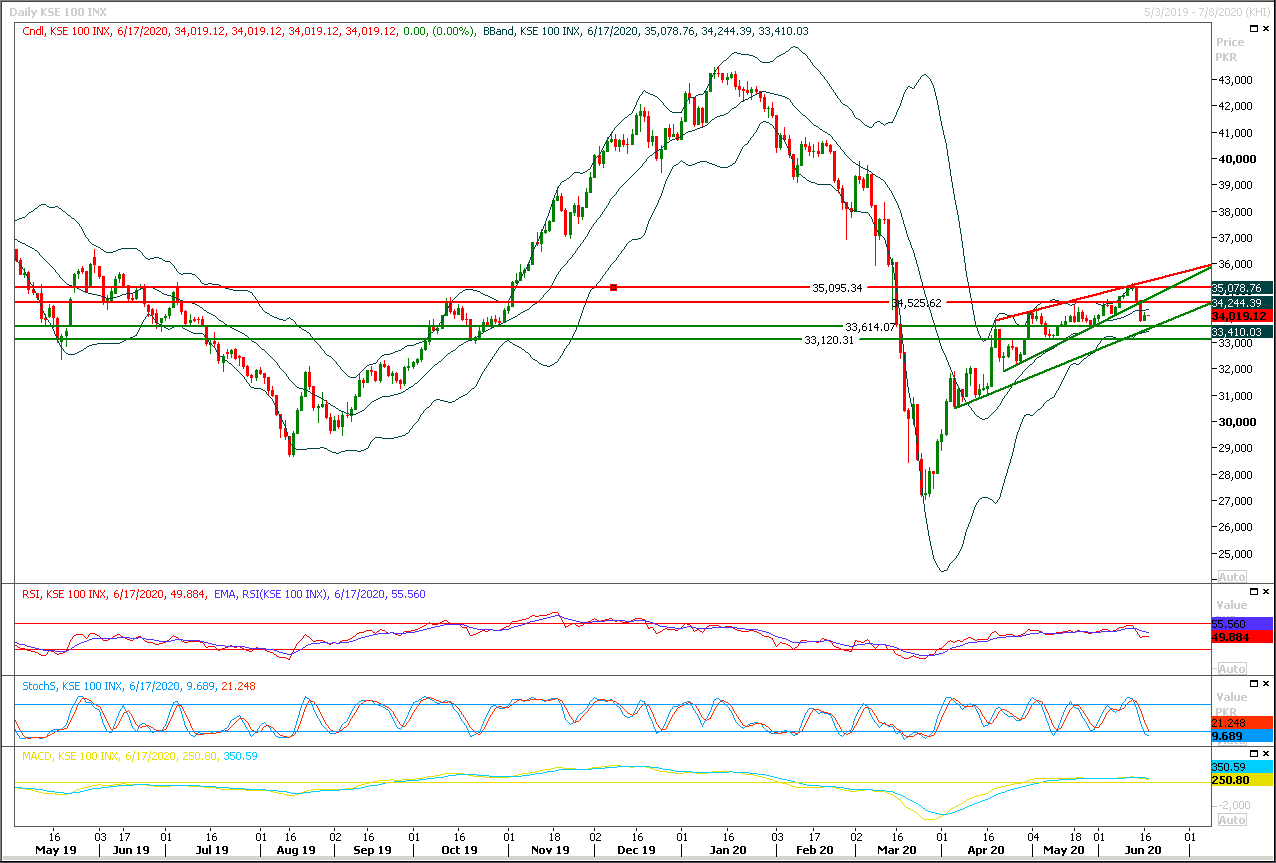

Technical Overview

The Benchmark KSE100 index have continued its bearish journey after giving breakout of its rising wedge in downward direction during last trading session, to continue bearish sentiment daily momentum indicators also have changed their direction downward. As of now index have a strong supportive region ahead at 33,390pts where a rising trend line would try to support index against current bearish pressure mean while this region would be followed by two more supportive regions at 33,100pts and 33,000pts where horizontal supportive regions would try to push index again upward for retesting of supportive trend line of its previous wedge. For day trading long positions above 33,500pts with strict stop loss of 33,100pts could be beneficial, because index would try to take a spike to retest its resistant regions from where new short positions could be initiated. Currently index would remain bearish until it would not succeed in closing above 34,500pts, meanwhile bearish pressure would start piling up if index would slide below 33,00pts. Therefore it's recommended to stay cautious and swing trading could be beneficial with strict stop loss on both sides. Index would face initial resistances at 34,140pts and 34,300pts in case of bullish reversal therefore profit trading from intraday trades would be beneficial around these regions.

