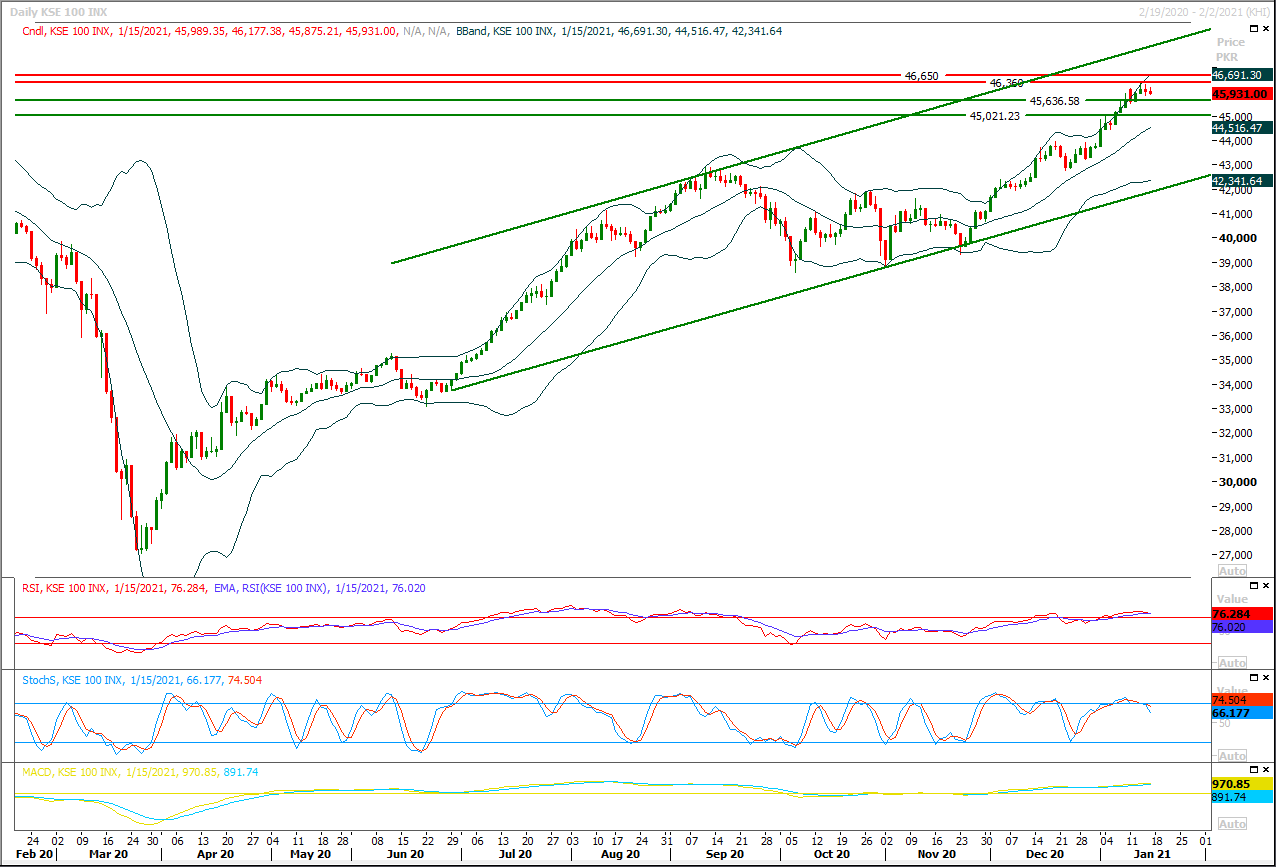

Technical Overview

The Benchmark KSE100 index is being capped by a descending trend line inside its bullish price channel on hourly chart. Meanwhile index had faced rejection from resistant trend line of this channel during last week therefore it's expected now that index would take a further dip during current trading session. It's expected that index would try to open with a negative gap and would slide further downward during the day. For current trading session index have initial supportive region at 45,800pts while breakout below that region would call for 45,500pts. While on flip side in case of bullish reversal index would face initial resistance between 46,100pts-46,200pts and breakout above this region would push index towards 46,350pts. It's recommended to stay on selling side for day trading and selling with strict stop loss of 46,650pts would be beneficial. Hourly momentum indicators are in bearish mode and once index would succeed in sliding below 45,800pts bearish sentiment would start prevailing in coming days while daily closing below 45,500pts would change sentiment for short term basis.

Regional Markets

Asia shares pare losses as China GDP pips forecasts

Asian share markets pared early losses on Monday as data confirmed China’s economy had bounced back last quarter as factory output jumped, helping offset recent disappointing news on U.S. consumer spending. Chinese blue chips edged up 0.4% after the economy was reported to have grown 6.5% in the fourth quarter, on a year earlier, topping forecasts of 6.1%. MSCI’s broadest index of Asia-Pacific shares outside Japan trimmed losses and were off 0.2%, having hit a string of record peaks in recent weeks. Japan’s Nikkei slipped 0.8% and away from a 30-year high. E-Mini futures for the S&P 500 dipped 0.3%, though Wall Street will be closed on Monday for a holiday. EUROSTOXX 50 futures eased 0.2% and FTSE futures 0.1%.

Read More...

Business News

Exports increase 9.7 per cent to Rs1.97 trillion in first half 2021

The exports from Pakistan in rupee increased by 9.7 per cent during the first half (H1) of the current fiscal year as compared to the corresponding period of last year, Pakistan Bureau of Statistics (PBS) reported. The exports during July-December (2020-21) were recorded at Rs1,978,764 million as against Rs1,803,776 million during July- December (2019-20), showing an increase of 9.7 per cent, according to provisional data of PBs. On a year-on-year basis, the exports from Pakistan during December 2020 amounted to Rs378,792 million as against Rs308,032 during December 2019, showing the growth of 22.97 per cent.

Read More...

0.85m tonnes sugar to be imported tax-free

Amid rising prices during the ongoing sugarcane crushing season, the government has decided to immediately allow import of almost 850,000 tonnes of sugar without any taxes and duties to prevent price hike. This includes tax and duty free import of 500,000 tonnes of refined sugar through the public sector, besides an offer to the local sugar mills to import another 350,000 tonnes of raw sugar. Informed sources told Dawn that the decision in principle came during a recent meeting held at the Prime Minister Office to review prices of essential commodities as part of a general situation on inflation.

Read More...

China remains top importer, traded products over $4,523m

China topped the list of countries from where Pakistan imported different products during the first five months of the current fiscal year (2020-21), followed by United Arab Emirates (UAE) and Singapore. The total imports from China during July-November (2020-21) were recorded at $4523.671 million against the $4025.183 million during July-November (2019-20), showing an increase of 12.38 per cent during the period, according to State Bank of Pakistan (SBP). This was followed by UAE, where Pakistan imported goods worth $2709.681 million against the imports of $3070.454 million last year, showing negative growth of 11.74 per cent.

Read More...

Cut in gas supply to industry likely amid LNG crisis

As foreign traders of liquefied natural gas (LNG) default on supplies amid gas shortages, the Cabinet Committee on Energy (CCoE) will meet here on Monday (today) to review the overall situation, including discontinuation of gas supplies to a large number of industries on a long-term basis. Following reports that two state-owned foreign suppliers had declined to supply their two committed vessels for delivery in February, Pakistani authorities are reported to have salvaged at least one of the vessels through high-level diplomatic efforts. However, the government has confirmed that one vessel committed for the second half of February will no more be available as the successful bidder (ENOC of the United Arab Emirates) has defaulted.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.