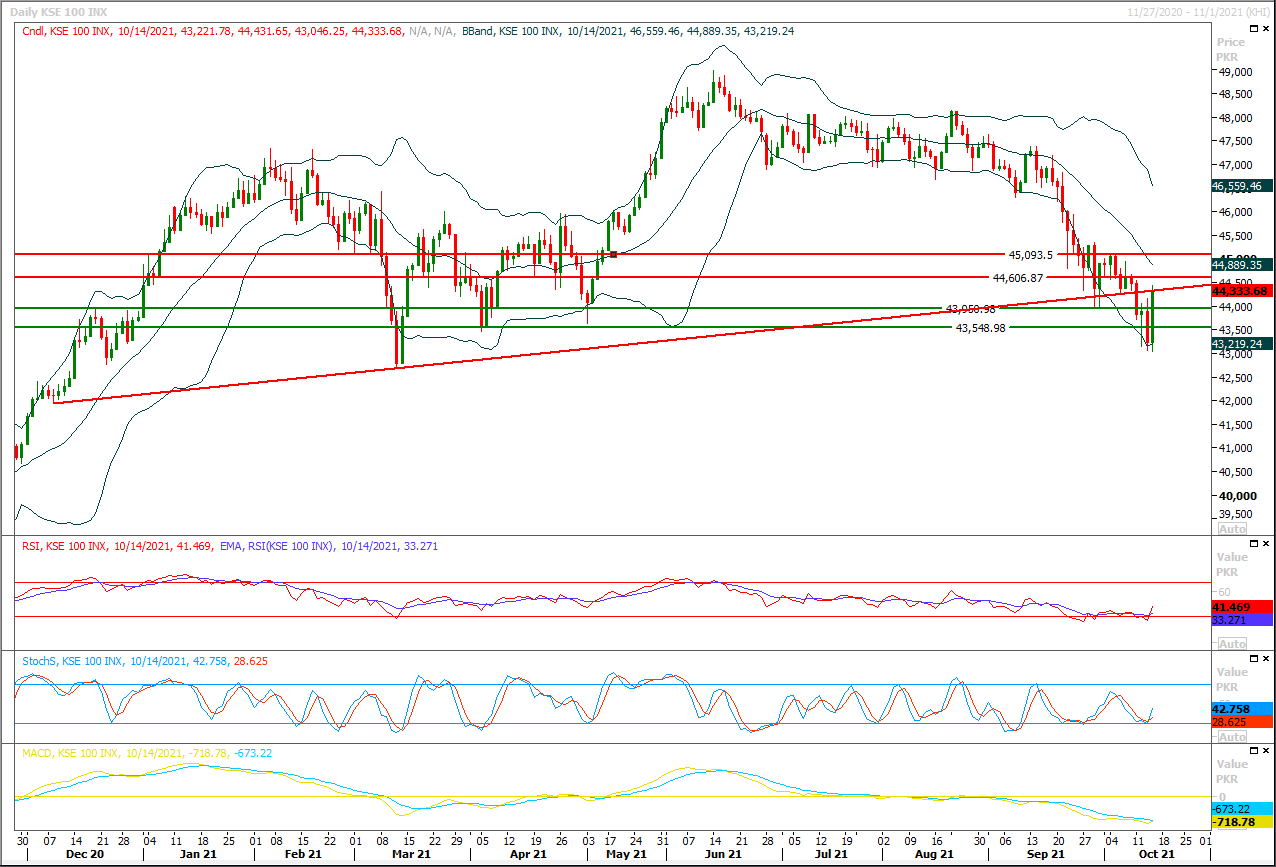

The Benchmark KSE100 index have bound back after getting support from a descending trend line during last trading session and a bullish engulfing pattern on daily chart have take place along with a daily double bottom. As of now it's expected that index would try to open with a positive gap as it exactly closed below a previous supportive trend line which would now try to react as a resistant one therefore a gap opening would favor bulls to maintain current bullish sentiment intact. For current trading session index would try to target 44,600pts initially where its being capped by horizontal resistant region and breakout above this region would not only confirm bullish engulfing pattern but also would open doors for 44,780pts and 45,065pts regions. While on flip side in case of rejection from its resistant regions index may slide towards 43,950pts and 43,760pts where its being supported by strong horizontal supportive regions. It's recommended to stay cautious as long as index is trading below 45,500pts and its recommended to post trailing stop losses on existing long positions because current pull back would be considered correction of last bearish rally on daily chart until index would not succeed in closing above 45,500pts. Currently hourly stochastic is ready for a bearish crossover but MACD is still in positive mode therefore any dip could be buying opportunity with strict stop loss of previous low.

Regional Markets

Former U.S. President Clinton hospitalized -CNN

Former President Bill Clinton, 75, was admitted two days ago to an Irvine, California, hospital where he is being treated for a non-COVID-19 infection, a spokesman said on Thursday."On Tuesday evening Former President Bill Clinton was admitted to UCI Medical center for treatment of a non-covid infection," Clinton spokesman Angel Urena said on Twitter."He is on the mend, in good spirits, and incredibly thankful to the doctors, nurses and staff providing him with excellent care," Urena said.

Read More...

Business News

Petroleum prices likely to be raised by up to Rs9

With Finance Minister Shaukat Tarin expected to meet International Monetary Fund’s managing director Kristalina Georgieva on Friday, the government may increase the petroleum prices by up to Rs9 per litre for the next 16 days if it goes by the calculations of the Oil & Gas Regulatory Authority.

Read More...

Bank deposits hit record Rs20tr in FY21

The bank deposits reached an all-time high of Rs20 trillion in FY21 creating a need for higher protection, said the Deposit Protection Corporation (DPC) which issued its first Annual Report on Thursday.The report says that the number of depositors covered under the protection offered by the corporation has increased due to healthy growth trend in bank deposits, which further boosted in FY21.

Read More...

WB commends govt efforts for economic recovery, policy reforms

Axel van Trotsenburg, Managing Director World Bank, has commended the efforts of government of Pakistan for economic recovery and policy reforms.A high-level Pakistani delegation comprising of Omar Ayub Khan, Minister for Economic Affairs, Shaukat Tarin, Minister for Finance & Revenue, Hammad Azhar, Minister for Energy, and other senior officials held a meeting with Axel van Trotsenburg, Managing Director, World Bank on the sidelines of WBG/IMF Annual Meetings 2021.

Read More...

Govt making all-out efforts to complete privatisation of PSMC by March next year

The government is making all-out efforts to complete the privatisation of Pakistan Steel Mills Corporation (PSMC) by March next year.The Ministry of Privatisation in collaboration with Ministry of Industries and other stakeholders is actively pursuing the corporate actions required to be completed prior to the subject transaction. In this regard, a meeting was held to overview the progress made thus far. The meeting regarding the revival of PSMC held under the chairmanship of Federal Minister for Privatisation and Minister for Industries & Production Makhdoom Khusro Bakhtiar.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.