Regional Markets

Asia stocks given pause by virus surge, geopolitics

Asian share markets took a breather on Wednesday as a resurgence of coronavirus cases challenged market confidence in a rapid economic recovery, even as the rebound in U.S. retail sales in May broke all records. MSCI’s broadest index of Asia-Pacific shares outside Japan went flat, having climbed 2.8% the previous day, with most markets across the region little changed. E-Mini futures for the S&P 500 dipped 0.2% and EUROSTOXX 50 futures eased 0.1%. That followed a robust session on Wall Street overnight. The Dow ended Tuesday up 2.04%, while the S&P 500 gained 1.90% and the Nasdaq 1.75%. Hopes for recovery had been bolstered by data showing U.S. retail sales jumped by a record 17.7% in May, recovering more than half the losses of the previous two months, though industrial output still lagged.

Read More...

Business News

Senators inquire into customised benefits for two companies in Finance Bill

A Senate panel on Tuesday opposed certain tax benefits by name to two companies operating in Gwadar through the Finance Bill 2020-21, with some members calling the move “vulgar”, “ridiculous” and “shocking”. “Who are the people behind these companies?” they repeatedly asked. “How can a company’s name be included in the law?” The Senate Standing Committee on Finance & Revenue led by Senator Farooq Hamid Naek also set the principle under Article 73 of the Constitution that it would not approve any clause to be included in the Finance Bill if it did not pertain to imposition, abolition, remission, alteration of regulation of any tax.

Read More...

Oil imports dip 74pc to three-month low

Pakistan’s oil imports plunged 73.55 per cent year-on-year to $326.75 million in May, hitting the lowest level since March when government-imposed lockdown to curtail the rising coronavirus cases in the country. Between July-May FY20, total oil imports fell 25.33pc to $9.807 billion during 11MFY20, from $13.135bn in the same period last year. The oil imports are on a downward trajectory since March, when they fell by over 32pc owing to a steep reduction in domestic demand as a result of lockdown across the country. April saw a further decrease of 55pc, the Pakistan Bureau of Statistics reported on Tuesday.

Read More...

Textile exports tumble 36.5pc in May

Pakistan’s textile and clothing exports tumbled for the third consecutive month in May falling 36.5 per cent year-on-year to $751.128 million compared to $1.185 billion in the corresponding month of last year, data released by the Pakistan Bureau of Statistics (PBS) showed on Tuesday. Compared to 64.5pc decline in April, when textile and clothing exports fell to $403.834m year-on-year—the lowest level in almost 17 years, month-on-month proceeds in May fared better owing to a recovery in international orders. The easing of lockdown in the North American and European countries—top export destinations for Pakistani textile goods will help revive the sinking exports. The Covid-19 has collapsed the demand for country’s exports during the last four months.

Read More...

Plastic imports decrease 11.64pc

The imports of plastic materials into the country witnessed decreased of 11.64 per cent during the first ten months of financial year (2019-20) as compared to the corresponding period of last year. Pakistan imported plastic worth $1635.650 million during July-April (2019-20) compared to the imports of $1851.180 million during July- April (2018-19), showing negative growth of 11.64 per cent, according to the Pakistan Bureau of Statistics (PBS). In terms of quantity, the imports of plastic witnessed an increase of 2.62 per cent as the country imported 1,318,942 metric ton of plastic during the period under review compared to the imports of 1,285,229 metric ton during last fiscal year. Meanwhile, on year-on-year basis, the plastic imports into the country during April 2020 dipped by 34.89 per cent when compared to the imports of the same month of the last year.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.