Technical Overview

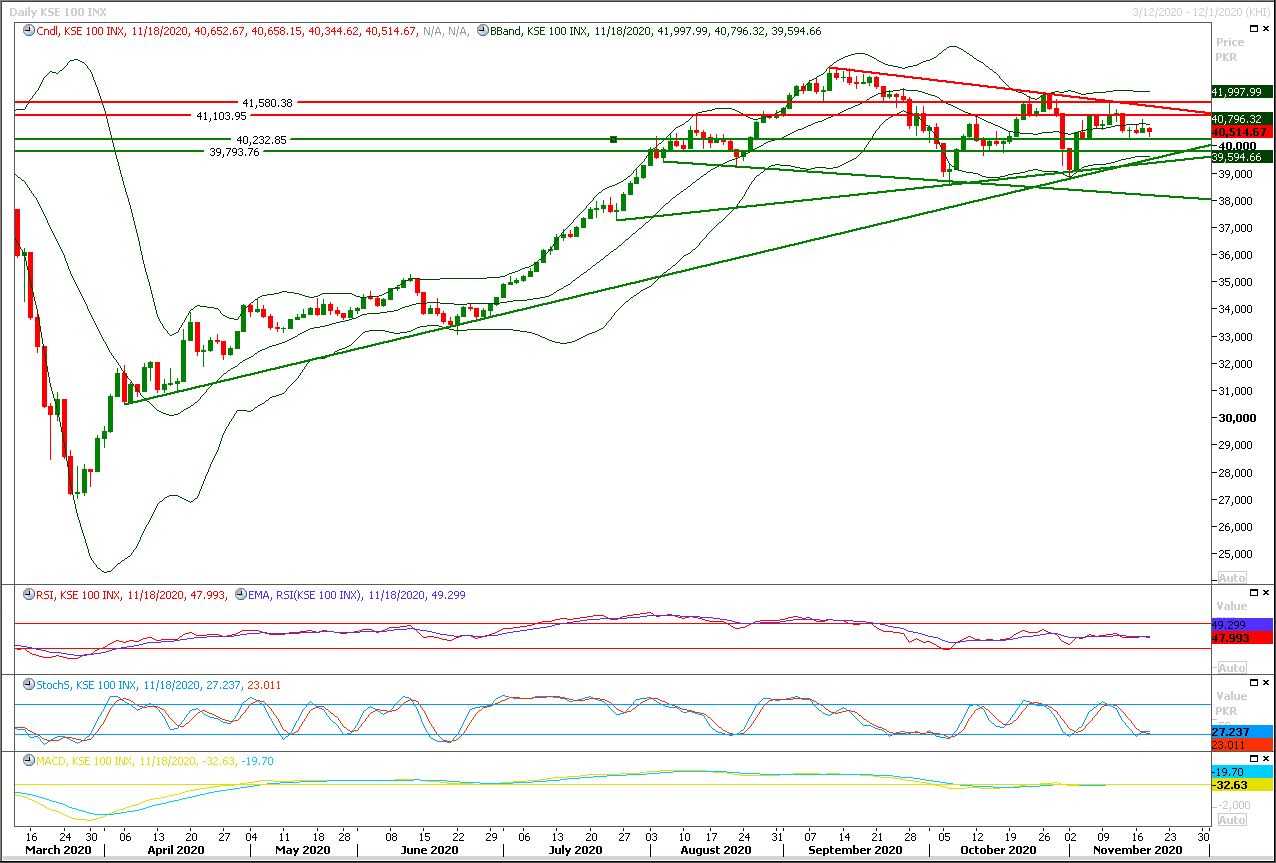

The Benchmark KSE100 index is being caged in a triangle on daily chart and its moving downward after facing rejection from resistant trend line of this wedge since start of last week. Mean while index have started moving downward again after completion of its 50% correction of its last bearish rally, so now it's expected that it would continue expansion of its last correction towards 40,200pts and penetration below that region would call for 40,000pts. While on flip side in case of reversal index would face initial resistance at 40,660pts and breakout above that region would call for 40,800pts and 41,000pts. Index would remain bearish until a daily closing above 41,000pts and 41,500pts would not succeed because daily momentum indicators are still in uncertain zone and it would turn towards bearish side if index would not succeed in closing above these regions. For day trading it's recommended to stay on selling side with strict stop loss.

Regional Markets

Asia stocks take a breather, bonds bet on Fed action

Asian shares eased from all-time highs on Thursday as widening COVID-19 restrictions in the United states weighed on Wall Street, while bonds were underpinned by speculation the Federal Reserve would have to respond with yet more easing.MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.5%, though that was from a record peak. Chinese blue chips were a fraction firmer. E-Mini futures for the S&P 500 steadied, after Wall Street took a late dip on Wednesday. The Dow ended down 1.16%, while the S&P 500 lost 1.16% and the Nasdaq 0.82%. Pfizer Inc shares had gained after the drugmaker said its COVID-19 vaccine was 95% effective and it would apply for emergency U.S. authorization within days.

Read More...

Business News

Real GDP estimated to contract by 0.4pc

The State Bank of Pakistan (SBP) said Wednesday that following the difficult but necessary stabilisation efforts during the first nine months of the fiscal year 2019-20, the country’s economy was well on course for a steady recovery on the eve of COVID-19 pandemic. The State of Pakistan’s Economy for the fiscal year 2019-20 report released by the State Bank says that by February 2020, the unprecedented balance of payments crisis created by the unsustainable macroeconomic policies of previous years had been forcefully addressed through sizable reductions in the twin fiscal and current account deficits.

Read More...

Govt opening up local markets for foreign investors: Hafeez

Adviser to the Prime Minister on Finance and Revenue Abdul Hafeez Shaikh on Wednesday outlined government’s policy of opening up local markets for foreign investors and facilitating them for business development and employment generation in the country. He made these remarks while addressing “THE FUTURE SUMMIT” through video link. He shared his thoughts on the topic titled “The Future of Pakistan”. Addressing the Summit, the adviser finance stated that Pakistan enjoys natural advantage to its strategic location, agricultural potential, mineral resources, vast coastlines and close proximity to resource rich Central and South Asian States.

Read More...

Pakistan, Russia agree to increase Islamabad’s share in equity of NSGP to 76pc

-Pakistan and Russia have agreed to increase Islamabad’s share in the equity of North South Gas Pipeline (NSGP) (renamed to Pakistan Stream Gas Pipeline) to 76 percent while Moscow will fund 24 percent. Similarly, it has also been agreed to rename the project from North South Gas Pipeline Project to Pakistan Stream Gas Pipeline (PSGP) Project. The final approval to the proposed amendments in the inter-governmental agreement (IGA) on North South Gas Pipeline (NSGP) will be given in the 8th session of Pakistan-Russia JCC on NSGP project in December, official source told The Nation.

Read More...

SECP approves first P2P Lending Platform in its Regulatory Sandbox

The Securities and Exchange Commission of Pakistan (SECP) has granted approval for launch of a Peer-to-Peer (P2P) Lending Platform under the first cohort of Regulatory Sandbox to support and encourage Fintech revolution in the country. P2P lending is an innovative alternative digital platform that connect borrowers with individual lenders, who come together to meet the borrowers’ loan requirements. The P2P lending helps the borrowers give out short-term loans that enable the SMEs to scale up their business, eventually qualifying them to take bigger bank loans.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.