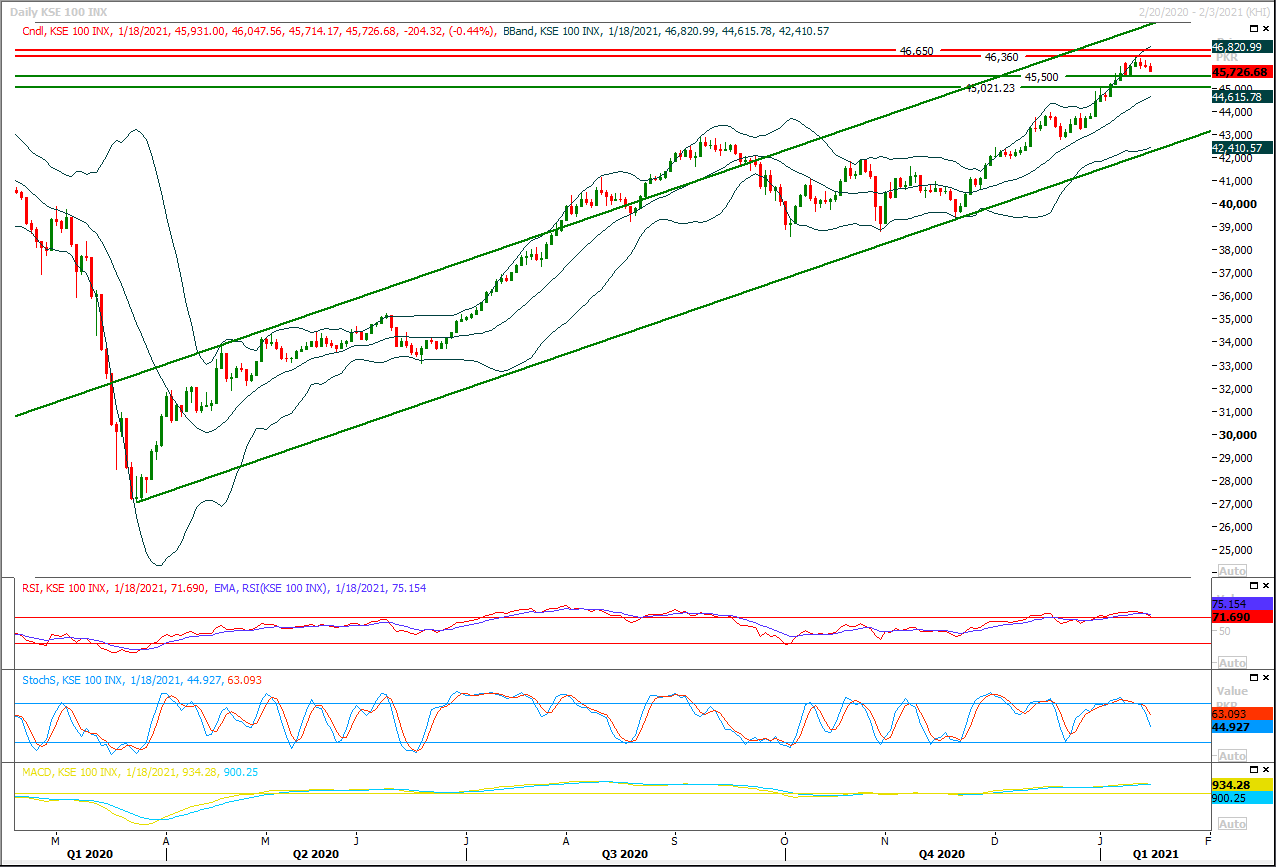

Technical Overview

The Benchmark KSE100 index had continued its bearish journey during last trading session but still succeed in maintaining above its major supportive region of 45,500pts. As of now it's expected that index would try to target its supportive region between 45,630pts- 45,500pts initially and if it would succeed in establishing ground above this region then a pullback could be witnessed before day end, but penetration below 45,500pts would push index towards 45,200pts and 45,000pts in coming days. Daily Stochastic and MAORSI are trying to changed their directions towards bearish side but MACD still have not left bullish sentiment therefore it's recommended to avoid short selling for short term trading until index gave a clear reversal sign on daily or weekly chart. Currently it's expected that index would try to bounce back after getting support from its supportive regions therefore it's recommended to stay cautious and buying on dip is recommended with strict stop loss of 45,500pts while on breakout of this region it's recommended to cut and reverse long positions. On flip side in case of reversal index would try to target 46,150-46,200pts where initially it would be capped by a strong horizontal resistant region while breakout above this region would call for 46,350pts and 46,600pts. Hourly momentum indicators are under pressure because Stochastic and MAORSI had changed their directions towards bearish side meanwhile MACD have entered bearish zone therefore it's recommended to adopt swing trading until daily momentum indicators set their direction.

