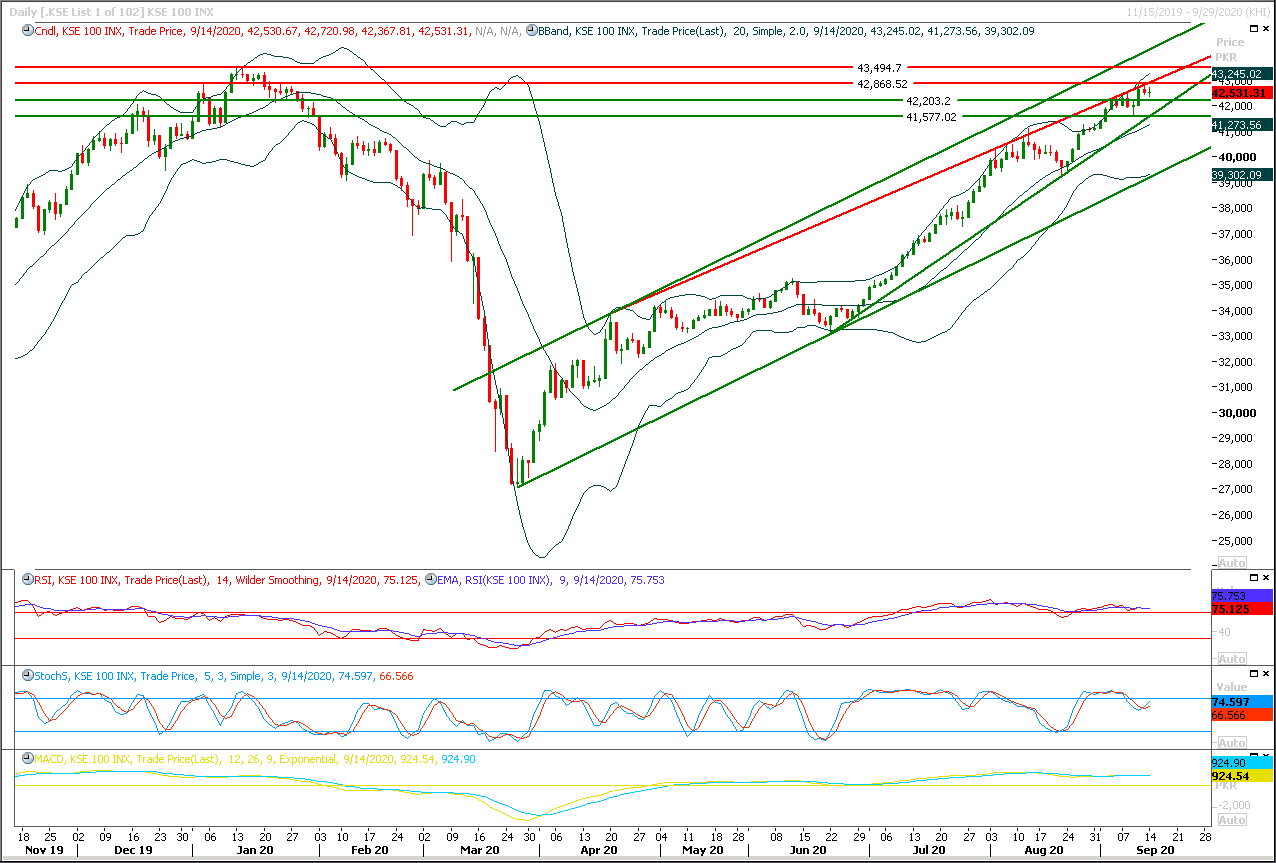

Technical Overview

The Benchmark KSE100 index have created a doji formation on daily chart during last trading session mean while daily stochastic have changed its direction towards bullish side but MACD is still in bearish mode which would try to create uncertainty among investors. Mean while index is being capped by two strong resistant objects at 40,860pts where crossover of a trend line is taking place with a horizontal resistant region, in case of breakout above this region index would continue its bullish momentum towards 43,000pts and 43,200pts. It's recommended stay cautious and post strict stop loss on existing positions. On intraday basis it's expected that index would try to take a spike to retest its resistant regions but in case of rejection from these region it would start sliding towards 42,300pts. Index would be considered bullish until it would not succeed in closing below 40,500pts therefore buying on dip with strict stop loss could be beneficial.

Regional Markets

Asian shares set to dip as investors await key data

Asian shares looked set to open lower on Tuesday as investors shifted focus to upcoming data and central bank meetings although positive developments around potential COVID-19 vaccines and increased deal activity are likely to stem losses. Australia’s S&P/ASX 200 futures were down 0.22% and Hong Kong’s Hang Seng index futures lost 0.08%. Japan’s Nikkei 225 futures were flat after Chief Cabinet Secretary Yoshihide Suga won a ruling party leadership election, paving the way for him to succeed Prime Minister Shinzo Abe. E-mini futures for the S&P 500 gained 0.11%.

Read More...

Business News

Remittances up by 24.4pc to $2.095 billion in August

The remittances sent by overseas Pakistanis reached to $2.095 billion during the month of August 2020, showing 24.4 per cent increase over the same month of last year, State Bank of Pakistan (SBP) reported Monday. This is the third month in row when workers’ remittances remained above $2 billion, according to latest data of the bank, which termed the remittance figure largely in line with SBP projections. Over the last three months, remittances reached an unprecedented level of $7.3 billion, showing 37.2 per cent higher than the same period last year.

Read More...

UK increases limit for investment in Pakistan

The UK’s credit financing agency, UK Export Finance yesterday increased its financing limit for UK businesses looking to export to and invest in Pakistan to £1.5 billion. This announcement will boost trade partnerships between the two countries and unleash Pakistan’s growth potential. UKEF helps secure large contracts by providing attractive financing terms to buyers and supporting working capital loans. The British High Commissioner to Pakistan, Dr Christian Turner met with the Federal Minister of Commerce for Pakistan Razaq Dawood to discuss trade ties and business potential between the two countries.

Read More...

CCP conducts inspection of Pakistan Sugar Mills Association’s offices

As part of an ongoing enquiry into the possible anti-competitive activities in the sugar industry, the Competition Commission of Pakistan (CCP) on Monday has carried out a search and inspection of the Pakistan Sugar Mills Association (PSMA) Lahore and Islamabad offices. The CCP authorised its officers to the ‘Enter and Search’ PSMA premises under Section 34 of the Competition Act, 2010 following indications of PSMA’s anti-competitive activities including, but not limited to, the collective stoppage of crushing in season 2019-20, collective rise in prices of sugar, and collective refusal to supply sugar to Utility Store Corporation (USC) as recently reported.

Read More...

Sale of Naya Pakistan Certificates begins through agent banks

The sale of Conventional Naya Pakistan Certificates (NPCs) began on Monday through agent banks amid to attract investments from overseas Pakistanis to boost foreign exchange reserves. In a tweet, the Ministry of finance said, Roshan Digital Account holders of UBL, HBL, MCB, Alfalah, Standard Chartered and Samba Bank can subscribe to NPCs by visiting NPC page of their respective bank. The ministry added that Shariah-compliant version is also coming very soon. In last week, Prime Minister Imran Khan had inaugurated the ‘Roshan Digital Account’, an initiative which will facilitate millions of overseas Pakistanis to undertake fund transfers, bill payments and investment activities in the country.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.