Technical Overview

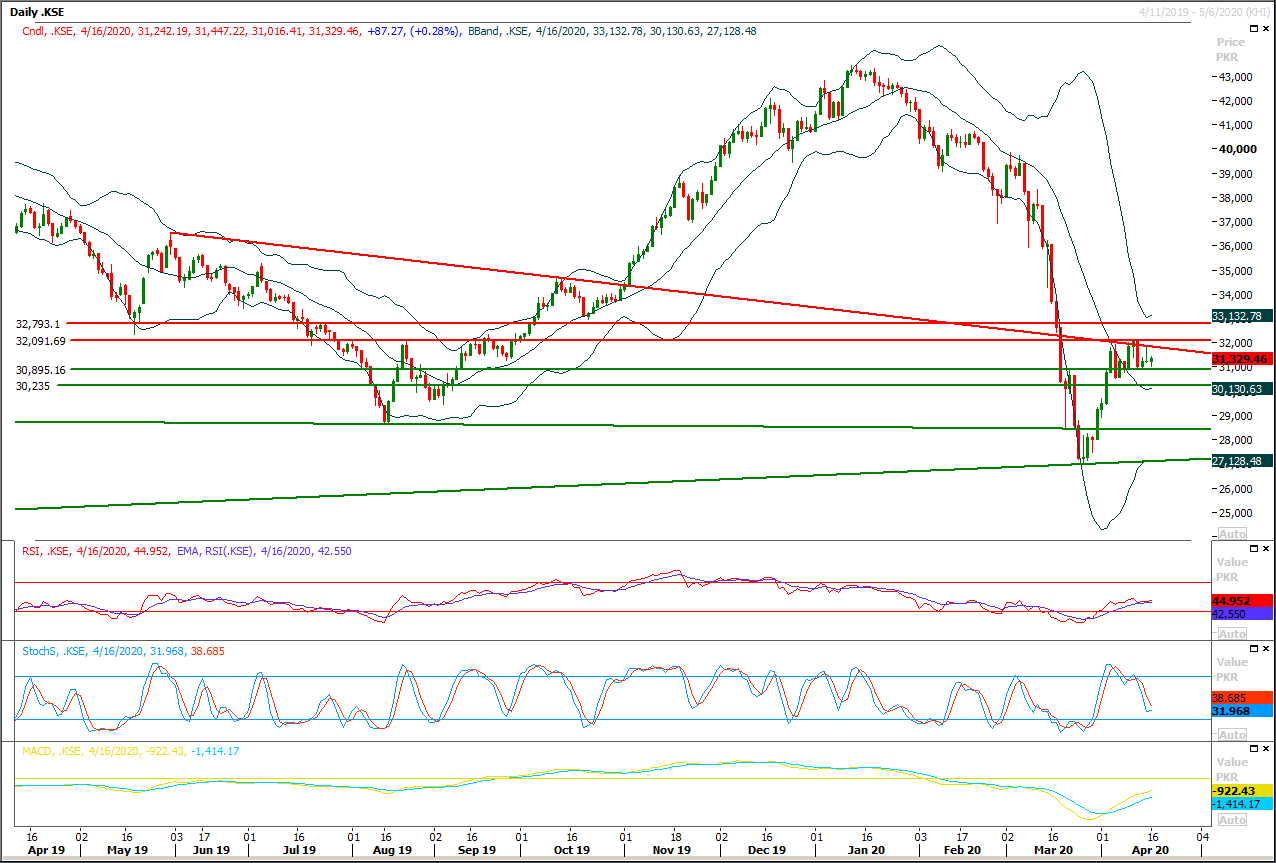

The Benchmark KSE100 index have formatted a triple bottom on a strong horizontal supportive region since start of this week and this region have converted into a strong accumulation region. Mean while index have maintained inside upper band of its daily Bollinger Band which indicates that bullish momentum would try to continue in coming days, on same time daily Bollinger Band have become flat and a burst out on either side could be witnessed and hopes for a bullish side breakout are stronger because daily momentum indicators are in bullish mode. It's expected that index would try to open with a positive gap and its initial target would be 31,800pts and hourly closing above this region would call for further advance sentiment towards 32,100pts. While index would face intraday resistance between 32,300pts to 32,500pts and if it would succeed in closing above this region on daily chart then next target would be 33,500pts and 35,000pts for correction of its last bearish rally.

