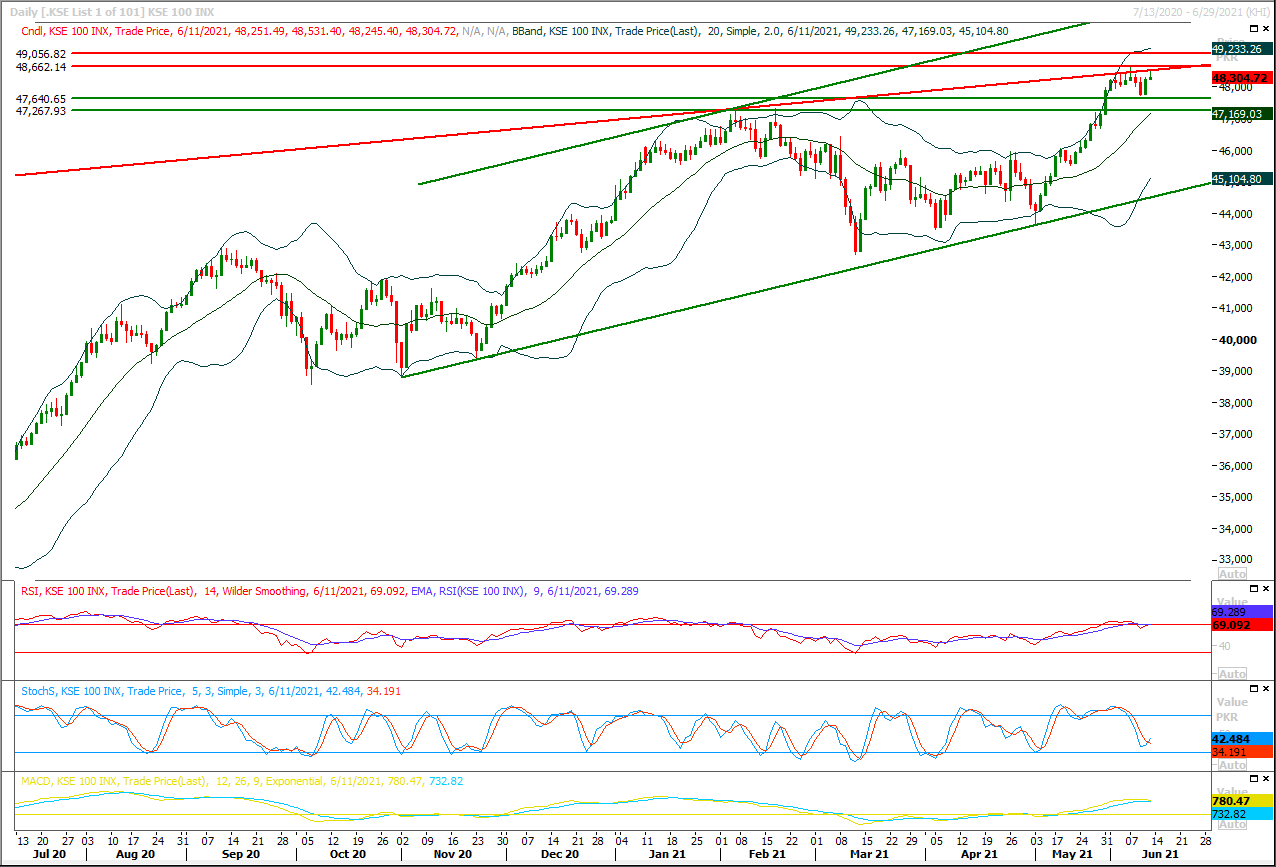

Technical Overview

The Benchmark KSE100 index had tried to continue its bullish trend for confirmation of its bullish engulfing pattern but faced rejection from its resistant trend line once again during last trading session. As of now it's being capped by same trend line at 48,550pts along with a strong horizontal resistant region at 48,660pts. Meanwhile a descending price channel is being formatted on hourly chart and index would be considered under pressure until it would not succeed in recovering above this channel. It's recommended to stay cautious until index succeeds in closing above 48,660pts because if it would face rejection this time then selling pressure would start piling up which may lead index initially towards 48,000pts and later on 47,730pts could be witnessed. Overall a volatile session would be witnessed during current trading session. Daily momentum indicators are ready for a bullish spike but if index would not succeed in closing above 48,660pts on daily chart then these would also start declining again. On longer run index would set its targets at 50,300pts once it would succeed in closing above its current resistant regions but its recommended to adopt wait and see strategy or swing trading could be beneficial.

