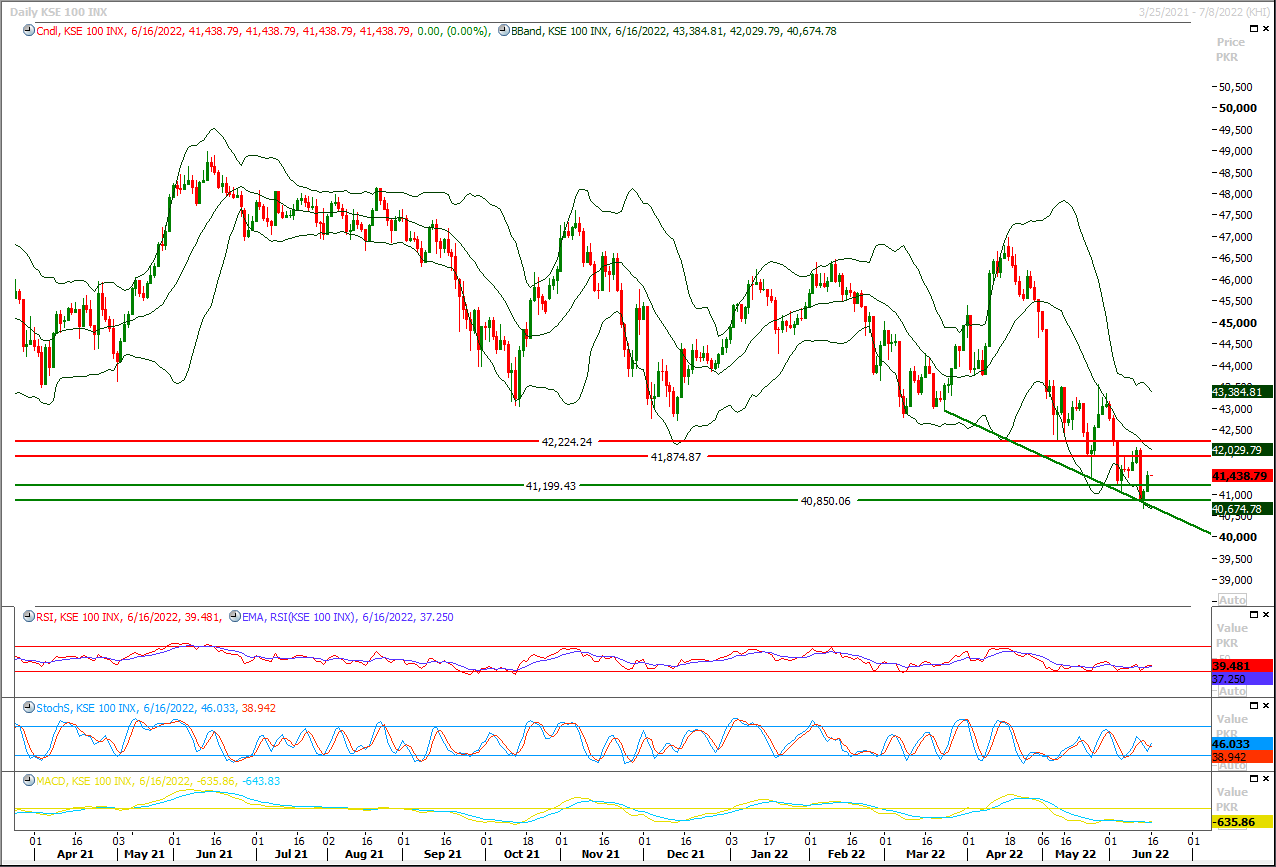

The Benchmark KSE100 index had continued its bullish journey during last trading session and succeeded in penetration above its initial resistant region of 41,300pts. As of now daily momentum indicators have changed their towards bullish side and it's expected that index would start the day with a positive note and it would try to target 41,860pts where it would face initial resistance from a horizontal resistant region, breakout above this region on daily closing basis would open doors for 42,300pts in coming days therefore buying on dip is recommended to day trading or very short term trades. While on flip side in case of bearish pressure index would try to establish ground between 41,200pts-40,960ppts region and breakout below this region would call for 40,760pts. Overall sentiment would remain bullish as long as index is trading above 40,760pts. Today's closing with positive note will strengthen bullish sentiment.

