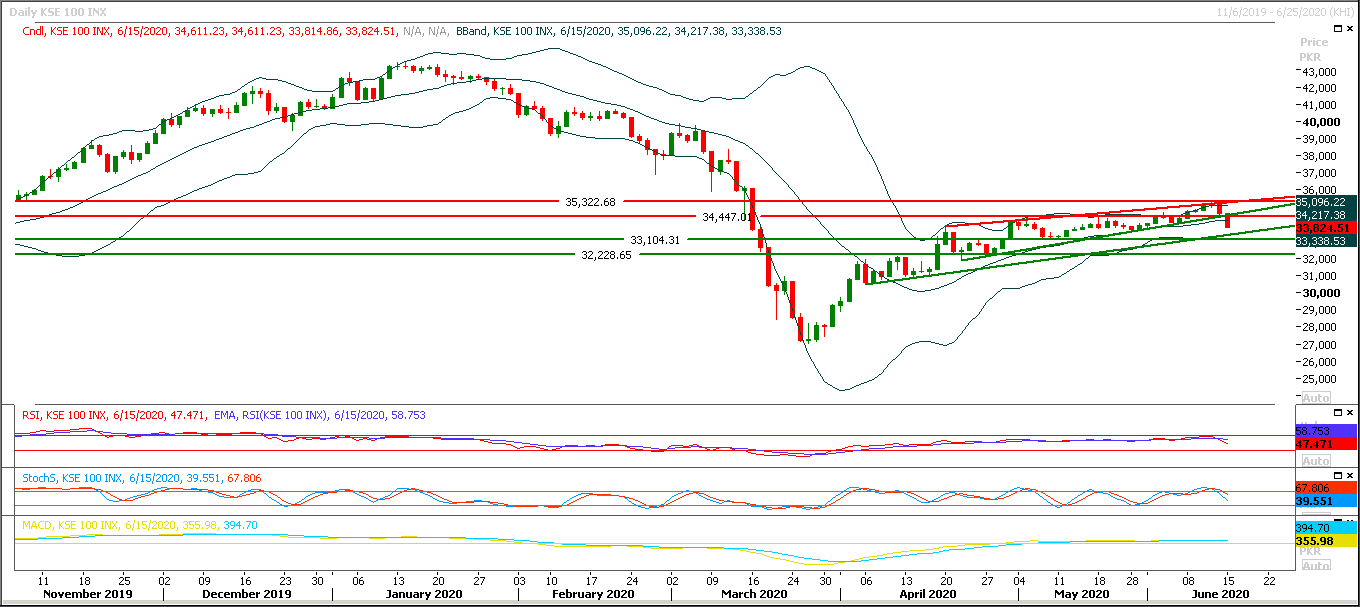

Technical Overview

The Benchmark KSE100 index have continued its bearish journey after giving breakout of its rising wedge in downward direction during last trading session, to continue bearish sentiment daily momentum indicators also have changed their direction downward. As of now index have a strong supportive region ahead at 33,390pts where a rising trend line would try to support index against current bearish pressure mean while this region would be followed by two more supportive regions at 33,100pts and 33,000pts where horizontal supportive regions would try to push index again upward for retesting of supportive trend line of its previous wedge. For day trading long positions above 33,500pts with strict stop loss of 33,100pts could be beneficial, because index would try to take a spike to retest its resistant regions from where new short positions could be initiated. Currently index would remain bearish until it would not succeed in closing above 34,500pts, meanwhile bearish pressure would start piling up if index would slide below 33,00pts. Therefore it's recommended to stay cautious and swing trading could be beneficial with strict stop loss on both sides. Index would face initial resistances at 34,140pts and 34,300pts in case of bullish reversal therefore profit trading from intraday trades would be beneficial around these regions.

Regional Markets

Asian shares jump, yields rise as Fed readies corp bond buying

Asian shares and Wall Street futures rallied on Tuesday as the formal start of the Federal Reserve’s corporate bond buying programme boosted global investor sentiment and calmed earlier worries about a second wave of coronavirus infections. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 2.2%, its biggest one-day gain since June 1. Australian stocks rose 3.0%, while shares in China rose 1.2%. U.S. stock futures, the S&P 500 e-minis, were up 0.98% following a late rally on Wall Street on Monday. Treasury yields rose and the yield curve steepened. The Fed said it will start purchasing corporate bonds on Tuesday in the secondary market, one of several emergency facilities launched in the wake of the coronavirus pandemic.

Read More...

Business News

Budget 2020-21: Rs56bn tax relief for small businesses in Punjab budget

Facing an uncertain income stream amid surging number of Covid-19 infections and deaths across Punjab, the Usman Buzdar government’s Rs2,240.7bn budget for the next financial year announced on Monday proposed to modestly increase development and current spending, including coronavirus-related expenditure of Rs50bn, give significant tax relief of Rs56bn to small businesses affected by the pandemic outbreak, encourage digitisation and documentation of the economy, and, at the same time, produce a cash surplus of Rs125bn to hold down the federal fiscal deficit. Hours before Punjab Finance Minister Makhdum Hashim Jawan Bakht read out his third budget speech, the provincial health authorities announced enforcing lockdown in several areas of Lahore with 300 or more infections each to halt the spread of the disease.

Read More...

Mill owners not selling sugar at Rs70 per kg, IHC told

The federal government on Monday informed the Islamabad High Court (IHC) that sugar mills were not complying with the condition of selling the commodity at Rs70 per kg to non-commercial consumers, hence, proceedings against them as recommended by the inquiry commission could not be stayed. IHC Chief Justice Athar Minallah on June 11 granted stay order against the recommendation of the inquiry commission on sugar scam that urged registration of criminal cases against sugar mill owners on the condition that they would supply the commodity to the common man at the rate of Rs70 per kg till June 25.

Read More...

FBR graft causing Rs1tr loss, minister tells Senate

As the government came under fire in the Senate for presenting what the opposition called an unrealistic budget, a federal minister said that corruption and incompetence of the Federal Board of Revenue (FBR) was causing around Rs1 trillion revenue loss to the exchequer. Minister for Narcotics Control Senator Azam Swati in a tirade against the FBR termed it the most corrupt institution in the country. Mr Swati said he used same words in a recent cabinet meeting. He revealed that the prime minister endorsed his stance and said “yes it is 100 per cent corrupt and said that is why we are going for automation”, alleging that a majority of those in the FBR were extremely corrupt and even an FBR inspector was making big bucks.

Read More...

Rupee losses 61 paisas

The exchange rate of Pakistani rupee lost 61 paisas against US dollar in the interbank on Monday to close at Rs164.85 compared to the last closing of Rs164.24. However, according to Forex Association of Pakistan, the buying and selling rates of Dollar in open market were recorded at Rs 164.5 and Rs 165.25 respectively. The State Bank of Pakistan reported that in interbank, the price of Euro depreciated by 27 paisas to close at Rs 185.55 against the last day’s trading of Rs 185.82. The Japanese yen remained stable at Rs 1.53 whereas a decrease of 27 paisas was witnessed in the exchange rate of British Pound which was traded at Rs 206.72 as compared to its last closing of Rs 206.99. The exchange rates of Saudi Riyal and Arab Emirates Dirham increased by 17 paisas each to close at Rs 43.93 and Rs 44.88 respectively.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.