Regional Markets

Asia shares look to China for recovery lead, earnings in focus

Asian share markets edged ahead on Tuesday as investors wagered China’s economic strength would help underpin growth in the region, even as pandemic lockdowns threatened to lengthen the road to recovery in the West. Data out on Monday had confirmed China’s economy was one of the few in the world to grow over 2020 and actually picked up speed as the year closed. MSCI’s broadest index of Asia-Pacific shares outside Japan firmed 0.2%, to be a whisker from record highs. Japan’s Nikkei bounced 1%, recovering all the losses suffered on Monday when caution had dominated markets. U.S. stocks also looked a little steadier as futures for the S&P 500 added 0.4% and NASDAQ futures 0.3%. Analysts at JPMorgan felt the coming earnings season could brighten the mood given the consensus in Europe was for a fall of 25% year-on-year, setting a very low bar.

Read More...

Business News

Around 8,383km additional gas pipelines being laid in current FY

The two state-companies, SNGPL and SSGC, are reinforcing their network by laying around 8,383 kilometres (KM) additional transmission and distribution pipelines collectively across the country as per the target given for the current fiscal year. The Sui Northern Gas Pipelines Limited (SNGPL) is working on the task to lay 6,965 KM lines, while the Sui Southern Gas Company (SSGC) is in process of placing 1,418 KM pipelines in their respective areas, according to an official document available with APP. During the last fiscal year, the companies had laid around 5005 KM lines, out of which the SNGPL placed 4,155 KMs and SSGC 850 KMs.

Read More...

Pakistan’s IT services exports can reach $10 billion

The Overseas International Chamber of Commerce and Industries (OICCI)’s digital report has noted that Pakistan’s IT services exports have potential to reach $10 billion. The “OICCI Recommendations for Digital Economy” report was launched Monday highlighting the much-needed shift required to capture the opportunity of digital transformation happening within and outside Pakistan through New Economy mindset. By digitizing most, if not all, key segments of the economy could boost IT export to US$10 billion annually, provide significant growth to GDP, attract billions of dollars of FDI and create hundreds of thousands new jobs within a short time.

Read More...

CDNS reaches net target of Rs430 billion

The Central Directorate of National Savings (CDNS) has reached the free deposit of Rs 430 billion in last six months from July 01 to December 31st current Fiscal Year (FY) 2020-21. The Central Directorate of National Savings (SDNS) has compensated an amount of Rs 440 billion to its investors after the termination of major prize bonds of Rs 40,000 and the recent cancellation of prize bonds of Rs 25000, a senior official of CDNS told APP here on Monday. Replying to a question, he said that the federal government has recently suspended the prize bonds of Rs25,000 and has given a six-month deadline to investors to en-cash their savings of Rs184 billion. The government has already cancelled prize bonds of Rs 40,000 and CDNS repaid to the investors the encashment worth Rs 158 billion in previous FY 2019-20, he said. The Senior official achieved a collective net target of Rs 42 billion in the last six months by July 1st to December 31 of the current fiscal year 2020-21.

Read More...

Pakistan Prosperity Index reaches all-time high of 116.3 in Nov 2020

Policy Research Institute of Market Economy (PRIME) on Monday has released a report that stated that Pakistan Prosperity Index continues to pose an upward trend, reaching an all-time high of 116.3 in November 2020. PRIME, in its bi-monthly report on Pakistan Prosperity Index (PPI), reviewed country’s macro-economy based on the analysis of four periodic data sets- industrial production, trade volume, price levels, and private sector lending. On a 12-month rolling basis, this issue of the report covers the period December 2019 to November 2020, with June 2019 as the base period. span class="label label-success float-right">

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.