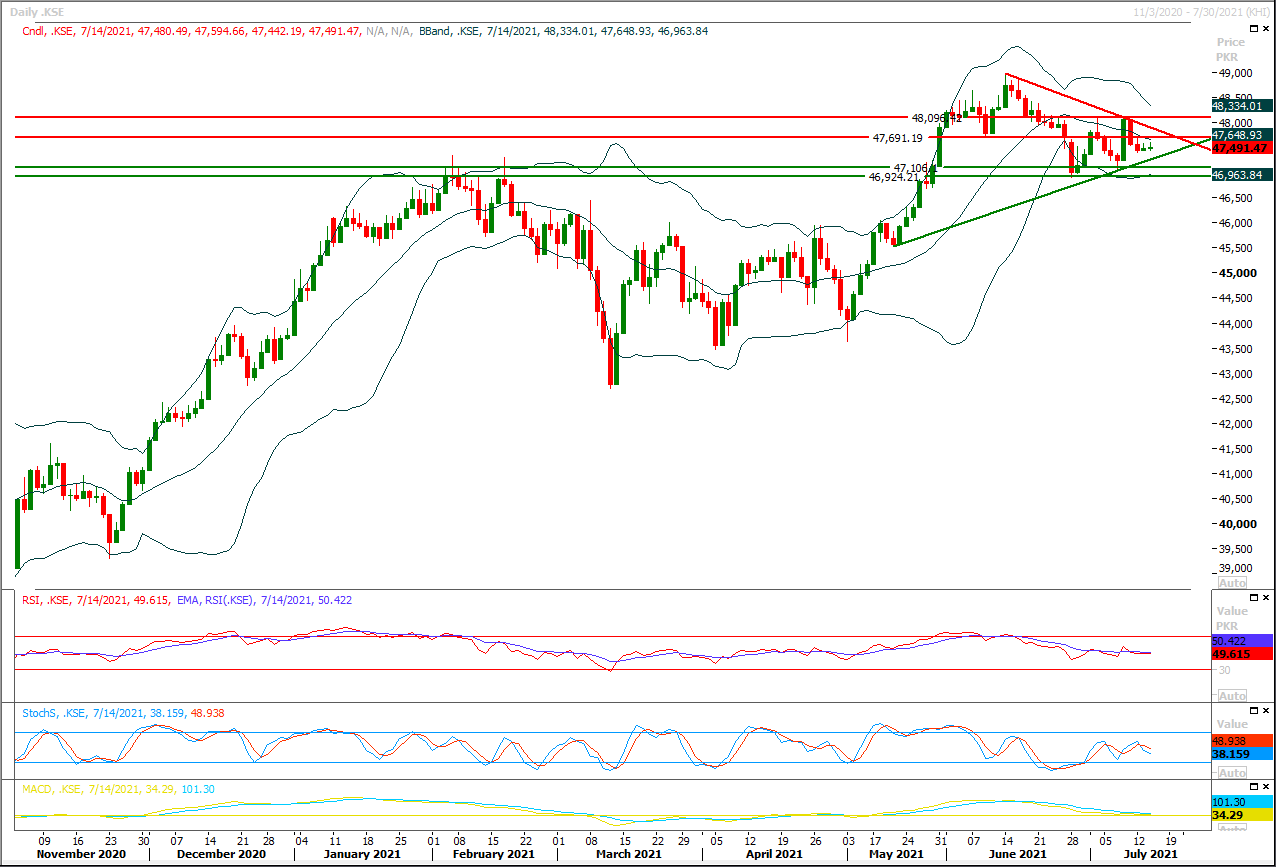

The Benchmark KSE100 index had continued its bearish journey towards 61.8% correction of its last bullish pull back during last trading session inside a bullish price channel on hourly chart. As of now hourly momentum indicators are ready for a pullback but daily indicators have generated bearish crossovers therefore it's recommended to stay cautious and post trailing stop loss on existing long positions. Meanwhile it's being caged inside a daily triangle and right now it's standing at supportive trend line of that triangle. Currently it's expected that index would try to establish ground above 47,330pts-47,200pts region but breakout below this region would call for 46,900pts. While on flip side in case of reversal index would call for 47,700pts initially and breakout above this region would call for 47,900pts and 48,065pts. Today's closing matters a lot as index would try to set its trend if it would gave a breakout in either side.

Regional Markets

China's economic growth more than halves in second quarter

China's economic growth more than halved in the second quarter from a record expansion in the first three months of the year, as slowing manufacturing activity, higher raw material costs and new COVID-19 outbreaks weighed on the recovery momentum.Gross domestic product expanded 7.9% in the April-June quarter from a year earlier, official data showed on Thursday, missing expectations for a rise of 8.1% in a Reuters poll of economists.Growth slowed significantly from a record 18.3% expansion in the January-March period, when the year-on-year growth rate was heavily skewed by the COVID-induced slump in the first quarter of 2020.

Read More...

Business News

Japanese labour market will be opened for highly skilled Pakistanis

Japan is embarking on a project of Human Resource exchange with Pakistan under which the Japanese labour market will be opened for highly skilled Pakistanis.Kuninori Matsuda, Ambassador of Japan, stated this while talking to the Federal Minister for Finance and Revenue, Shaukat Tarin here at the Finance Division. SA PM on Finance and Revenue Dr. Waqar Masood was also present during the meeting.While extending a warm welcome to Kuninori Matsuda, the ambassador of Japan, the finance minister stated that Pakistan and Japan enjoy sound friendly relations since 1952 which have been getting stronger with each passing day.

Read More...

Pakistan, Uzbekistan vow to boost bilateral trade, investment ties

Pakistan and Uzbekistan joined hands to attract leading companies in pharmaceuticals, textile, leather, production of construction materials and agriculture industries.The two sides agreed on the importance of further increasing bilateral trade and investment, in full partnership between the public and private sectors, and involving the relevant Chambers of Commerce, as well as export development and investment promotion agencies of both countries. Increasing the frequency of official visits and bilateral meetings (virtual and / or physical) between representatives of the respective private sectors to explore major development projects and investment opportunities was a highlight of the meeting of Intergovernmental Commission.

Read More...

Gas production declined by 10 per cent in fiscal year 2019-20: Ogra

The share of Punjab in gas consumption had increased by 1.96 per cent during 2019-20, while the share of Sindh decreased by 2.63 per cent.Balochistan had produced 11 per cent of the country’s natural gas during 2019-20 and consumed only 2 per cent, similarly KP produced 12 per cent of the total natural gas while the consumption was 9 per cent of the total consumption, said Ogra in its regulated Petroleum Industry Report 2019-20.Punjab against the share of 3 per cent in the total natural gas production had consumed the major chunk of 52 per cent during 2019-20 against the consumption of 51 per cent during 2018-19.

Read More...

$1bn takes SBP reserves to five-year high

The State Bank of Pakistan (SBP) has received $1 billion against the issuance of Eurobonds which took the foreign exchange reserves of the central bank to a five-year high of $18.2bn.Pakistan issued Eurobonds last week which attracted investors from the international market — reflecting improved confidence in the economy and external account.With the arrival of $1bn, total SBP reserves at $18.2bn are higher than the $18.14bn it held in the financial year 2015-16. The country’s total reserves include holding of scheduled banks. On July 2, the country’s reserves were $24.4bn compared to $23.098bn in FY16.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.