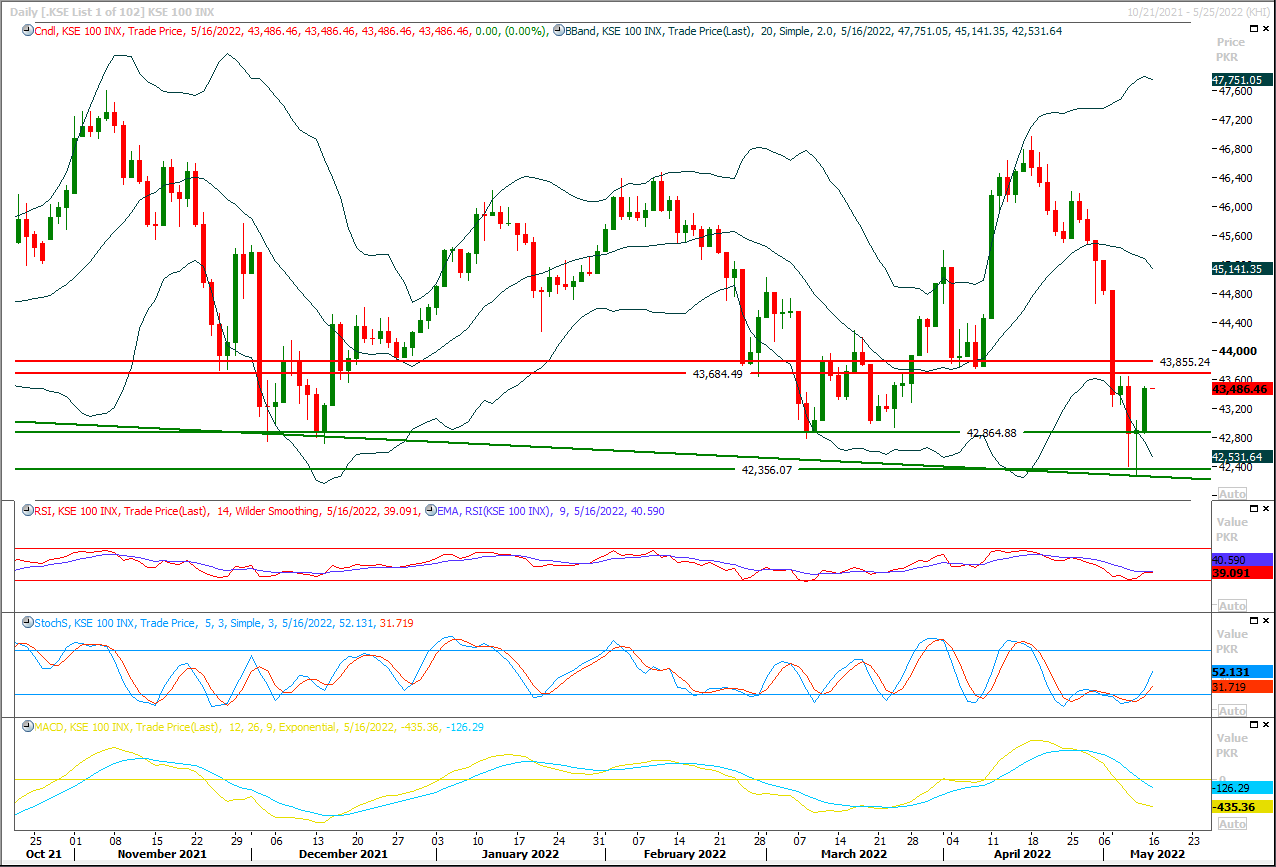

The Benchmark KSE100 index have created a morning shooting star on daily chart during last trading session after establishing ground above supportive trend line of descending wedge during last week. As of now it's expected that index would show some volatility therefore it's recommended to stay cautious until index gave a confirmation of morning star at day end today. Today's closing above 43,850pts would confirm reversal in bullish side but rejection before this region would create a cheat pattern which would be more dangerous in coming days. Currently daily and intraday momentum indicators are in bullish mode and these would try to push index towards 43,680pts initially. On flip side index would find initial support at 42,800pts on a horizontal supportive region while breakout below this region would call for 42,500pts and 42,300pts. To continue in bullish direction index needs to close above 43,860pts.

