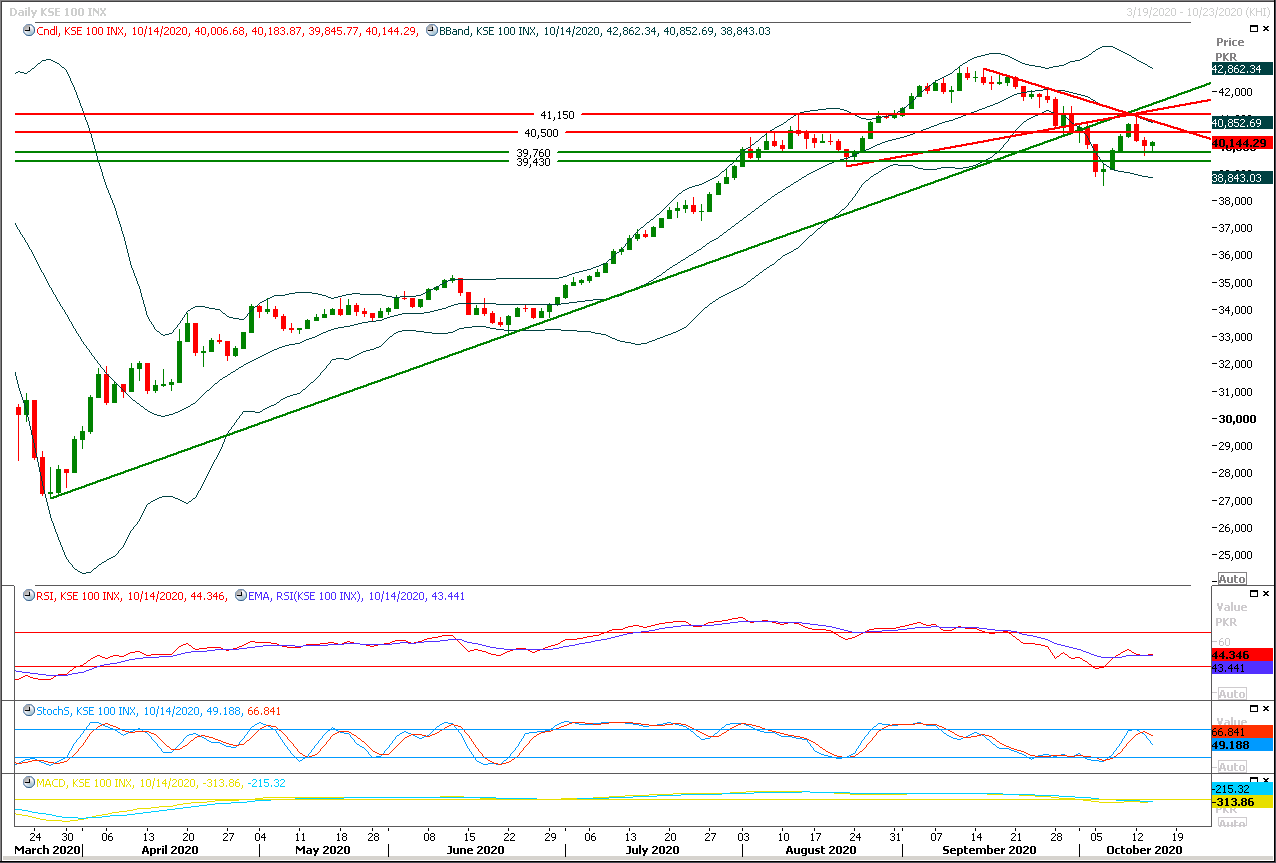

Technical Overview

The Benchmark KSE100 index is being caged in a very tight range on daily chart and with every passing day this range is being narrowed aggressively. Daily momentum indicators have again changed their direction towards bearish side on completion of daily bearish correction therefore it's recommended to adopt swing trading strategy until index succeeds in giving a clear breakout in either direction. Currently index is trying to bounce back after completing bullish correction of its last corrective rally and if it would succeed in penetration above 40,500pts then it can be expected that index would continue its bullish journey towards 40,760pts and 41,000pts while in case of rejection from its resistant regions index would start sliding downward again and this could be more dangerous because daily closing below 39,700pts would call for 39,000pts or 38,760pts in coming days with expansion towards supportive trend line daily descending wedge. Swing trading could be beneficial for day trading with strict stop loss of 40,500pts on bullish side and 39,700pts on bearish side.

