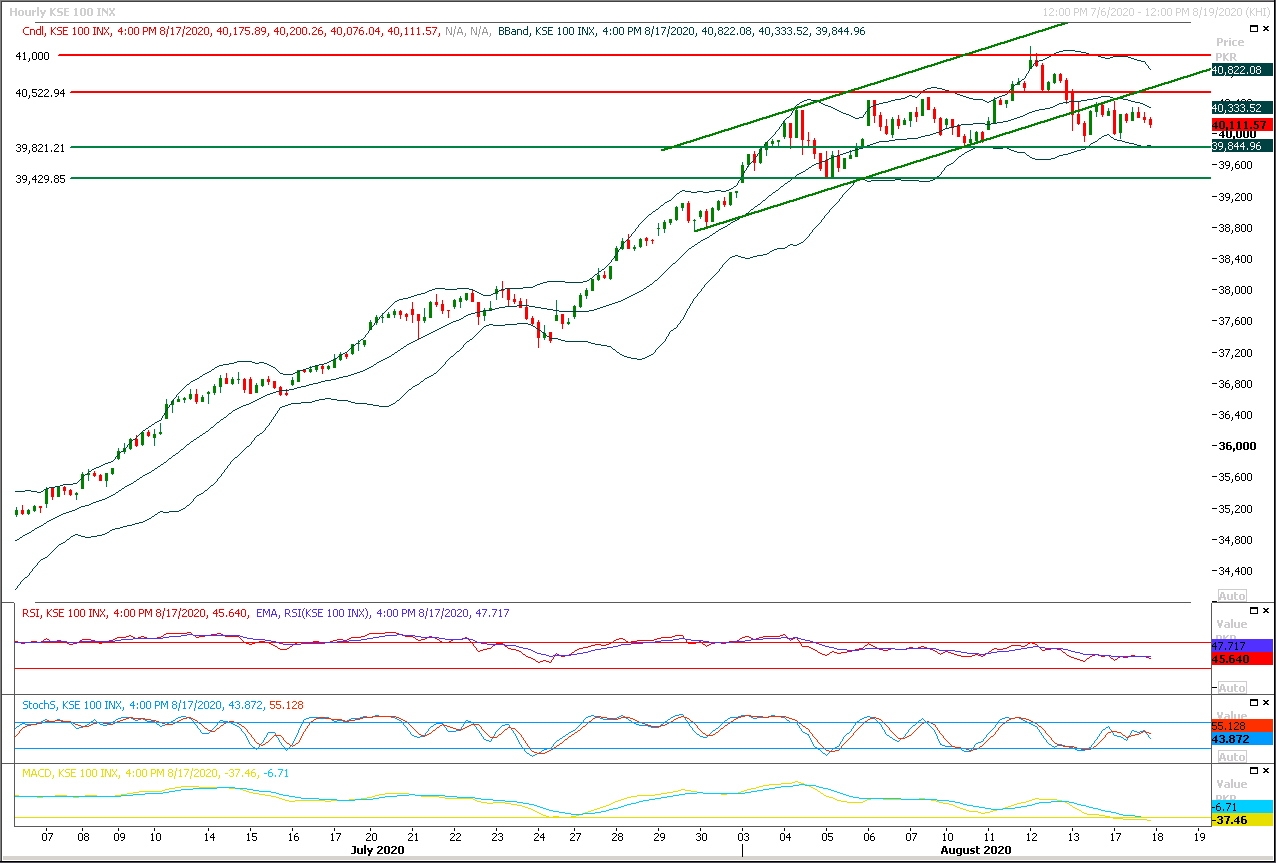

Technical Overview

The Benchmark KSE100 index have continued its bearish momentum after getting resistance from supportive trend line of its bearish channel on hourly chart during last trading session. As of now intraday momentum indicators have changed their direction towards bearish side therefore some kind of serious pressure would be witnessed which would try to push index towards 39,800pts. Mean while on flip side in case of bullish spike index would face major resistances at 40,330pts and 40,530pts on intraday basis. It's expected that index would remain under pressure until it would not succeed in closing above 40,760pts on daily chart. Therefore selling on strength with strict stop loss could be beneficial in current scenario. Once index would succeed in sliding below 39,800pts then its next target would be 39,500pts and 39,200pts.