Asian share markets were struggling to sustain even a minor rally on Monday after shockingly weak data from China underlined the deep damage lockdowns were doing to the world's second-largest economy.China's April retail sales plunged 11.1% on the year, almost twice the drop forecast, while industrial output dropped 2.9% when analysts had looked for a slight increase.The risks had been to the downside given new bank lending in China hit the lowest in nearly four and half years in April.China's central bank also disappointed those hoping for a rate easing, though Beijing on Sunday did allow a further cut in mortgage loan interest rates for some home buyers.

Read More...Indian pop group Bombay Vikings were wrong when they sang “good times are here to stay”. In the tech and venture ecosystem, they are long gone. And for real this time, or so the data seems to suggest.The slowdown in fundraising activity is quite clear: global funding dipped to $45 billion in April, according to Crunchbase. The lowest since February 2021. To be fair, this is no peanuts either but the idea of what’s big has somewhat been distorted over the last couple of years.This slowdown is accompanied by a correction in valuations as people who built their entire companies and portfolios around cash burn have suddenly woken up to the fact that profitability is indeed a desirable thing to chase. Tweets from investors and founders on this virtue have begun already, all preaching the need to be quiet and do the sustainable thing, forgetting how their own FOMO (fear of missing out) led to us here in the first place.

Read More...

State Bank Governor Assumes Charge As ACU Board Chairman

Dr Murtaza Syed, Governor (Acting) State Bank of Pakistan (SBP) assumed the charge of Chairman of the Board of Directors of the Asian Clearing Union (ACU) in the 50th meeting of the ACU Board held in Islamabad on May 13, 2022 in both physical and virtual modes.Established in 1974 with permanent headquarters in Iran, the Asian Clearing Union (ACU) is a payment arrangement system whereby member countries settle payments for intra-regional transactions among their central banks on a net multilateral basis. Currently, the Central Banks of Bangladesh, Bhutan, Iran, India, Maldives, Myanmar, Nepal, Pakistan and Sri Lanka are members of the ACU. The main objectives of the clearing union are to facilitate payments among member countries for eligible transactions, thereby economising on the use of foreign exchange reserves and transfer costs, as well as promoting trade and banking relations among the participating countries.

Read More...

PIAF Wants Exports On Sustainable Growth As Trade Deficit Keeps Widening

The Pakistan Industrial and Traders Associations Front on Sunday called for controlling trade deficit which has widened by almost 65 percent to $39.290 billion in July-April 2021-22, stressing the need for putting the economy on a balanced and sustainable growth trajectory, addressing the underlying structural vulnerabilities.PIAF senior vice chairman Nasir Hameed and vice chairman Javed Siddiqi stressed the need for building on gains on the ease of doing business front, which requires not just the capacity development in key public institutions, but also a continuous dialogue with relevant stakeholders to ensure smooth implementation, he added. Referring to a report, Nasir Hameed said that the country’s imports during July-April (2021-22) totaled $65.537 billion as against $44.731 billion during the corresponding period of last year showing an increase of 46.51 percent. The exports and imports data revealed that the imports in April were $6.679 billion as compared to $6.407 billion in March 2022 showing an increase of 4.25 percent and by 27.41 percent as compared to $5.242 billion in April 2021.

Read More...

Saudi Aramco Says Q1 Profits Jump 82pc As Oil Prices Surge

Energy giant Saudi Aramco posted Sunday an 82 percent jump in first quarter profits, buoyed by the surge in oil prices that has made it the world’s most valuable company.The announcement continued a string of recent positive economic news for Saudi Arabia, where a booming oil sector is fuelling the fastest growth rate in a decade. Aramco’s net income of $39.5 billion was up from $21.7 billion in 2021, “primarily driven by higher crude oil prices and volumes sold, and improved downstream margins,” it said in a press release. The latest financial results were published four days after Aramco dethroned Apple as the world’s most valuable company, with shares worth $2.42 trillion compared to Apple’s $2.37 trillion. In March, Aramco reported a 124 percent net profit surge for 2021.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.