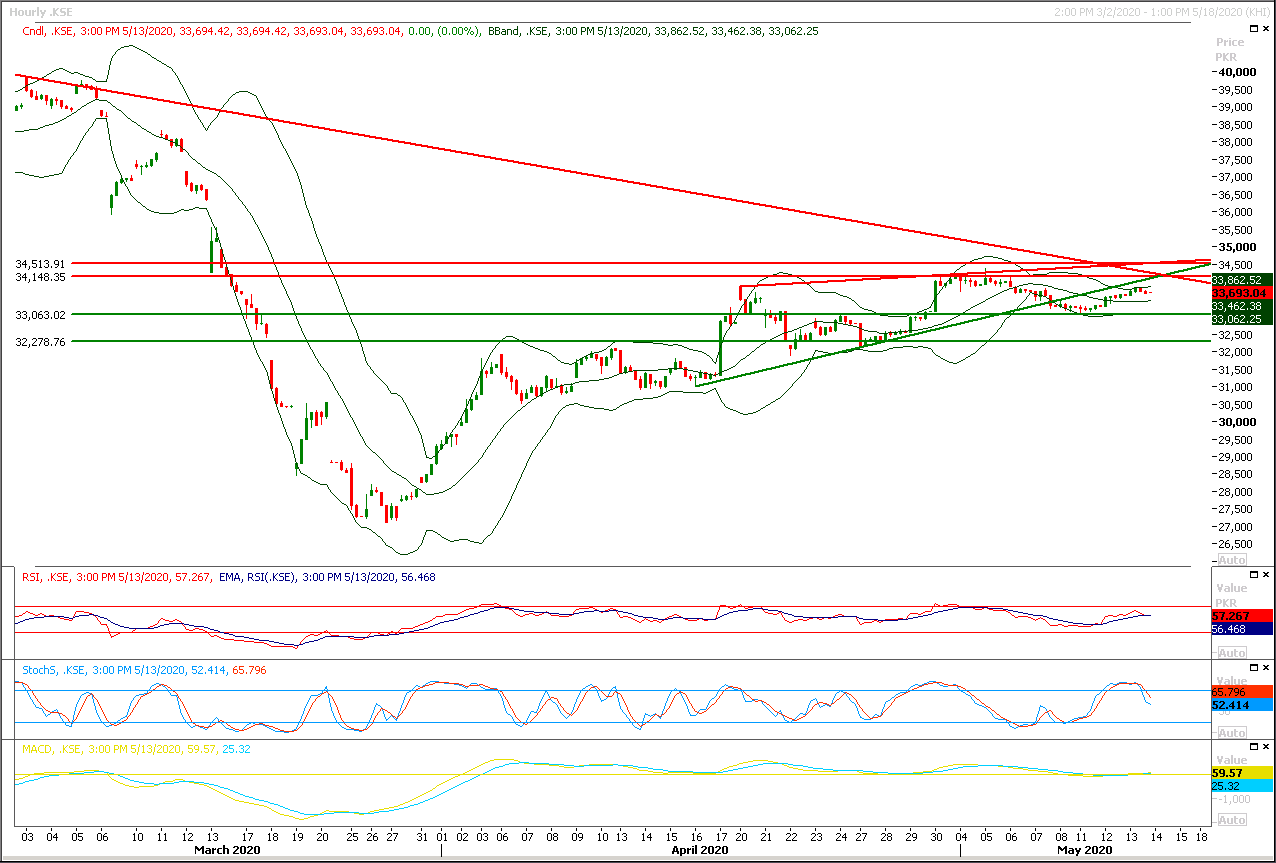

Technical Overview

The Benchmark KSE100 index is moving below supportive trend line of its rising wedge during last many days and today it's expected that it would try to gave a breakout of that region by retesting its daily double top. It's recommended to stay cautious and avoid initiating new short positions until index generate a clear reversal sign on daily or hourly chart. For today index have two major resistances at 34,400pts and 34,530pts and these regions could react as major resistances to change sentiment towards bearish side if index would not succeed in closing above these both, while closing above 34,500pts would call for 35,200pts.

