Technical Overview

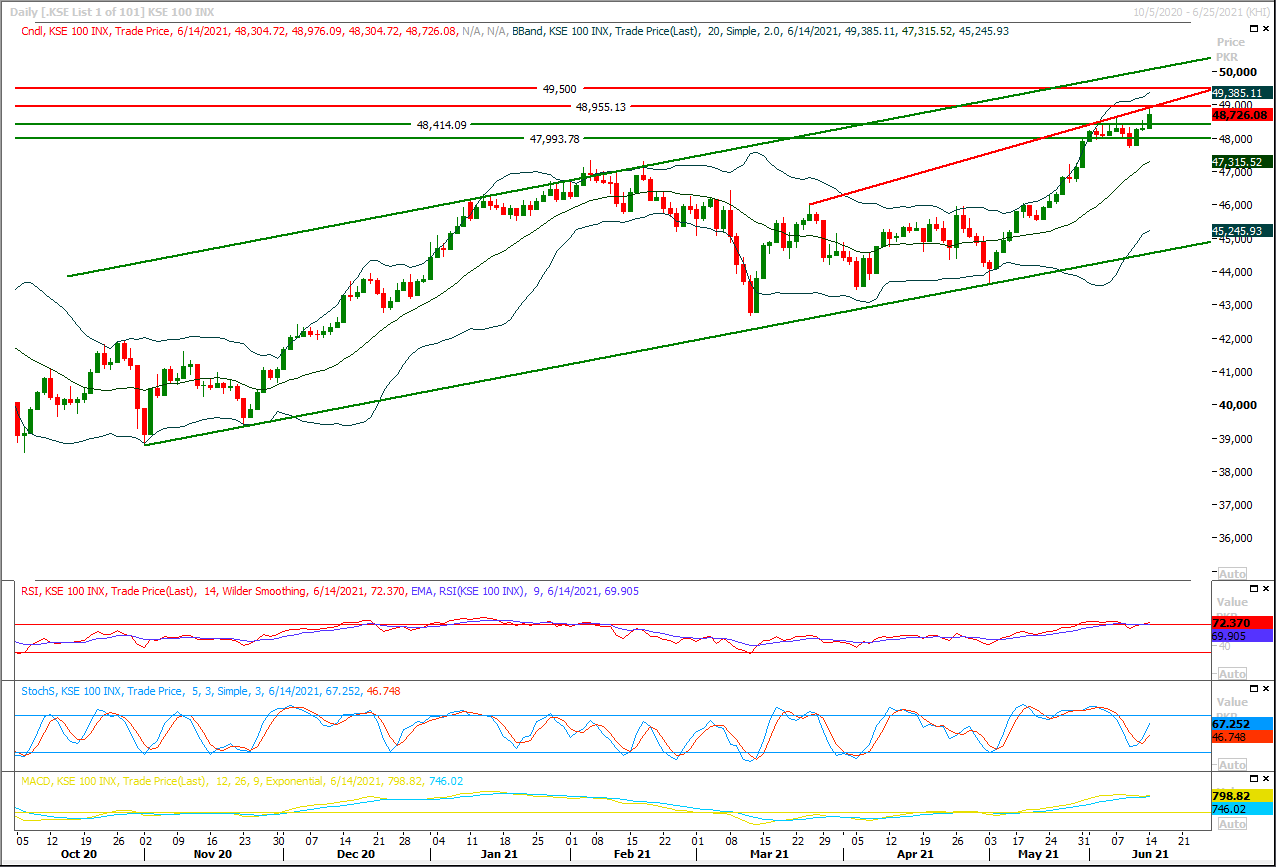

The Benchmark KSE100 index had faced rejection from a resistant trend line during last trading session while it was trying to expand its previous bullish correction on hourly chart, meanwhile a strong resistant trend line is trying to cap current bullish sentiment. As of now it's expected that index would face major resistance at 49,050pts where 61% expansion of its last correction would also complete along an ascending trend line. Meanwhile hourly momentum indicators have generated bearish crossovers which indicates that index may start a correction on intraday basis, therefore it's recommended to stay cautious and post trailing stop loss on existing long positions because if index would succeed in sliding below 48,600pts then selling pressure would start piling up which may push index initially towards 48,450pts and breakout below this region would call for 48,000pts. In case index would gave a daily closing below 48,500pts then current breakout above 48,660pts would be considered as a false penetration and index would move further downward for a deeper correction. While daily closing above 49,050pts would instigate fresh buying volumes and index would start moving towards its next target at 50,300pts.

