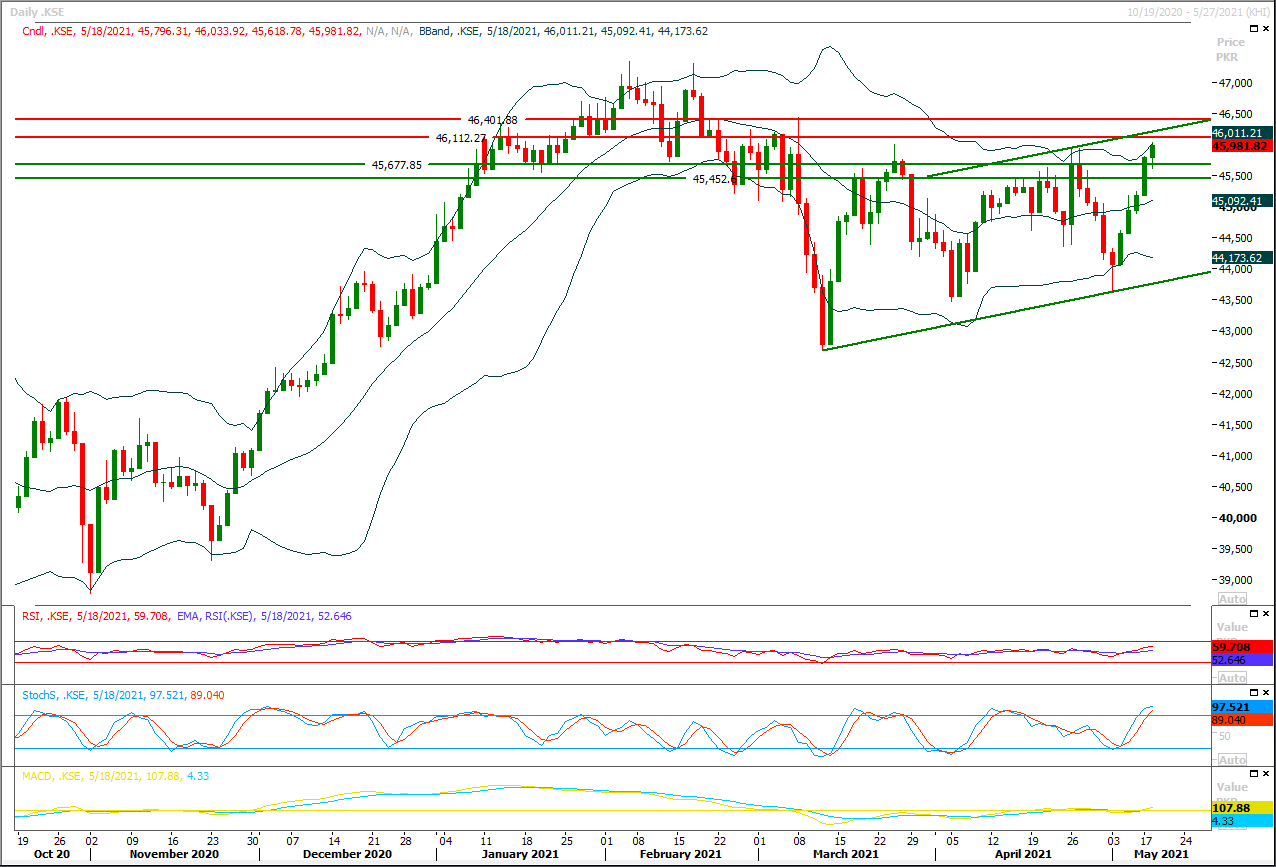

Technical Overview

The Benchmark KSE100 index is moving in a bullish price channel on hourly and daily charts but have faced rejection from its triple top during last trading session but still it succeed in maintaining above its major supportive region and closed with a net positive change at day end. As of now it's expected that index would initially face resistance at 46,200pts where a strong horizontal resistant region would try to push index back into negative zone therefore it's recommended to stay cautious and post trailing stop loss on existing long positions. Breakout above 46,200pts could push index towards46,400pts-46,500pts region on intraday basis but to initiate new long positions for short term trading its recommended to wait for closing above 46,500pts. On flip side in case of rejection from its resistant regions index would try to establish ground above 45,500pts but breakout below that region would call for 45,200pts. Hourly momentum indicators are in mixed mode and a slight push in downward direction would start adding pressure on index.

