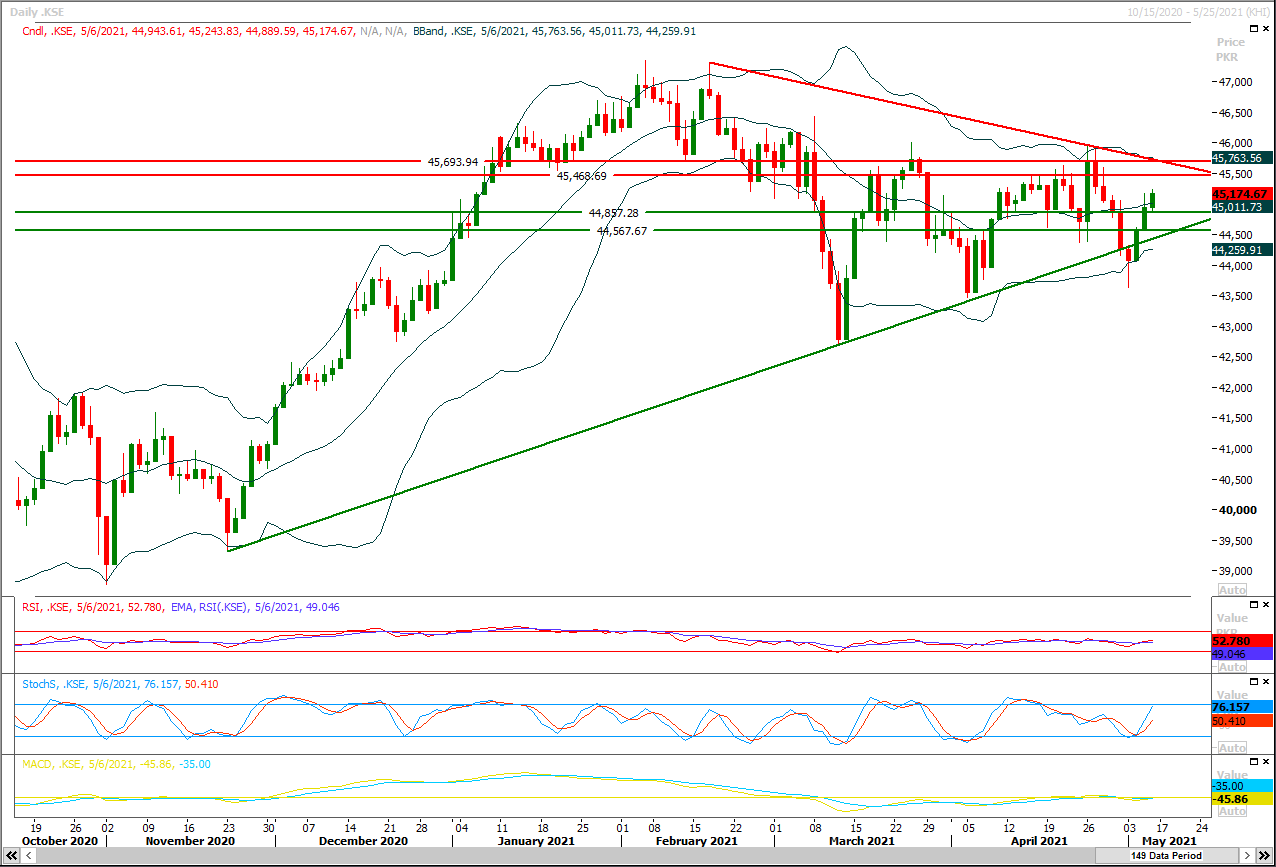

Technical Overview

The Benchmark KSE100 index had continued its bullish journey during last trading session and succeeded in closing above its initial resistant region of 45,000pts but it's still being capped by two more at 45,200pts and 45,500pts. For current trading session it's expected that index would try to target 45,500pts where its being capped by a strong resistant region and if it would succeed in giving a breakout above this region then next target would be 45,860pts and 46,000pts in coming days. While rejection from its resistant regions would push index towards 44,860pts initially and breakout below this region would call for 44,500pts. It's recommended to stay cautious and post trailing stop loss on existing long positions as if index would not succeed in breakout above 45,200pts or 45,500pts then it would face some serious pressure. Intraday and daily momentum indicators are in bullish mode therefore it's recommended to avoid short selling as breakout above 45,500pts would push index further upward. Overall index would remain caged in a tight range until it would not succeed in closing above 46,200pts.

