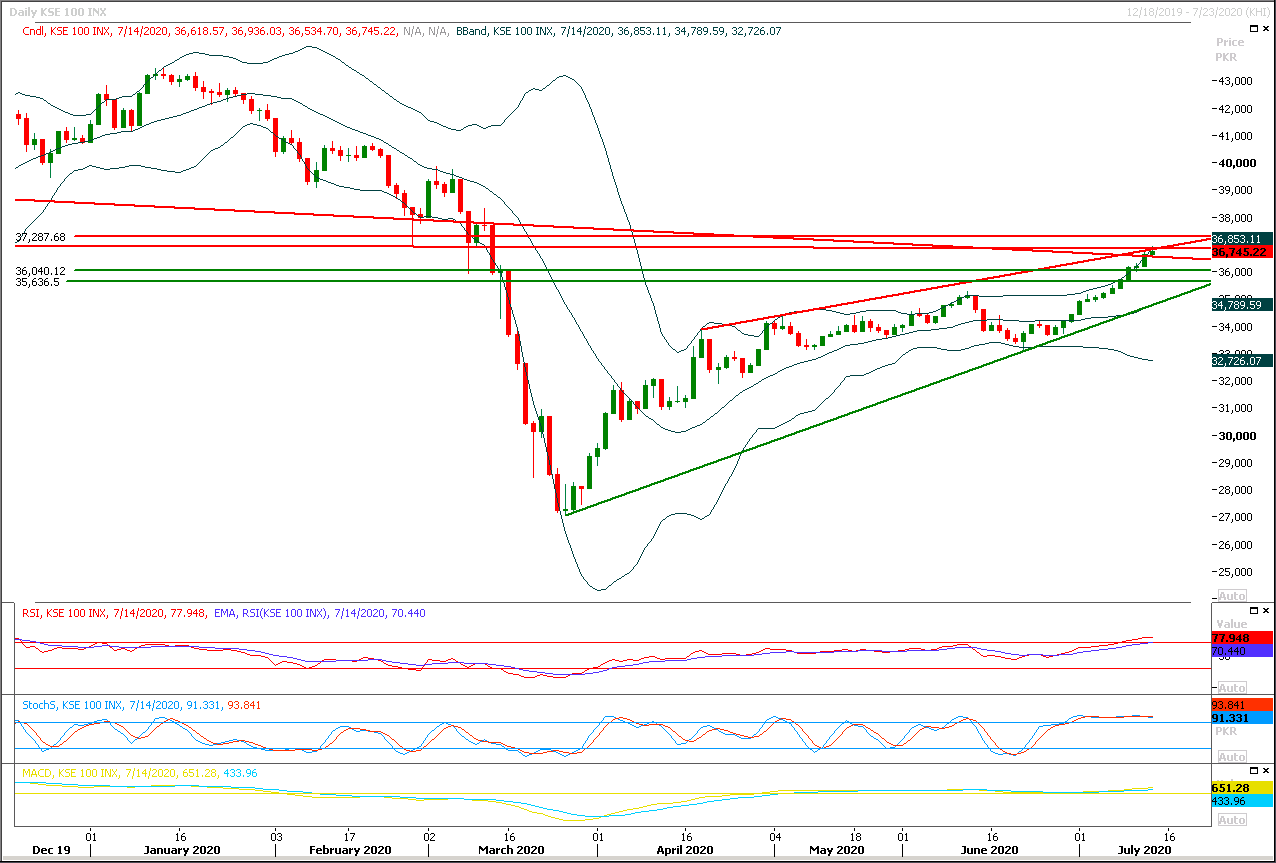

Technical Overview

The Benchmark KSE100 index is moving in a rising wedge on daily chart to complete its bearish correction and its going to complete that correction at 37,280pts on daily and weekly charts. As of now it's expected that index would face strong resistances at 36,880pts and 37,280pts region from a descending trend line on weekly chart along with resistant trend line of its rising wedge and strong horizontal resistant regions on daily chart. Daily momentum indicators have reached overbought region and it's expected that index could start its bearish sentiment any time. For current trading session index is being capped by strong resistant regions at 36,880pts 37,000pts therefore selling on strength with strict stop loss of 37,280pts could be beneficial. In case index would try to create a cheat pattern be penetration above its correction level then it would be recommended to stay cautious and trail selling stop losses towards 37,860pts but being remained on selling side would be beneficial until index take a dip to complete its correction. While on the other side in case of facing rejection from its resistant regions index would try to slide downward and would find some ground at 36,000pts and breakout below that region would call for 35,860pts.

