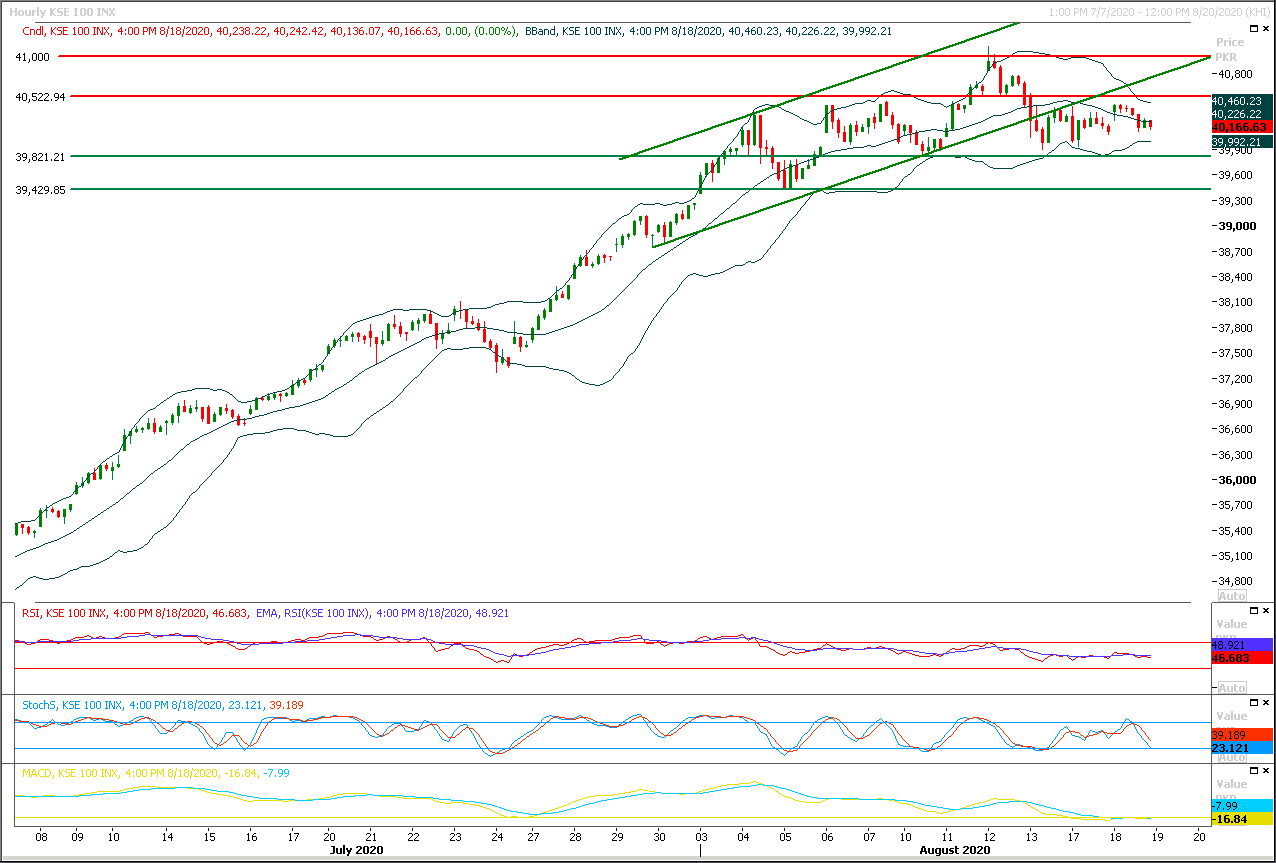

Technical Overview

The Benchmark KSE100 index have continued its bearish momentum after getting resistance from supportive trend line of its bearish channel on hourly chart during last trading session. As of now intraday momentum indicators have changed their direction towards bearish side therefore some kind of serious pressure would be witnessed which would try to push index towards 39,800pts. Mean while on flip side in case of bullish spike index would face major resistances at 40,330pts and 40,530pts on intraday basis. It's expected that index would remain under pressure until it would not succeed in closing above 40,760pts on daily chart. Therefore selling on strength with strict stop loss could be beneficial in current scenario. Once index would succeed in sliding below 39,800pts then its next target would be 39,500pts and 39,200pts.

