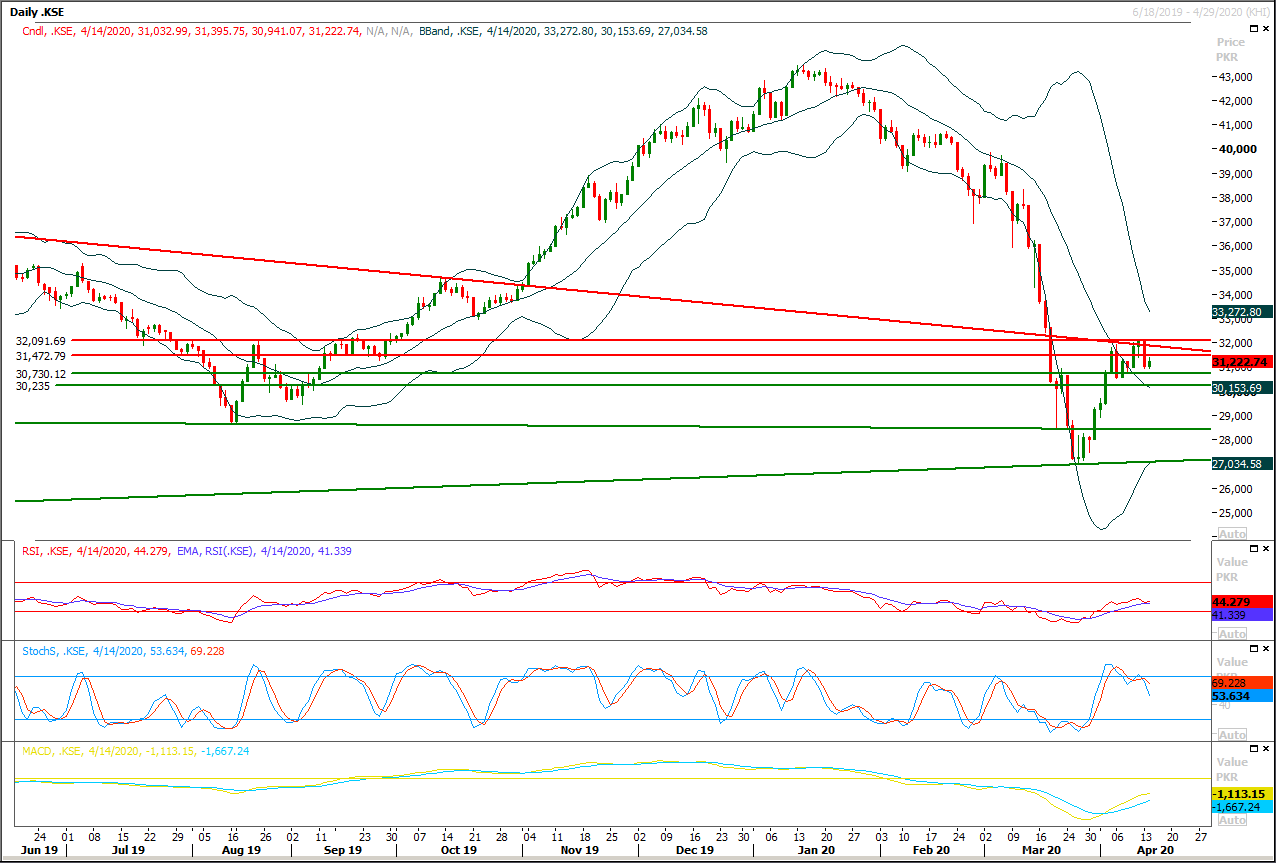

Technical Overview

The Benchmark KSE100 index have tried for a format a cheat pattern after daily evening shooting star during last two trading sessions therefore uncertainty among investors could be witnessed during current trading session mean while index would try to amend daily double bottom after facing resistance from a strong horizontal resistant region. For current trading session index seems to be caged between 31,500pts and 30,730pts and breakout of either side would push index for further 500-800pts in respective direction. It's recommended to stay cautious and start selling on strength with strict stop loss until index succeed in closing above 32,500pts on daily closing basis, while breakout above 32,500pts would call for 33,500pts and 34,000pts.