Regional Markets

Asian markets set to shake off coronavirus spread, U.S.-China tensions

Asian markets appeared set to shake off heightened tensions between the United States and China and the spread of coronavirus, with stock futures pointing to early gains on Wednesday.Australian S&P/ASX 200 futures YAPcm1 rose 0.47% in early trading, Japan's Nikkei 225 futures NKc1 were up 0.7%, and Hong Kong's Hang Seng index futures .HSI HSIc1 rose 0.46%. E-mini futures for the S&P 500 EScv1 rose 0.82%. The strong signals for Asian markets came after U.S. investors shook off lingering bad news about the spread coronavirus to send major indices higher on Tuesday, buoyed by a rise in cyclical stocks. The Dow Jones Industrial Average .DJI rose over 2%, while the S&P 500 .SPX gained 1.34% and the Nasdaq Composite .IXIC climbed 0.94%. The stock surge came after three U.S. states reported new record daily deaths from the pandemic, and as tensions continued to grow between the United States and China. “Markets have shown a remarkable ability to look through rising infection rates and rising risks of lockdowns,” said Michael McCarthy, chief markets strategist at CMC Markets. “At the moment, the market seems to be quite lively and happy to rally on despite those increasing economic risks.” MSCI’s gauge of stocks across the globe .MIWD00000PUS closed up 0.53%.Read More...

Business News

Cotton cultivation down 1.3pc

Cotton crop sowing in the country during current season (2020-21) decreased by 1.3 per cent compared to the last year. Cotton, major cash crop and industrial raw material for the textile sector, was on downwards trajectory due to various issues, said Ministry of National Food Security and Research’s Cotton Commissioner Dr Khalid Abdullah. Talking to APP on Tuesday, he said that cotton crop was cultivated on 2.457m hectares against the target of 2.663m hectares. He said that 92pc of the cotton cultivation target was achieved during current season. He said that area under cotton cultivation in Punjab decreased by 2.5pc as crop was sown over 1.890m hectares against the target of 2.03m hectares. ARTICLE CONTINUES AFTER A

Read More...

Opec sees oil demand soaring

Global oil demand will soar by a record 7 million barrels per day (bpd) in 2021 as the global economy recovers from the coronavirus crisis but will remain below 2019 levels, Opec said in its monthly report. It was the first report in which Opec assessed oil markets next year. It said the forecast assumed no further downside risks materialised in 2021 such as US-China trade tensions, high debt levels or a second wave of coronavirus infections. “This assumes that Covid-19 is contained, especially in major economies, allowing for recovery in private household consumption and investment, supported by the massive stimulus measures undertaken to combat the pandemic,” Opec said.

Read More...

Regulator proposes up to 6pc cut in gas prices

The Oil and Gas Regulatory Authority (Ogra) on Tuesday determined 2-6 per cent reduction in the prescribed prices of two gas utilities for fiscal year 2020-21 to pass on partial impact of decline in international oil prices to gas consumers. The regulator forwarded two separate determinations on revenue requirements of the Sui Northern Gas Pipelines Limited (SNGPL) and the Sui Southern Gas Company Limited (SSGCL) for advice on gas sales price for each category of consumers. The regulator has set an average prescribed rate for the SNGPL at Rs623.31 per million British thermal unit (mmBtu) instead of existing rate of Rs664.25 per mmBtu, down by 6pc. The company had demanded a prescribed price of Rs1,287 per mmBtu with about Rs174 billion previous year adjustment and about Rs73bn on account cost of liquefied natural gas (LNG) diverted to residential and commercial consumers in winters.

Read More...

KE places order for furnace oil supply for 2020: PSO

Pakistan State Oil has alleged that K-Electric has placed the order for furnace oil supply for 2020 after the delay of nine months, whereas, the estimate of required fuel for next year is still awaited. As per fuel supply agreement (FSA), K-Electric (KE) has to provide PSO at least 02 months prior to the beginning of each year a monthly estimate of the anticipated requirement of furnace oil (F0), said a spokesman of the PSO here. This is just an estimate and not a firm demand. This estimate, which was to be provided in April 2019, was provided in Jan 2020 whereas, the same is still awaited for this year, the spokesman claimed. As per FSA, firm demand has to be placed 30 days prior to the commencement of every month, which was not followed for June and the demand for June was confirmed for 120,000 metric tons (MT) on May 15, 2020 after continuous follow up by PS0.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.