Bearish bets on several Asian currencies hit a record high in the face of rising U.S. interest rates that supported the dollar, while repeated COVID-19 lockdowns threatened to disrupt economic recovery in China, a Reuters poll found on Thursday.Short positions in the South Korean won , the Singapore dollar , the Malaysian ringgit , and the Philippine peso hit their highest on record, according to the fortnightly poll of 10 respondents.The greenback was perched at a two-decade high this week, as red-hot U.S. inflation data increased the likelihood of more aggressive interest rate hikes from the Federal Reserve.On Wednesday, the Fed delivered a widely anticipated 75 basis point (bps) hike that markets deciphered as a proactive move to curb inflationary pressures, helping Asian currencies firm. The poll responses were collated before the Fed's decision.

Read More...The government has decided, in principle, to reverse the drastic tax relief provided to the salaried class in its proposed federal budget for 2022-23, official sources told Dawn.In the recently presented budget, the government had unexpectedly given major relief in terms of tax rates to individuals with higher salaries by reducing the maximum tax rate from 35pc to 32.5pc. The proposed budget also reduced the number of slabs from 12 to seven.According to the official, the revised tax slabs and other proposals have been submitted to the International Monetary Fund (IMF). “Technical level talks will start in the next few days,” the official said, adding that they would “try to protect the salaried class falling in lower slabs”.

Read More...

Punjab’s spending focus remains on social sector

The PML-N-led coalition government in Punjab has decided to continue its political rival PTI’s flagship universal health insurance programme or Insaf Sehat Card by allocating a hefty amount of over Rs127 billion in its first Annual Development Plan worth Rs685bn announced for 2022-23 on Wednesday.Before coming into power on April 16, the PML-N had been critical of the health insurance scheme terming it an attempt to appease the PTI supporters in the private sector healthcare.Overall, the social sector has claimed the lion’s share of 40 per cent in the ADP, which is 22pc more than last year’s Rs560bn. At least 24pc of the ADP has been earmarked for infrastructure development, 6pc for production and 2pc for the Services sector, while 28pc funds have been set aside for other programmes and special initiatives for 2022-23.

Read More...

Rupee Loses Rs1.29

Exchange rate of Pak rupee weakened by Rs 1.29 against the US dollar in the interbank trading on Wednesday and closed at Rs 206.45 against the previous day’s closing of Rs 205.16. The buying and selling rates of dollar in the open market were recorded at Rs 206 and Rs 208 respectively. The price of Euro appreciated by Rs 1.73 and closed at Rs 216.49 against the previous day’s closing of Rs 214.86. Meanwhile, Japanese Yen remained unchanged to close at Rs 1.53, whereas a decrease of 41 paisas was witnessed in the exchange rate of British Pound, which was traded at Rs 249.41 as compared to its last closing of Rs 249.82. The exchange rates of Emirates Dirham and Saudi Riyal increased by 34 paisas to close at Rs 56.20 and Rs 55.02 respectively.

Read More...

Public Debt Projected To Soar By Rs5.632 Trillion To Rs54.109 Trillion In Next Fiscal Year

Pakistan’s public debt is projected to increase by Rs5.632 trillion to Rs54.109 trillion in next fiscal year.The country’s public debt was Rs48.477 trillion during the current fiscal year, which is projected to enhance by Rs5.632 trillion to Rs54.109 trillion in next financial year. The Medium-Term Budget Strategy Paper showed that Pakistan’s external as well as domestic debts would record increase in the upcoming fiscal year. External debt is estimated to increase to Rs20.561 trillion in FY23 from Rs18.085 trillion in FY22. Similarly, the domestic debt is also projected to enhance from Rs30.392 trillion to Rs33.548 trillion in the next year.However, the public debt to GDP (Gross Domestic Product) ration is projected to decline in next fiscal year. The public debt to GDP ration would reduce to 69.1 percent in upcoming financial year from 72.4 percent. “The debt to GDP ratio will increase and reach around 72.4 percent at the end of ongoing fiscal year (FY22) primarily due to higher federal fiscal deficit and depreciation of Pak rupee against US dollar.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.