While on flip side if index would follow its bearish trend again then after breakout of 30,730pts index would continue its bearish journey towards 30,200pts while breakout below 30,000pts would push index further downward and index would then try to find some ground at 29,700pts.

Regional Markets

Asia shares consolidate, China cuts another interest rate

Asian share markets took a breather on Wednesday as warnings of the worst global recession since the 1930s underlined the economic damage already done even as some countries tried to re-open for business. China moved again to cushion its economy, cutting a key medium-term interest rate to record lows and paving the way for a similar reduction in benchmark loan rates. While not unexpected, it did help MSCI’s broadest index of Asia-Pacific shares outside Japan edge up 0.3% to a fresh one-month top. Shanghai blue chips, however, eased 0.2%. Japan’s Nikkei was still off 0.5%, though that followed a 3% jump the previous session. E-Mini futures for the S&P 500 dipped 0.5%, following a 3% rise in New York.

Read More...

Business News

IMF sees negative 1.5pc growth in Pakistan this year

The International Monetary Fund (IMF) on Tuesday projected economic recession for Pakistan following the coronavirus-related ‘The Great Lockdown’ that would sharply contract the global economy this year. The fund projected Pakistan’s economy to shrink by 1.5pc during this fiscal year, compared to 3.3pc growth in 2018-19. These estimates are generally comparable with 1.3pc decline in the country’s economic output forecast by the World Bank on Sunday. “As a result of the pandemic, the global economy is projected to contract sharply by 3pc in 2020, much worse than during the 2008–09 financial crisis,” said the IMF in its annual flagship World Economic Outlook (WEO) released on Tuesday. “It is very likely that this year the global economy will experience its worst recession since the Great Depression, surpassing that seen during the global financial crisis a decade ago.

Read More...

SBP says all targets to be revised downward

The State Bank of Pakistan (SBP) on Tuesday said that the revised GDP growth target of three per cent was unachievable even after ignoring the impact of pandemic on the economy as the agriculture sector and large-scale manufacturing failed to compensate for subdued domestic market activity. The projections are likely to be revised downward further as the optimism from stabilisation is now subject to risks arising from the global and domestic spread of Covid-19, said the central bank in its Second Quarterly Report on the State of Pakistan’s Economy. The report mostly deals with the pre-coronavirus economic performance but it also covered the grave and disastrous impact of the pandemic on the economy. It notes that the situation is extremely fluid and highly uncertain, the economic outlook remains subdued compared to the pre-outbreak estimates.

Read More...

FBR issues refunds of Rs51.5b

FBR has issued refunds of Rs 51.5 billion through FASTER (Fully Automated Sales Tax E-Refund System). FBR has released the latest information relating to the issuance of refunds through FASTER. As per record, since July 2019, a total of refunds amounting to Rs. 64.5 billion were claimed through FASTR system. Out of it, refund cases of Rs 57b were processed. Out of these processed cases, refund payment of Rs 51.5 billion have been made to the exporters and businessmen so far. The remaining unpaid refund cases have been withheld due to incomplete date provision by the exporters and businessmen. Meanwhile, FBR has devised a centralized system of online payment of Sales Tax, FED and Income Tax refunds directly in the bank account of the taxpayers. For this purpose, FBR has requested the taxpayers to update their IRIS profile. In the given bank account details area in the system, IBAN detail row is added wherein taxpayers are required to add their complete Bank’s IBAN number of same Bank Account whose details are already available in IRIS profile to receive Sales Tax, FED and Income Tax refund cheques. FBR has advised the taxpayers to do the needful as soon as possible to avail electronic transfer facility.

Read More...

Stabilisation efforts, regulatory measures yielded notable improvements in first half: SBP

The State Bank of Pakistan (SBP) said Tuesday that the stabilisation efforts and regulatory measures yielded notable improvements during the first half of fiscal year 2020, however noted that the global and domestic spread of COVID-19 has brought an exceptional set of challenges for the country. According to SBP’s second quarterly report on the state of economy, the current account deficit contracted to a six-year low, foreign exchange reserves increased, the primary budget recorded a surplus, and core inflation eased. Importantly, export-based manufacturing showed signs of traction and construction activities picked up, indicating that the economy was on the path of recovery.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.