While on flip side index would try to find ground at 33,800pts and 33,500pts in case of any bearish pressure.

Regional Markets

Asia shares follow S&P 500 higher, oil and gold jump

Asian shares were led higher by S&P 500 futures on Monday and oil prices hit a five-week peak as countries’ efforts to re-open their economies stirred hopes the world was nearer to emerging from recession. MSCI's broadest index of Asia-Pacific shares outside Japan still edged up 0.4%. Japan's Nikkei .N225 rose 0.6% and Chinese blue chips .CSI300 0.3%. More carefree were E-Mini futures for the S&P 500 ESc1 which added 1.1%, even though results from a raft of U.S. retailers this week are likely to make grim reading. EUROSTOXX 50 futures STXEc1 also gained 1.5% and FTSE futures FFIc1 1.4%.

Read More...

Business News

Pakistan exports plunge 12.71pc to Rs2.88 trillion in 10 months

Exports from the country, in rupee term, increased by 12.71 per cent during the first ten months of the current fiscal year as compared to the corresponding period of last fiscal year, Pakistan Bureau of Statistics (PBS) reported. The exports from the country during July– April (2019-2020) were recorded at Rs2883,787 million as against Rs 2,558,582 million during the corresponding period of last year, showing an increase of 12.71 per cent, according to provisional data released by PBS. However, on year-on-year basis, the exports from the country decreased by 46.62 percent in April 2020 as compared to the exports of April 2019. The exports in April 2020 were recorded at Rs157,412 million as against the exports of Rs 294,883 million during April, 2019. Likewise, the exports on month-on-month basis decreased by 45.23 percent in April 2020 when compared to the exports of Rs287,411 million in March, 2020.

Read More...

Govt to provide Rs37b subsidy on fertilizers to growers

The government would provide Rs37 billion subsidy on fertilizers to growers under its agriculture relief package in order to cope with the COVID-19 after effects to maintain food safety and security in the country. The relief package was also aiming at boosting agriculture production, support farmers and enhance per acre farm income to alleviate poverty from the country. The subsidy would be provided for next Kharif Season crop, which started from April to October 2020, said a senior official in the Ministry of National Food Security and Research. Talking to APP, he said a subsidy of Rs925 per bag to DAP and other phosphatic fertilizers and Rs243 per bag on urea and other nitrogen fertilizer had been worked out.

Read More...

Govt plans to lay off 8,000 PSM employees, ECC told

The government plans to terminate the services of over 8,000 remaining staff of the Pakistan Steel Mills (PSM) — the country’s largest but closed industrial unit — through a compensation package of about Rs19 billion. A meeting on Wednesday of the Economic Coordination Committee (ECC) of the cabinet presided over by Prime Minister’s Adviser on Finance and Revenue Dr Abdul Hafeez Shaikh had an initial discussion on the “Human Resource Rationalisation Plan” for PSM, worth Rs18.74bn. The ECC also took up a proposal of the petroleum ministry for hedging of oil imports, but the summary was withdrawn by the ministry.

Read More...

Amid slowdown in agricultural sector, urea inventory could surge to 1 MT by year-end

Based on latest sales data from the National Fertilizer Development Centre, the urea market seems to be under significant pressure with the accumulation of 850,000 tonnes inventory due to a slowdown in the country’s agricultural sector. The fertilizer industry had started the year with an opening inventory of 600,000 tonnes, but the inventory has continued to soar on the back of highest-ever quarterly production of 1.42 million tonnes by the manufacturers and declining sales volume. If the same trend continues, the urea inventory could surge to an estimated 1 million tonnes by the year-end. Compared to the same period last year, the urea sales in April registered a decline of 18 per cent to 240,000 tonnes. At the same time, the sales fell by 12 per cent against last month’s figure of 303,000 tonnes.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.