Regional Markets

Asian shares rise in early trade, investors eye Fed meeting

Asian shares rose early on Tuesday, tracking Wall Street higher, though investors looked to a much-anticipated Federal Reserve policy meeting to see if the central bank would signal any change to the U.S. monetary policy outlook. Japan's Nikkei rose 0.89% in early trading and MSCI's broadest index of Asia-Pacific shares outside Japan was up 0.23%. An early driver was Australian shares, which rose 1.03%, though Chinese blue chips (.CSI300) dropped 0.16% and Hong Kong fell 0.21%. All three resumed trading after being shut on Monday for a public holiday. Overnight the S&P 500 and Nasdaq closed at record highs, helped by tech names, though the Dow Jones Industrial Average fell 0.25%.

Read More...

Business News

BoI launches online platforms to assist investors

style="text-align: justify;">The Board of Investment (BoI) on Monday launched three platforms to provide local and foreign investors ease of online registration for zone enterprises as well as a comprehensive database of existing and potential investors that will promote business activities. The three platforms — Pakistan Regulatory Modernization Initiative Strategy (PRMI), Special Economic Zone Management System (SEZMIS) and Investor Relationship Management System (IRMS) — were launched by World Bank Country Director Najy Benhassine, British High Commissioner to Pakistan Christian Turner and Senior Private Sector Specialist IFC Charles Schneider respectively. Explaining the objectives of the platforms, BoI Secretary Fareena Mazhar said the aim was to go for gradual transition to a paperless environment that will reduce the compliance burden for businesses.Read More...

CCP passes order to end entry barrier for cable internet service provider

The Competition Commission of Pakistan, in one of its orders passed recently emphasized that cable internet and telephony services are an essential facility and the lack of space should not be used as an excuse to give preferential treatment to a specific internet service provider or to discriminate against a certain internet service provider by creating barriers to entry in the market. The order further states that the proprietary rights arising from a utility corridor serving public purposes, whether owned or managed by the municipality or a private entity, are essential public utility corridors. In the order passed recently by the CCP, it directed the management of a housing society based in Islamabad to restore a level playing field by giving ‘Right of Way (ROW)’ to an Islamabad-based Cable Internet and Telephony Services (CIT Services) provider on the same terms and condition as are being offered to other existing operators.

Read More...

Post-facto nod of parliament sought for Rs1.2tr grants

Parliament will be required to give post-facto approval to a record Rs1.248 trillion supplementary grants for expenditure overruns and re-appropriation, budget documents show. When compared to Rs545 billion that had been regularised last year, the documents presented by the Ministry of Finance (MoF) show 130 per cent higher supplementary grants which required parliament’s nod. Subsidies, power sector, water division, defence services, health-related expenditures, civil armed forces and related agencies stand out in exceeding budgetary allocations, according to the ministry documents.

Read More...

Punjab doles out massive uplift funds for PTI legislators

The Usman Buzdar government on Monday rolled out its Rs2,232.7 billion fiscally expansionary, growth budget for the next financial year that doles out massive funds for the Pakistan Tehreek-i-Insaf legislators for execution of development projects in their constituencies under the district development package, proposes launching of a universal health insurance scheme and implementation of infrastructure projects across Punjab. The provincial government has increased the size of its development spending for the next fiscal by more than 66 per cent to Rs560bn from the outgoing year’s Rs337bn to fund the three-year generous Rs360bn district development package that will be spent mostly on the schemes recommended by the PTI legislators to give their voters something to feel good about the economy before the next elections.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.