Regional Markets

Asia shares sluggish after Wall Street's tech-inspired rally

Asian stocks inched up on Tuesday as Sino-U.S. tensions weighed on optimism generated by Wall Street’s tech-driven rally, while the dollar dropped against almost all major currencies.MSCI’s broadest index of Asia-Pacific shares outside Japan gained 0.19%, to sit not far short of its pre-pandemic late January high. Japan’s Nikkei dipped 0.52%, while most markets traded in a narrow band with Chinese blue chips dropping 0.25%. The Australian benchmark index rose 0.12%. E-Mini futures for the S&P 500 were flat. The Nasdaq surged to a record high close on Monday and the S&P 500 approached its own record level, with both indexes lifted by technology stocks. “We saw some strength in tech again with semiconductors driving the boat,” Thomas Hayes, chairman at Great Hill Capital said of the U.S. rally.

Read More...

Business News

Fitch Ratings affirms Pakistan’s long-term foreign-currency IDR at ‘B-’

Fitch Ratings has affirmed Pakistan’s long-term foreign-currency Issuer Default Rating (IDR) at ‘B-’ with a Stable Outlook. Pakistan’s ‘B-’ rating reflects weak public finances, including large fiscal deficits and a high government debt/GDP ratio, a challenging external position characterised by large external debt repayments against low foreign-exchange reserves and low governance indicator scores. The coronavirus pandemic has exacerbated these challenges by depressing economic growth and pressuring the public finances. The external finances appear resilient to the shock due to the authorities’ policy actions and continuing multilateral and bilateral financial support.

Read More...

SPI inflation falls 0.22pc

The Sensitive Price Indicator (SPI) based weekly inflation for the week ended on August 13, for the combined consumption group, witnessed decrease of 0.22 per cent as compared to the previous week. The SPI for the week under review in the above mentioned group was recorded at 133.94 points against 134.23 points registered in the previous week, according to the latest data of Pakistan Bureau of Statistics (PBS). As compared to the corresponding week of last year, the SPI for the combined consumption group in the week under review witnessed an increase of 7.01 per cent. The weekly SPI with base year 2015-16=100 is covering 17 urban centres and 51 essential items for all expenditure groups. The Sensitive Price Indicator for the lowest consumption group up to Rs17,732 witnessed 0.06 per cent decrease and went down from 140.40 points in last week to 140.32 points during the week under review.

Read More...

Remittances hit monthly record high of $2.768b in July

Inflow of foreign remittances was recorded at historic level of $2.768 billion in July this year, showing growth of 36.5 percent due to the measures taken by federal government and State Bank of Pakistan (SBP). Pakistan received foreign remittances worth $2.768 billion in July 20 as compared to $2.028 billion of remittances received in same month of previous year, showing an increase of 36.5 percent. This was highest ever remittances Pakistan has received in a single month, said ministry of finance on Monday. Prime Minister Imran Khan has also shared the news on Twitter. He said remittances from overseas Pakistanis reached 2,768 million dollars in July this year, which is the highest ever amount in one month in the history of Pakistan. Sharing good news about Pakistan’s economy, he said this is 12.2 percent increase over the month of June this year and 36.5 percent increase over July last year.

Read More...

Textile and clothing exports post growth of 14.4pc in July

Pakistan’s textile and clothing exports posted a growth of 14.4 percent to $1.272 billion in July 2020 as compared to $1.112 billion in corresponding month of previous year. Data released by Pakistan Bureau of Statistics (PBS) showed that country’s textile exports have rebounded in July 2020 after registering negative growth in previous fiscal year. The massive increase in textile exports has helped in increasing country’s overall exports to $2 billion in the month of July. Exporters had resumed production in July to honour their international orders. In textile sector, according to PBS, exports of knitwear had enhanced by 20.42 percent during July over a year ago. Similarly, exports of bed wear had also recorded an increase of 25.3 percent. Meanwhile, exports of ready-made garments had also surged by 18.04 percent. Exports of cotton cloth had recorded a growth of 1.15 percent and exports of tents, canvas and tarpaulin had gone up by 155 percent, art, silk and synthetic exports increased by 14.01 percent.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.