Regional Markets

Asian stocks mixed on fading U.S. stimulus hopes, virus concerns

Asian markets were off to a mixed start on Thursday as hopes of U.S. fiscal stimulus before the presidential election faded and a record number of new coronavirus infections in parts of Europe propelled investors toward safe-havens such as gold.MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS slipped 0.1%. Australia's S&P/ASX 200 .AXJO rose 0.6%, while Japan's Nikkei 225 .N225 fell 0.3%. Hong Kong's Hang Seng index futures .HSI.HSIc1 were down 0.49%. E-mini futures for the S&P 500 EScv1 were flat. On Wall Street, the Dow Jones Industrial Average .DJI fell 0.58%, the S&P 500 .SPX lost 0.66% and the Nasdaq Composite .IXIC dropped 0.8%..

Read More...

Business News

ECC approves Rs72.63 billion for onward disbursements of PHL

The Economic Coordination Committee (ECC) of the Cabinet on Wednesday has in principle approved technical supplementary grant amounting to Rs72.635 billion to Power Holding Limited (PHL) for onward disbursements to respective banks or through financial instruments as and when due during the current financial year. The ECC chaired by Adviser to the Prime Minister on Finance Dr. Abdul Hafeez Shaikh has approved technical supplementary grant for PHL. In an earlier decision, the ECC had decided to shift the power sector debt stock of Rs804 billion to public debt. As per debt repayment schedule agreed between PHL and lending institutions, an amount of Rs72.635 billion were required to be paid partially during the FY 2019-20 and remaining is payable in 2020-21 as principal repayments to lenders.

Read More...

ICCI asks FBR to provide relief in taxes to small shopkeepers

The Islamabad Chamber of Commerce and Industry (ICCI) has asked the Federal Board of Revenue (FBR) to provide relief in taxes to small shopkeepers in order to alleviate their difficulties. Sardar Yasir Ilyas Khan, president ICCI, said that the five-month lockdown due to the Covid-19 pandemic has led to a great recession in the business activities and has badly hit the small traders due to which they were facing multiple problems including payment of shops rents. Therefore, it was the need of the hour that FBR should provide relief in taxes to small shopkeepers in order to alleviate their difficulties. He was addressing a delegation of Traders Welfare Association, Jinnah Super Market that visited ICCI led by its President Asad Aziz.

Read More...

Govt gets Rs1.11b by privatising 23 state owned properties

The federal government has generated Rs1.113 billion by privatising 23 properties in last month. “Twenty three out of Twenty six properties were successfully auctioned on over and above the reserved price, earning Rs1.113 billion for national exchequer,” the Privatisation Commission (PC) said in a statement on Wednesday. A special meeting of Inter-Ministerial Committee (IMC) on assets management on privatisation was held in Islamabad. The meeting was chaired by the Federal Minister for Maritime Affairs Ali Haider Zaidi, Federal Minister/Chairman Privatisation Mohammed Mian Soomro also attended the meeting.

Read More...

Rupee hits five-month high against dollar as greenback falls to Rs163.20

The rupee hit a five-month high on Wednesday as the dollar was trading at Rs163.20 in the interbank market, data from the Exchange Companies Association of Pakistan (ECAP) showed. “Steps taken by the State Bank of Pakistan are positive and the new rules and regulations discouraging illegal currency movement in the country have helped the rupee in the last few weeks,” ECAP Chairman Zafar Paracha said while speaking to Dawn. Better foreign currency inflows and lower outflows due to declining imports and debt repayments have also bolstered the outlook for the local currency.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.