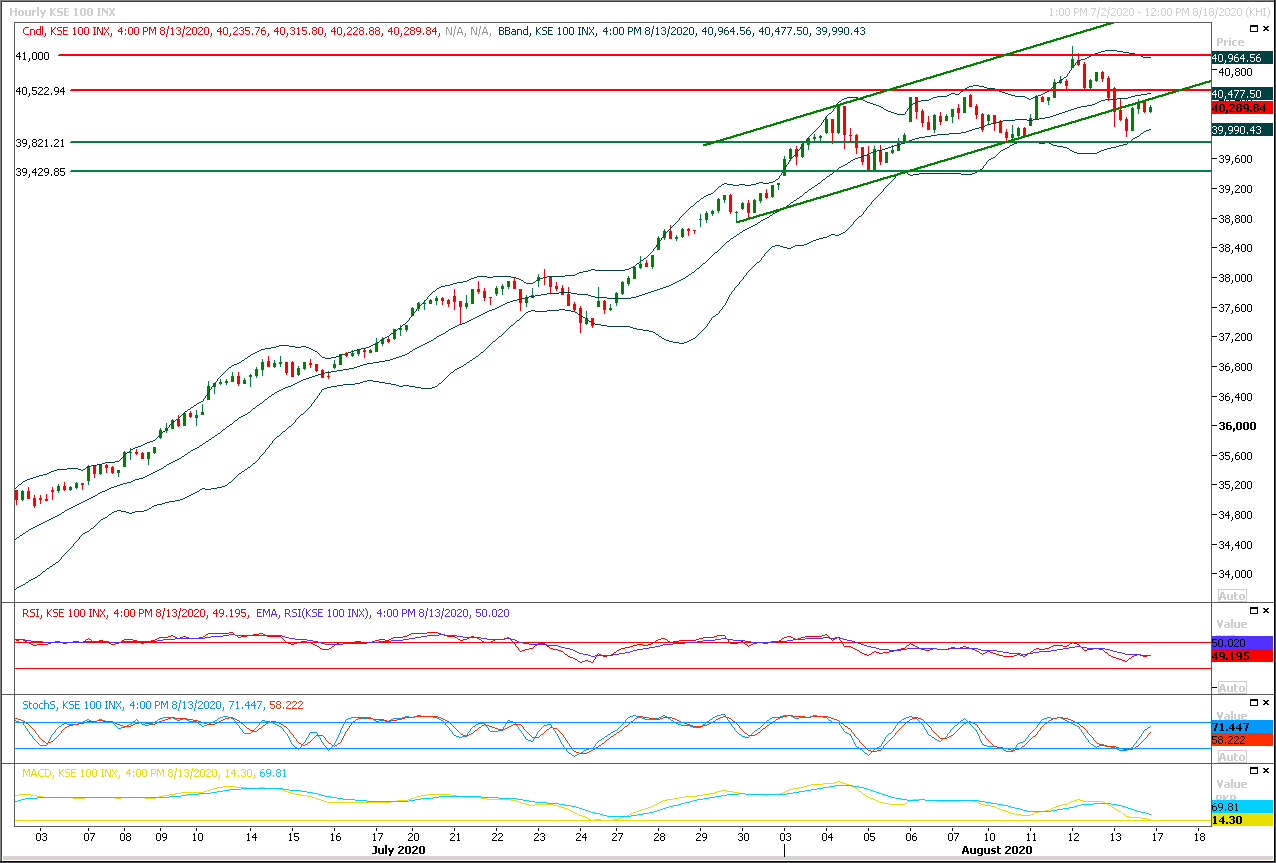

Technical Overview

The Benchmark KSE100 index have retested supportive trend line of its previous bullish trend channel and have faced rejection initially from that line but as of now it's expected that index would try to take a spike today again and would try to retest its major resistant region of 40,500pts, in case of breakout above that region index enter into bullish zone again but if it would not succeed in penetration above this region then some kind of serious pressure would be witnessed which would try to push index towards 39,820pts where it would try to find some ground from a strong horizontal supportive region. Intraday momentum indicators are in mixed mode but most importantly hourly MACD is entering negative zone and if index would not succeed in closing above 40,500pts then pressure would start piling up. It's recommended to adopt swing trading with strict stop loss on both sides until index succeeds in giving a breakout on either side. In case of bullish breakout above 40,500pts index would try to target 41,000pts and 41,200pts.

