Technical Overview

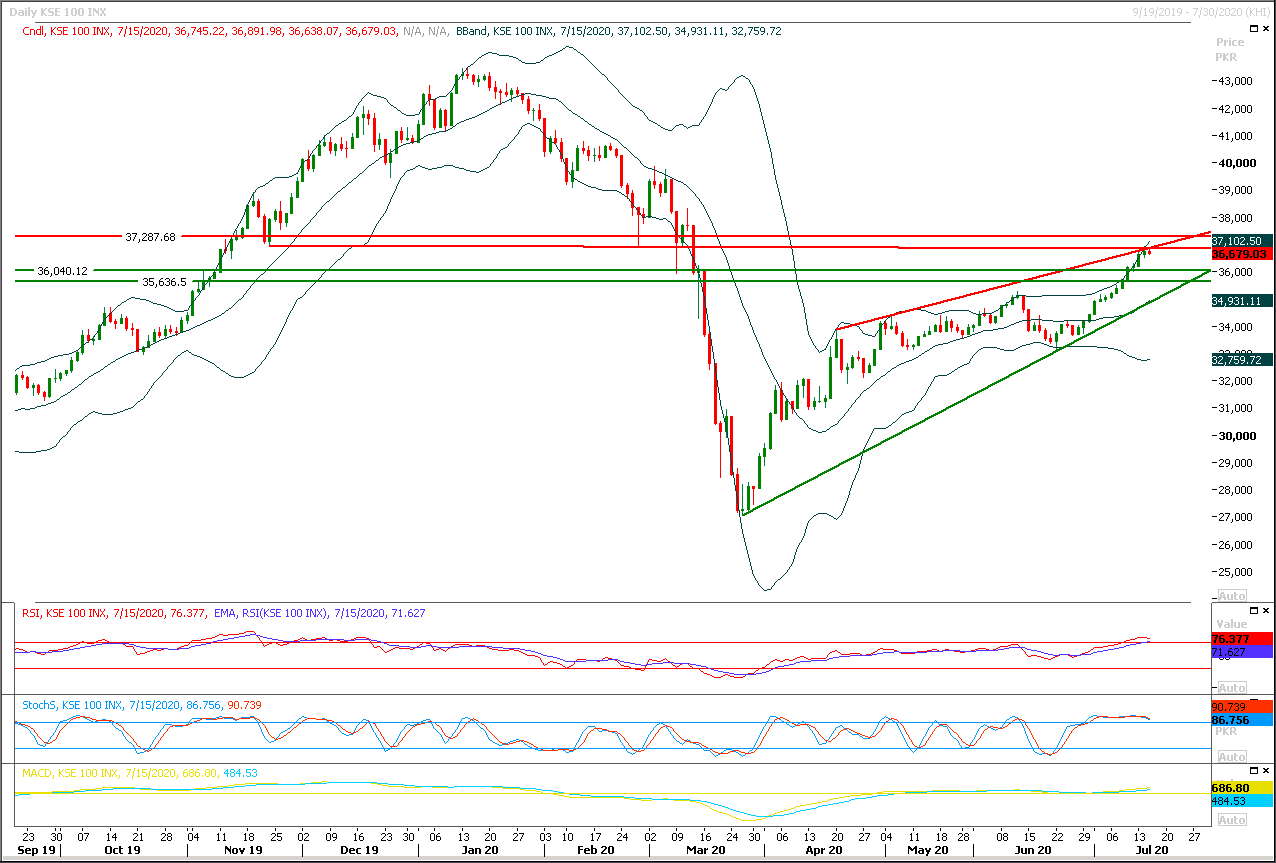

The Benchmark KSE100 index is being capped by two strong resistant trend lines since last three trading session and have face rejection from this region during last trading session. As of now index seems in bearish mode on intraday basis because daily momentum indicators have change their direction, meanwhile index have entered into lower band of its hourly Bollinger band after squeezing it to very narrow range. Index have not succeeded in giving bullish breakout of its daily rising wedge despite of healthy trading volume in last three trading session which is increasing uncertainty among investors. For current trading session index have major resistance at 36,880pts. In case of breakout above 36,880pts index would try to target 37,000pts and 37,200pts. Meanwhile in case of rejection from these regions would push index towards 34,480pts and then 36,000pts. Index would remain bearish until it would not succeed in closing above 37,200pts where its 61.8% correction of last bearish rally is being complete. It needs to be very cautious while trading in coming days because index could try to format a cheat pattern by penetration above this region and then sliding downward later.