Regional Markets

Asia shares cautious ahead of China data test

Asia shares cautious ahead of China data testAsian shares edged cautiously higher on Monday catching the tailwind from a bounce on Wall Street and ahead of what are expected to be upbeat readings on the Chinese economy, though any disappointment could quickly chill the mood. Industrial output and retail sales are forecast to show hefty annual gains given activity in April last year was badly marred by pandemic lockdowns. Exports remain strong as the developed world reopens, while stimulus at home should support retail spending. MSCI's broadest index of Asia-Pacific shares outside Japan firmed 0.2%, nudging further away from a four-month trough hit last week. Japan's Nikkei gained 0.4%, having also touched its lowest since early January last week. S&P 500 futures and Nasdaq futures were both flat, following Friday's rally. The U.S. data calendar is light this week, putting the focus on minutes of the Federal Reserve's last policy meeting for any clue when officials there might start to talk about tapering.

Read More...

Business News

Pak economy holds potential for faster growth despite challenges: Experts

Pakistan economy is on solid growth path and has potential to grow at much higher rate in next five years despite a challenging environment across the globe, Khaleej Times reported while quoting experts. Top government officials, analysts and corporate leaders repose trust in growing economy and said higher GDP growth in 5-6 per cent per annum was going to be a ‘new normal’ in next five years amid considering strong economic indicators of the country, it said. “Yes, we have a potential to grow at much higher rate in coming years. The State Bank of Pakistan projects three per cent GDP growth in financial year 2020-21 and four per cent in 2021-22,” Dr Reza Baqir, Governor, State Bank of Pakistan (SBP), told the paper during an event in Dubai last week. The paper quoted newly-appointed Finance Minister, Shaukat Fayyaz Ahmed Tarin having said that Pakistan would go for an ambitious six per cent economic growth target in the next two years as the International Monetary Fund (IMF) shows its willingness to renegotiate tough conditions for a $6 billion loan in the wake of rising Covid-19 cases.

Read More...

Nine out of 22 energy projects completed under CPEC

The China Pakistan Economic Corridor (CPEC) is gaining momentum with every passing day of Pak-China relationship, because of which the project would continue with more strength in days ahead. With the smooth sailing of CPEC project, Pakistan is foreseeing massive economic activity during days ahead. An appreciable outcome of a novel Belt and Road Initiative (BRI) of the Chinese government, Pakistan becomes the key player in the regional economic activity. Commenting with respect to the 70th celebrations of Pakistan-China diplomatic relations, an official in CPEC Authority requesting not to be named, exclusively told APP that the mega project would further strengthen the bilateral relations with China. Their strategic relationship, which was being strengthened with every passing day, was of great importance both on regional as well as international fronts, the official said. This project would not only earn billions of dollars revenue through trade but also generate thousands of jobs for the local people besides infrastructure development, power generation and projects in transportation, railways, agriculture, science and technology and tourism sectors.

Read More...

Govt, KE to sign agreement for supply of 2,050MW to Karachi

While de-linking the past payables and receivables worth hundreds of billions of rupees, the government and the K-Electric have agreed to sign a new power purchase agreement (PPA) for supply of a total of 2,050MW to Karachi — instead of historic 650MW — under which the government would make timely payment of tariff subsidies and the KE would clear its power bills through standby letters of credit (SBLC). In doing so, the government has made a commitment to also sign a separate agreement for payment of market-based mark-up on delayed subsidy payments by the ministry of finance. The KE would provide SBLCs backed by an escrow account to ensure that the Central Power Purchase Agency (CPPA) gets automatic payments for the monthly bills on account of power supply to the KE. The old payables and receivables would be settled through arbitration.

Read More...

Exports to China rose by 31pc, says Dawood

Adviser to Prime Minister on Commerce and Investment Abdul Razak Dawood has said that Pakistan’s exports to China have increased by 31 per cent over the past nine months. In a series of tweets on Sunday, Mr Dawood shared details of the achievement. “The Second Phase of Pakistan-China FTA (FTA-II) became operational on 1st January 2020. MOC is glad to share that during Jul-Apr 2021 our exports to China have increased by 31% to USD 1.951 Billion from USD 1.491 Billion in corresponding period last year.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.