Regional Markets

Asian stocks at seven-month highs after Wall Street cracks more records

Asian shares climbed to a seven-month peak on Wednesday tracking the S&P 500, which scaled all-time highs driven by ever expanding policy stimulus aimed at cushioning the blow to economies from the coronavirus pandemic. MSCI’s broadest index of Asia-Pacific shares outside of Japan rose 0.3%, up for a third straight day to 570.80 points, a level not seen since late January. The gains were driven by Australian shares, up 0.8% and South Korea, which added 0.6%. Japan’s Nikkei nudged up too though Chinese shares started weaker with the blue-chip CSI300 index off 0.7%.

Read More...

Business News

Cars sale, production fell by 7.70pc, 49.73pc respectively in July

The sale and production of cars decreased by 7.70 per cent and 49.73 per cent respectively during the first month of current financial year 2020-21 compared to corresponding period of last year. During the July 2020, as many as 10,123 cars were sold against the sale of 10,968 units while the production of cars decreased from 16,472 units to 8,280 units, showing negative growth of 7.70 and 49.73 per cent respectively, according to Pakistan automobile Manufacturing Association (PAMA). Among cars, the sale of Honda cars increased by 52.20 per cent from 1,452 units during July 2019 to 2,210 units during July 2020 while Suzuki Swift sale also grew by 4.59 per cent from 174 units to 182 units. The sale of Toyota Corolla went down from 1,981 units to 1,528 units, showing decreased of 22.86 per cent, the data revealed.

Read More...

China provides $100,000 to Pakistan for controlling locust

China National Petroleum Corporation (CNPC), a state-owned Chinese company on Tuesday provided $100,000 to Ministry of National Food Security and Research (MoNFS&R) in order to strengthen its efforts against desert locust. The cheque of $100,000 was handed over to the Federal Minister for National Food Security and Research Syed Fakhar Imam in ceremony which was also attended by Chinese Ambassador, Yao Jing and Dr Gu Wenliang, Agriculture Counsellor/Second Secretary from the Chinese Embassy. Speaking on the occasion Syed Fakhar Imam acknowledged the existence of expanding friendly relations between the two friendly countries.

Read More...

Tier-I retailers must integrate with POS till 31st: FBR

Federal Board of Revenue (FBR) has asked all Tier-I retailers to integrate with Point of Sale (Linked Invoicing System) till the last date i.e. 31st August, 2020. The FBR directed this to all retailers who have the network of chain stores throughout Pakistan, located in air-conditioned big shopping malls or plazas and their cumulative electricity bill during the immediately preceding twelve consecutive months exceeds twelve hundred thousand rupees. FBR has warned that the last date for such integration is 31st August, 2020 and afterwards those who failed to integrate would be imposed a penalty up to rupees one million and if the offence continued, the business premises of such retailer shall be sealed.

Read More...

WPPs to reduce delayed payment rate by 2.5pc, RoE to 13pc, O&M cost by 20-25pc

The Wind Power Plants (WPPs) have agreed to reduce Delayed Payment rate by 2.5 per cent, Return on Equity (RoE) to 13 per cent, O&M cost by 20 to 25 per cent. A MoU of Understanding (MOU) signed between the Committee for Negotiations with Independent Private Power Producers (IPPs) and the Wind Power Plants (WPPs) representing the 2006 RE Policy projects represented by the Pakistan Wind Energy Association, agreed that WPPs shall coordinate with their lenders and make all efforts to extend the debt-tenor by five years, reduce the spread over LIBOR by 50-75 basis points and reduce the spread over KlBOR by I00-125 basis points. Entire benefit from these changes shall be passed on to the power purchaser, said the copy of the MoU available with The Nation.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.