Regional Markets

Wall St Week Ahead Fed meeting looms for stocks as inflation worries collide with ‘Goldilocks’ markets

Investors will be zeroing in on the Federal Reserve’s monetary policy meeting next week as a “Goldilocks” market environment that has helped lift stocks to record highs and tamed a bond selloff is tested by rising inflation. Stocks have climbed steadily in recent weeks and now stand at fresh records, extending a rally that has seen the S&P 500 (.SPX) gain 13% this year and nearly 90% from its March 2020 low. U.S. government bonds have also rallied after their first-quarter selloff, with the benchmark 10-year Treasury yield , which moves inversely to prices, recently at 1.46%, some 30 basis points below its first quarter highs. The Fed has maintained that it has the tools to deal with accelerating inflation. The central bank may open discussion at the Tuesday-Wednesday meeting about when to begin unwinding its $120 billion per month purchases of government bonds, though most analysts don’t expect a decision before the Fed’s annual Jackson Hole, Wyoming, conference in August.

Read More...

Business News

FPCCI demands govt to give tax relief to chambers

style="text-align: justify;">Chambers all over Pakistan play crucial role for voicing the feedback and suggestions of business industry. Being the platform for related sectors including, trade, exports, manufacturing and other industries, these chambers have contributed a lot for boosting economic growth, industrial expansion and trade maximisation. Their role behind the growth rate and in bringing relevant business reforms despite financial constraints is commendable. Its government’s duty to facilitate these chambers which in turn shall facilitate industry and it would eventually have a trickle-up effect for the national economy, says Raja Muhammad Anwer, Vice President (Punjab) Federation of Pakistan Chambers of Commerce and Industry (FPCCI).Read More...

IMF asked to allow extension of construction amnesty scheme

Finance Minister Shaukat Tarin has said the government has sought from the International Monetary Fund a six-month extension of the amnesty scheme launched under the prime minister’s package for construction industry. Prime Minister Imran Khan had announced the package in April 2019. “We have approached the IMF for an extension of the scheme for the construction industry for six months,” Mr Tarin said at a post-budget briefing on Saturday, adding that the people were opting for the scheme to avail the facility. The government has already extended the last date of the scheme until June 30 from Dec 31 last year. The builders and developers are required to get registered on computer-based IRIS software of the Federal Board of Revenue (FBR) on or before June 30 this year and the projects should be completed before Sept 30, 2023.

Read More...

Wapda power houses supplying 5,800 MW to national grid

Power Houses of Water and Power Development Authority (Wapda) are supplying 5,800 MW to the national grid during off-peak hours, the Wapda spokesman said. All Wapda power houses including Tarbela were working as per their routine. The Power Houses were generating electricity according to water discharges, he added, He said currently, Tarbela was supply 2,932 MW to the National Grid. The power generation would further increase including from Tarbela during peak hours, he said.

Read More...

Over 75 per cent of Karachi is exempt from load-shed: K Electric

According to K-Electric Spokesperson, “KE is focused on serving the evolving needs of its customers. With this resolve, we continue to invite feedback as we drive improvement in our services across the board. With the support of the communities we operate in, we have overcome theft and brought a steady supply of power to the city; today over 75 per cent of Karachi is exempt from load-shed, with industries exempt since 2010. Reducing price of electricity is beyond mandate of distribution companies in Pakistan, including KE. Under the Uniform Tariff Policy, category-wise rates for consumers are also the same across the country. KE spokesperson further said, “Policy load-shed follows the prevailing guidelines set by the relevant authorities, and is directly linked with theft of electricity.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.