Regional Markets

Asia shares move ahead led by China gains

Asian shares firmed toward recent peaks on Monday as Chinese markets swung higher, while investors waited to see if the recent sell-off in longer-dated U.S. Treasuries would extend and maybe take some pressure off the beleaguered dollar. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS gained 0.5% to 565.74, moving nearer to the January top of 574.52. Chinese blue chips .CSI300 led the way with gains of 2.0%, with the country's central bank providing more medium term loans to the financial system. Japan's Nikkei .N225 dipped 0.6% after touching a six-month peak on Friday, as the country suffered its biggest economic contraction on record in the second quarter. E-Mini futures for the S&P 500 ESc1 firmed 0.39% to be just below the record close of 3,386.15. [.N]

Read More...

Business News

Govt starts real-time monitoring of oil, gas production

Amid calls from the provinces for transparency, the federal government has started real-time monitoring of oil and gas exploration and production (E&P) through a dashboard application provided by a US-based vendor firm. The petroleum division of the ministry of energy said on Sunday it had introduced ‘an advanced and innovative dashboard application for effective management and monitoring of E&P information for the first time in the country with collaboration of LMKR’- a petroleum technology company. It said the Exploration Management System (EMS) was a Windows-based, multi-user GIS database application which would enable the Directorate of Petroleum Concession (DGPC) to access real-time E&P data information.

Read More...

Taming inflation is difficult

Rising prices of wheat flour and sugar continue to make headlines. Hoarding and short supplies of sugar and hoarding and smuggling of wheat and wheat flour are often blamed for making these most essential food items dearer by the day. According to the Pakistan Bureau of Statistics (PBS), national average prices of wheat flour and sugar have shot up 18.6 per cent and 23.5pc, respectively, on a year-on-year basis. PBS statistics show that the price of plain bread also went up by 18.5pc and that of a one-kilogram pouch of vegetable ghee by 19.8pc over the same period. Eggs and fresh loose milk have become 35pc 8.5pc costlier, respectively. The list of essential food items registering price hikes in a year goes on and on.

Read More...

Indicators show gradual recovery of corona-hit economy

Despite enormous challenges at external as well as internal fronts due to outbreak of coronavirus and subsequent lockdown, the country’s economic indicators show that coronavirus-hit economy was not only recovering now but was also showing steady growth and gaining stability as suggested by the data of first month of the current fiscal year (July 2020). Likewise, the global entities, monitoring the performance of different economic sectors across the world, have also started recognizing the growth of Pakistan economy as is indicated by reports and rating indices they published. During the month of July 2020, Pakistan’s exports registered an increase of 6.04 per cent, from $1.886 billion last year to $2 billion, whereas imports declined from $3.713 billion to $3.640 billion, showing fall of 1.97 per cent. Based on the figures, the trade deficit witnessed a reduction of 10.24 per cent during July.

Read More...

Regional exports dip 24pc in FY20

Pakistan’s exports to regional countries dipped by 24 per cent year-on-year during 2019-20 mainly due to lockdown imposed in March to curtail the spread of coronavirus. Exports to the region — Afghanistan, China, Bangladesh, Sri Lanka, India, Iran, Nepal, Bhutan, and the Maldives — fell to $3.738 billion in FY20, from $4.658bn the previous year, according to the latest data compiled by the State Bank of Pakistan. The trade deficit with the region declined during the year under review as imports from these countries also dipped.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.