Regional Markets

Asian shares fall despite China GDP beat as Sino-U.S. tensions, virus fears weigh

Asian shares and U.S. stock futures fell on Thursday, weighed down by concern about deteriorating U.S.-China relations and the economic cost of a resurgence in coronavirus infections that is prompting some places to reimpose containment measures.MSCI’s broadest index of Asia-Pacific shares outside Japan slid by 0.83%, while Tokyo’s Nikkei fell 0.49%. U.S. S&P 500 e-mini stock futures declined by 0.33%. Shares in China fell 1.06% and Australian stocks shed 0.22% after the country’s jobless rate jumped to the highest since the late 1990s. Shares in Hong Kong, and Seoul also fell. Oil futures fell after OPEC and its allies agreed to scale back output cuts, renewing concerns over excess supply. Risk appetite took a hit due to worries about a wide-ranging dispute between the United States and China over the control of advanced technologies and the protection of civil liberties in Hong Kong.Read More...

Business News

ECC orders ramped-up wheat imports as flour prices continue to spiral

Amid rising flour prices, the Economic Coordination Committee (ECC) on Wednesday expressed concern over failure of the relevant agencies and provinces to meet wheat procurement targets and streamline imports, further aggravating the supply situation and price hike. The rising price of wheat was not on the meeting’s agenda but discussion took place around it nonetheless in light of the Prime Minister’s statement a day earlier calling for a crackdown on wheat hoarding. The ECC meeting, presided over by Finance Adviser Dr Abdul Hafeez Shaikh, was told that the total procurement by the public sector including the provinces was 21 per cent short of about 8.8 million tonnes target whereas the imports were yet to begin. Khyber Pakhtunkhwa had procured about 19,000 tonnes against 100,000 tonnes target and its crop output was also not up to the mark. Shaikh and other members of the meeting showed concern over the situation and wondered why the KP government failed to take things seriously when its crop output was on the lower side and should have proactively moved to ensure maximum procurement and lined up imports.

Read More...

Govt raises Rs249bn, exceeding T-bill auction target

The government on Wednesday raised Rs249 billion in first auction of treasury bills (T-bills) of this fiscal year against the target of Rs100bn. The cut-off yields on all tenors were reduced indicating the possibility of further cut in interest rates in next monetary policy review. The cut-off yield on three-month T-bills was reduced by 29 basis points (bps) to 6.56 per cent, which was the highest cut while the government raised Rs103.1bn against the bids of Rs173.7bn. For six-month papers the yield was reduced by 9bps to 6.57pc picking up Rs62.2bn against the bids of Rs157.3bn.

Read More...

Nepra decides to constitute technical body to improve, finalise IGCEP 2020-47

National Electric Power Regulatory (Nepra) has decided to constitute a technical committee to further improve and finalise the NTDC’s Integrated Generation Capacity Expansion Plan 2047 after serious objections to the plan were raised by the provinces, stakeholders and experts. During the NEPRA public hearing, via video link, on the Integrated Generation Capacity Expansion Plan (IGCEP 2020-2047) here Wednesday, the provinces, Azad Kashmir, key public/private sector stakeholders and experts have raised objection to the proposed plan and termed it unrealistic, overambitious, undermines indigenous energy resources and demanded changes to the plan. Sindh government has alleged NTDC of not taking the province on board while making the policy.

Read More...

Foreign investors contributed Rs1.2tr tax revenue, invested $3b in 2019

The Overseas Investors Chamber of Commerce and Industry (OICCI) has contributed over Rs1.2 trillion in 2019, towards the tax revenue of Pakistan, which is approximately one third of the total tax collection in the country. The OICCI, the chamber of leading 200 foreign investors in Pakistan belonging to 35 countries, has released the consolidated financial contribution of its members for the year 2019 based on feedback from 150 members, 50 being subsidiaries of Fortune 500 companies and 57 listed on the Pakistan Stock Exchange. The foreign investors have contributed significantly towards the GDP of the country and have maintained the OICCI position as the largest chamber of commerce in terms of economic contribution in the country. This comprehensive survey is being conducted annually since 2009.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.