Regional Markets

U.S., Canada, Mexico hold 'robust' trade deal talks, downplay differences

Trade ministers from the United States, Canada and Mexico said on Tuesday they held "robust" talks on the new North American trade deal and pledged to fully enforce its higher standards, while downplaying differences over a range of other irritants. The ministers, in a joint statement issued after their first meeting to review the U.S.-Mexico-Canada Agreement on trade that took effect in July 2020, also vowed to focus on fighting climate change and crack down on imports of goods to the region made with forced labor. "The USMCA commits us to a robust and inclusive North American economy that serves as a model globally for competitiveness, while prioritizing the interests of workers and underserved communities," the ministers said. The statement came after U.S. Trade Representative Katherine Tai met virtually with Mexican Economy Minister Tatiana Clouthier and Canadian Trade Minister Mary Ng in the initial meeting of the governing body for the trade deal, which regulates some $1.5 trillion in annual North American trade.

Read More...

Business News

Remittances grow by 29pc to record $24.2 billion in 10 months

The workers’ remittances have surpassed previous records, reaching $24.2 billion during the first ten months of the current fiscal year, showing growth of 29 per cent over the same period of last year. The remittances during July-April (2020-21) also crossed the total remittances of the last fiscal year (2019-20) by over $1 billion, according to latest data released by the State Bank of Pakistan (SBP). During the month of April 2021, the workers’ remittances rose to an all-time monthly high of $2.8 billion, 56 percent higher than the remittances of the same month of last year. The remittance inflows during July-April (FY2020-21) were mainly sourced from Saudi Arabia ($6.4 billion), United Arab Emirates ($5.1 billion), United Kingdom ($3.3 billion) and the United States ($2.2 billion). Proactive policy measures by the government and SBP to encourage more inflows through formal channels, curtailed cross border travel in the face of COVID-19, altruistic transfers to Pakistan amid the pandemic, orderly foreign exchange market conditions and more recently, Eid-related inflows have contributed to record levels of remittances this year.

Read More...

Wyeth Pakistan announces share buyback

Wyeth Pakistan Ltd, a listed company on the pharmaceutical sector, informed the Pakistan Stock Exchange on Tuesday that the parent company, Wyeth LLC, USA resolved to consider purchase of shares from all minority security holders in order to increase its ownership and de-list the company. Wyeth LLC, USA currently holds 40.55 per cent shareholding in Wyeth Pakistan. The company observed that the shares held by Wyeth Holdings LLC, previously Wyeth Holdings Corporation, USA being an affiliate of Wyeth LLC would continue to hold securities and shares in the de-listed entity. The company made the disclosure of the price sensitive information under rule 5.13 of Voluntary Delisting Rules of the PSX.

Read More...

‘Climate change to cost Pakistan $3.8bn yearly’

Warning of an increase of up to 2.5 degrees Celsius in temperature over the next two decades, the Asian Development Bank (ADB) and World Bank (WB) have estimated that Pakistan is facing up to $3.8 billion in annual economic loss due to climate change. A joint study titled “Climate Risk Country Profile” for Pakistan released by the two international lending agencies on Tuesday put Pakistan among the top risk-prune countries in terms of increase in average temperatures and resultant economic and social losses.

Read More...

Banking sector infection ratio rises to 9.3pc

The infection ratio of the banking sector has increased from eight per cent in December 2018 to 9.3pc at the end of March 2021, with the textile sector appearing as the biggest defaulter till the end of the first quarter of the current fiscal year (1QFY21). Latest data shared by the State Bank of Pakistan (SBP) shows that the advance for the textile sector till March 2021 was Rs1,383.9 billion while the default amount was Rs166.4bn. The SBP reported the infection ratio was 12pc for this sector. Textile remained the biggest defaulter despite lower advances compared to the production and energy transmission sector.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.