Technical Overview

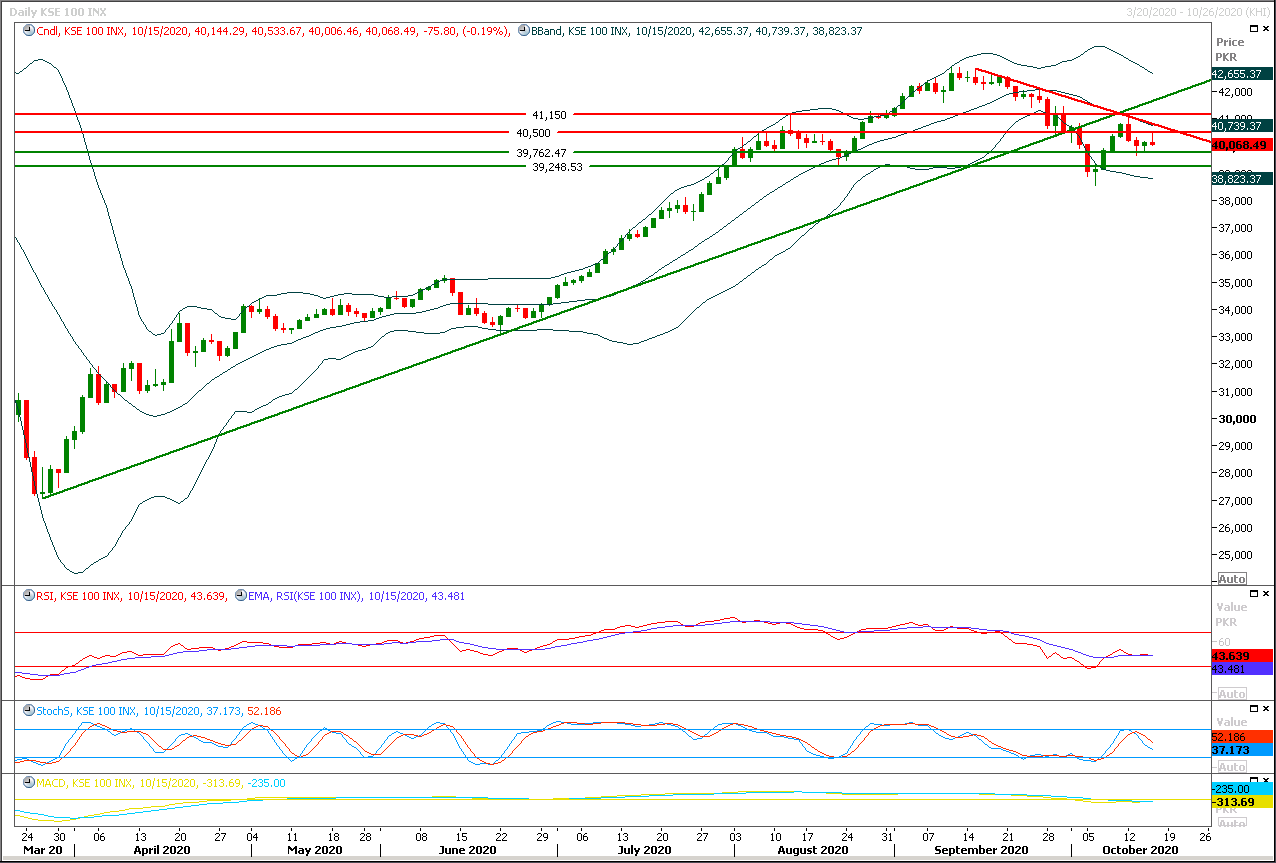

The Benchmark KSE100 index have formatted a hammer on daily chart after facing rejection from strong resistant region of 40,500pts during last trading session, mean while index have started sliding downward after completing its 61.8% correction of last bearish rally on hourly chart which is a continuation sign of bearish sentiment which may lead index towards expansion of that correction towards 39,700pts and breakout below that region would call for 39,500pts and 39,200pts. Daily and intraday momentum indicators are strongly bearish therefore selling on strength could be beneficial with strict stop loss and it seems that index would try to move in a volatile situation today and a sharp recovery could be witnessed before day end therefore swing trading would be beneficial as well in second half of the day. Mean while a weekly bearish engulfing pattern is in making state and if index would succeed in closing below 40,000pts at day end today then index would enter into a bearish zone in coming days which may lead index towards a weekly double bottom at 38,500pts.

Regional Markets

Asian stocks under pressure, dollar in demand amid resurgent virus fears

Asian stocks came under pressure on Friday as investors sought safe havens, such as the U.S. dollar, fearing that a resurgence in coronavirus cases and a lack of additional U.S. fiscal stimulus would hobble the world economy.Safe-haven demand due to signs of a stalling U.S. economy drove the dollar index =USD 0.398% higher after touching a two-week high of 93.91, while the Japanese yen strengthened 0.08% versus the greenback at 105.38 per dollar. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS closed 0.04% lower. The euro EUR= was down 0.01% to $1.1705, while a firmer U.S. dollar dragged on sterling GBP=, which was last trading at $1.2902, down 0.09% on the day. Spot gold XAU= was little changed at $1,908.07 an ounce.

Read More...

Business News

Pakistan will try to sign framework agreement with China next month

Pakistan will try to sign a framework agreement with China on Western Route of CPEC (D.I.Khan Zhob) during the meeting of 10th Joint Cooperation Committee (JCC) of the corridor which is likely to be held next month. All the preparations for the Railways project ML-I have been completed and it will also be finalized during the upcoming JCC which is most likely to be held during third week of November, official source told The Nation here. A consultative meeting to review the preparations for the upcoming 10th Joint Cooperation Committee (JCC) meeting on CPEC was held here under Federal Minister for Planning, Development & Special Initiatives Asad Umar in chair.

Read More...

ECC okays import of 340,000 metric tonnes of wheat

The Economic Coordination Committee (ECC) of the Cabinet on Thursday has granted approval for the import of 340,000 (MT) Metric Tonnes of wheat and decided that the imported quantities would be distributed amongst the three parties i.e Pakistan Agricultural Storage & Services Corporation (PASSCO), Punjab and KP in proportion to what they have ordered/ demanded. Adviser to the Prime Minister on Finance Dr. Abdul Hafeez Shaikh chaired the meeting of the Economic Coordination Committee (ECC) of the Cabinet through video link from Lahore.

Read More...

Govt working to complete privatisation of 4 to 5 PSEs

The government is working to complete the privatization of four to five public sector entities during current fiscal year that might generate more than budgeted Rs100 billion to the national kitty. “The Privatization Commission is likely to complete the transactions of 4 to 5 entities by June 2021 out of 19 transactions,” said an official of the Privatization Commission (PC) while talking to The Nation on Thursday. He further said that government might privatize one or two PSES during current calendar year. According to the PC, there are 19 PSEs on the active list for privatization including Pakistan Steel Mills (PSM) and Pakistan International Airlines owned Roosevelt Hotel, New York.

Read More...

China remains top importer, traded products of over $1884m

China topped the list of countries from where Pakistan imported different products during the first two months of the current fiscal year (2020-21), followed by United Arab Emirates (UAE) and Singapore. The total imports from China during July-August 2020-21 were recorded at $1884.801 million against the $1592.096 million during July-August 2019-21, showing an increase of 18.38 per cent during the period, according to State Bank of Pakistan (SBP). This was followed by UAE, where from Pakistan imported goods worth $1089.203 million against the imports of $1268.907 million last year, showing negative growth of 14.16 per cent.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.