While on flip side index would find strong round above 30,900pts and this region would resist against any unexpected bearish pressure. It's recommended to stay on long side and cut and reverse short positions in mainstream scripts.

Regional Markets

Asian stocks set to rise as markets brace for China GDP data

Asian stocks look set to bounce on Friday to recover towards a one-month high as investors, following Wall Street’s lead overnight, sought silver linings in a run of data that showed the world is in its worst recession in decades. Any gains, however, may be capped in early trade as investors stay on the sidelines before a spate of Chinese data, due Friday, that will likely show the world’s No. 2 economy shrinking for the first time on record between January and March. A Reuters poll showed China’s economy is forecast to have shrunk 6.5% in the first quarter from a year ago. E-Mini futures for the S&P 500 index ESc1 rose right from the closing bell and jumped 3.5% to a five-week high, while the Nikkei futures NKc1 pointed to gains of 545 points.

Read More...

Business News

SBP slashes policy rate by 200 bps to 9pc in third such move in a month

The State Bank of Pakistan in an emergency meeting of the monetary policy committee (MPC) on Thursday slashed the country's policy rate by 200 points to nine per cent, the third time the central bank has reduced the interest rate in less than a month. The decision was taken "in light of the reduction in growth and inflation" projections released by the International Monetary Fund (IMF) earlier this week, said a statement released by the SBP. The statement added the committee "remains ready to take whatever further actions become necessary in response to the evolving economic impact of the coronavirus."

Read More...

Textile exports decline by 0.54pc in 8 months: SBP

The exports of textile and its articles from the country dipped by 0.54 percent during the first eight months of current financial year 2019-20 as compared to the corresponding month of last year. Pakistan exported textile and its articles worth $9150.859 million during July-February (2019-2020) against the exports of $9200.576 million during July-February (2018-2019), showing negative growth of 0.54 percent, according to the data issued by the State Bank of Pakistan. The commodities that contributed in growth were man-made filaments, export of which grew from $19.069 million last year to $36.526 million during the period under review, showing growth of 91.54 percent.The exports of articles of apparel and clothing accessories (knitted or crocheted) grew by 1.63 percent from $2025.018 million to $2058.204 million while the exports of articles of apparel or clothing accessories (not knitted or crocheted) also increased by 9.92 percent from $1643.131 million to $1806.223 million. During the period under review, the export of man-made staple fiber increased by 3.36 percent from $200.286 million to $207.026 million whereas the export of other special woven fabrics, tufted textile fabrics, lace increased by 27.89 percent from $20.512 million to $26.234 million, the data revealed.

Read More...

Forex reserves up by $252m

The foreign exchange reserves held by State Bank of Pakistan (SBP) increased by $252 million during the week ending on April 10 to $10.974 billion. According to figures issued by the SBP on Thursday, the forex reserves inched up due to official inflows. During the corresponding period, the net foreign reserves held by commercial banks were $6.321 billion and the total reserves held by the country were recorded at $17.295 billion.

Read More...

LCCI seeks consultation on draft of ordinance regarding hoarding

The Lahore Chamber of Commerce & Industry (LCCI) has urged the government to take stakeholders on board before implementation of ordinance regarding hoarding. In a statement issued here on Thursday, LCCI President Irfan Iqbal Sheikh said that draft of the proposed ordinance should be shared with LCCI, Federation of Pakistan Chambers of Commerce & Industry and other Chambers for consultation and necessary rectification. He said that being the premier business body of the country, LCCI has always taken a strict stance against the hoarding practices as that result in unnecessary shortages, especially of essential commodities and sudden price hikes. LCCI has welcomed government’s decision of introducing an ordinance against illegal profiteering and hoarding. He said, “However, we are of the view that measures must be taken to ensure that this ordinance is not misused by the concerned authorities”, adding that sugar, flour, salt, pulses industries would have to maintain stocks at factories, and wholesale godowns for smooth business operation and supply chain.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.