Technical Overview

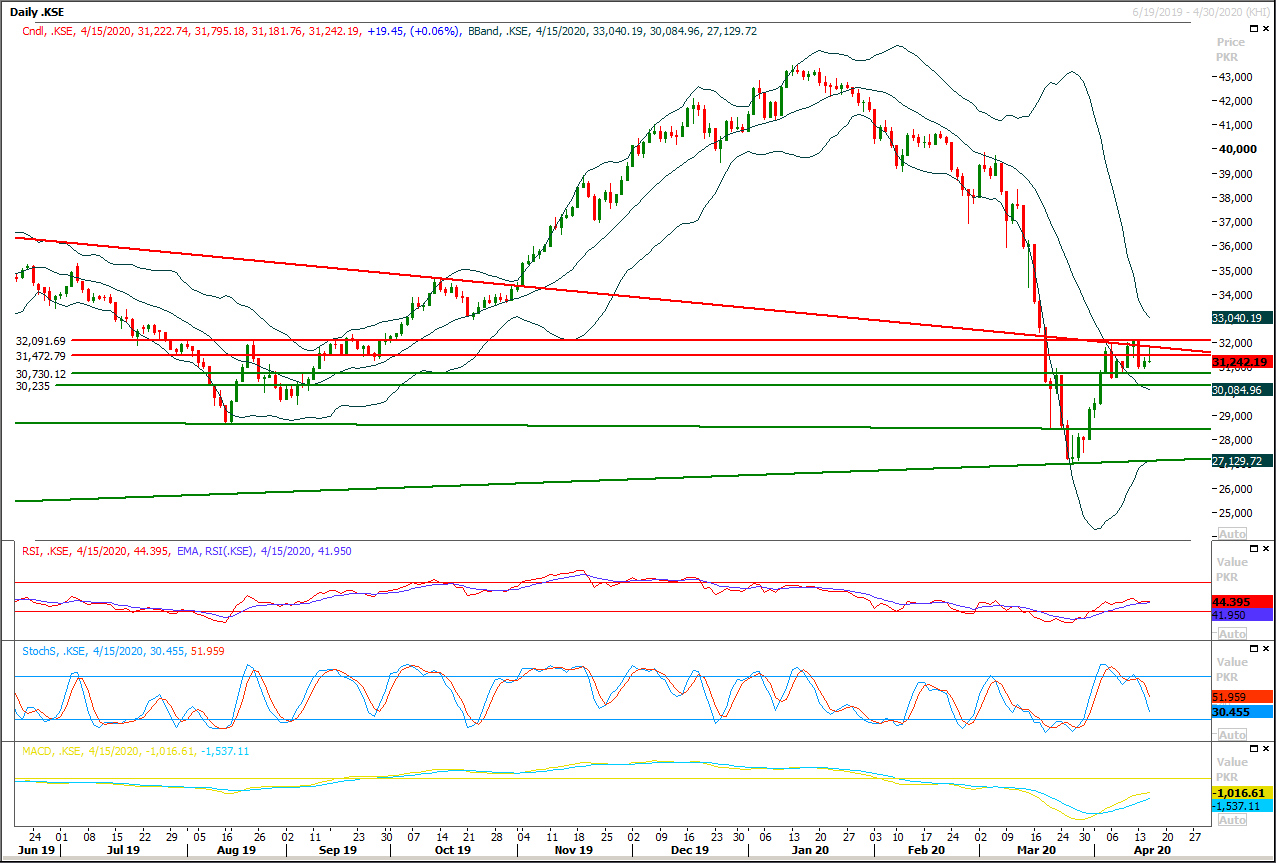

The Benchmark KSE100 index have tried for a format a cheat pattern after daily evening shooting star during last two trading sessions therefore uncertainty among investors could be witnessed during current trading session mean while index would try to amend daily double bottom after facing resistance from a strong horizontal resistant region. For current trading session index seems to be caged between 31,500pts and 30,730pts and breakout of either side would push index for further 500-800pts in respective direction. It's recommended to stay cautious and start selling on strength with strict stop loss until index succeed in closing above 32,500pts on daily closing basis, while breakout above 32,500pts would call for 33,500pts and 34,000pts.

While on flip side if index would follow its bearish trend again then after breakout of 30,730pts index would continue its bearish journey towards 30,200pts while breakout below 30,000pts would push index further downward and index would then try to find some ground at 29,700pts.

Regional Markets

Stocks slide as dire economic outlook weighs

World stock markets fell on Thursday, while bonds and the dollar held on to hefty gains, after a coronavirus-driven plunge in U.S. retail sales and factory production and increasing gloomy economic outlooks for Asia.U.S. retail sales fell the most on record last month, while manufacturing output fell by the most in 74 years, raising fears of a deep recession. In Asia, growth will grind to zero for the first time in 60 years in 2020, the International Monetary Fund said on Thursday, as exporters are pounded by slumping demand and anti-virus measures force consumers to stay home and shops to shut down. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.6%. In Japan, where a Reuters survey showed most firms feel stimulus measures announced so far are insufficient, the Nikkei .N225 fell 1.3%. E-mini futures for the S&P 500 ESc1 were 0.3% lower following a 2.2% drop on Wall Street overnight.

Read More...

Business News

SBP says all targets to be revised downward

The State Bank of Pakistan (SBP) on Tuesday said that the revised GDP growth target of three per cent was unachievable even after ignoring the impact of pandemic on the economy as the agriculture sector and large-scale manufacturing failed to compensate for subdued domestic market activity. The projections are likely to be revised downward further as the optimism from stabilisation is now subject to risks arising from the global and domestic spread of Covid-19, said the central bank in its Second Quarterly Report on the State of Pakistan’s Economy.

Read More...

Global oil production to witness 20 Mln Bpd drop due to OPEC+ deal

OPEC+ oil producers reached a new deal on Sunday, agreeing to reduce oil production by 9.7 million barrels per day for two months, starting in May. The deal resulted in a modest growth of 1-3 percent of oil prices in opening trading on Monday. According to the Azerbaijani Energy Ministry, global oil output will drop by 20 million barrels per day as a result of the OPEC+ agreement and plans of many producers outside the organisation. "The agreement, reached at the 10th meeting of OPEC+ ministers, is historic for oil producers, consumers, and the global economy in general. For the first time ever, a two-year decision with significant production cuts was reached in this format, which met global support. These OPEC+ steps support the energy market in several ways. First of all, all the obstacles to the implementation of the decision on production cuts will be removed on 1 May".

Read More...

Asad Umar defends decision to ease restrictions

Amid prevailing confusion due to political wrangling over the response to Covid-19, Minister for Planning, Development and Special Initiatives Asad Umar said on Wednesday that confusion was created because there were more than one option to deal with the situation. “No one including Prime Minister Imran Khan wanted to take a decision that had health implications, but sometimes difficult decisions are made even on issues related to public health,” the minister told a presser a day after the federal government eased the restrictions despite reservations by Sindh over its fallout on efforts to contain the virus.

Read More...

Stabilisation efforts, regulatory measures yielded notable improvements in first half: SBP

The State Bank of Pakistan (SBP) said Tuesday that the stabilisation efforts and regulatory measures yielded notable improvements during the first half of fiscal year 2020, however noted that the global and domestic spread of COVID-19 has brought an exceptional set of challenges for the country. According to SBP’s second quarterly report on the state of economy, the current account deficit contracted to a six-year low, foreign exchange reserves increased, the primary budget recorded a surplus, and core inflation eased. Importantly, export-based manufacturing showed signs of traction and construction activities picked up, indicating that the economy was on the path of recovery.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.